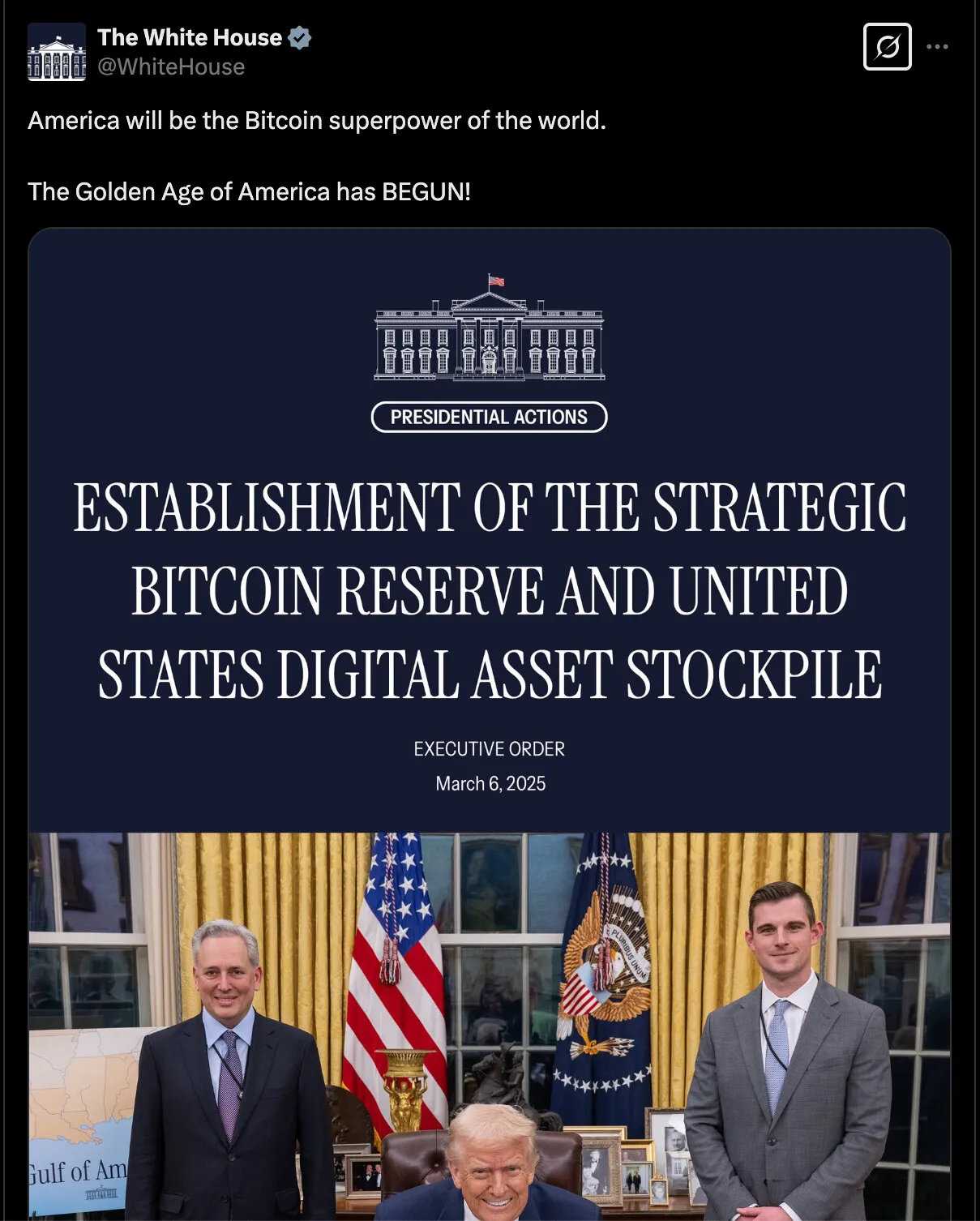

President Donald Trump signed an executive divulge on Bitcoin earlier this week, formally growing a Strategic Bitcoin Reserve (SBR) the utilization of most productive the seized Bitcoin the US govt already owns.

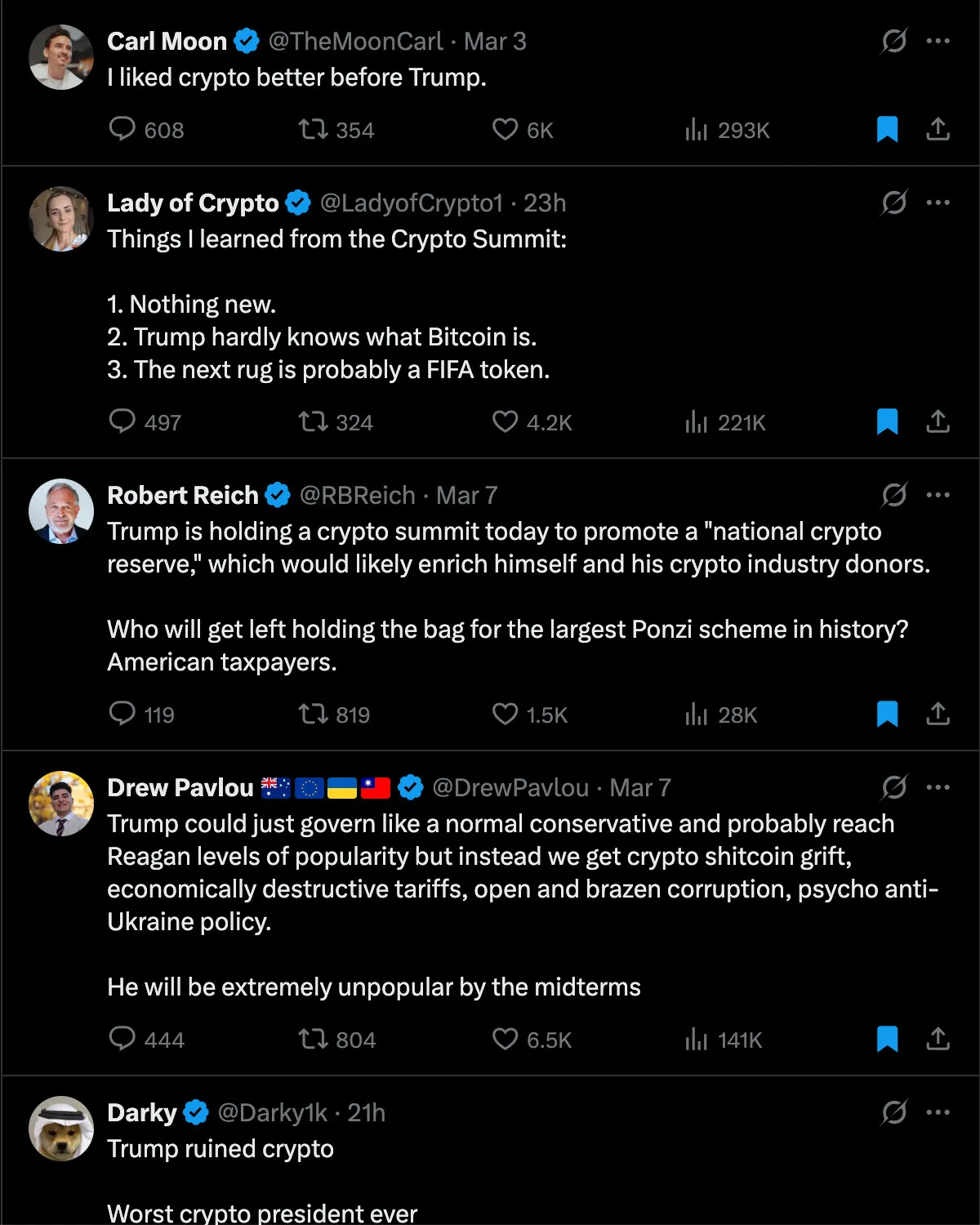

This means no new purchases, no market buys—lawful stockpiling what’s already been taken from criminals and fraudsters. Crypto merchants anticipated one thing varied. They wanted the govt.to start up procuring extra Bitcoin, which would possibly well well push costs up. As a substitute, they bought disappointment, they on occasion’ve been sharing their frustrations all over X (formerly Twitter).

Scott Melker, host of The Wolf of All Streets podcast, replied to the outrage with a post on X today, announcing, “When you observed that the Bitcoin SBR is inappropriate recordsdata on yarn of this can even most productive comprise seized Bitcoin, then you definately’re inappropriate at finding out and worse at comprehending what you are finding out. Promote me your Bitcoin.”

XRP attorney John Deaton backed him up, announcing, “Scott, as standard, is 100% field on. I’ve viewed quite a lot of adverse takes referring to the EO. I realize many crypto merchants had been hoping for a Strategic MultiCoin Reserve, no longer lawful a Strategic Bitcoin Reserve.”

Trump orders Treasury and Commerce to gain ‘funds-neutral’ strategies to salvage Bitcoin

Finally of his White Home crypto summit, Trump said, “Closing year, I promised to salvage The usa the Bitcoin superpower of the area and the crypto capital of the planet and we’re taking historic action to protect it up that promise.”

The executive divulge also directed Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick to make a selection out the supreme plot to earn extra Bitcoin with out spending taxpayer bucks. Which implies inventive strategies—loopholes, incentives, partnerships.

Deaton pointed to a serious tool at their disposal: the Substitute Stabilization Fund (ESF). The ESF gives the Treasury Secretary mountainous authority to salvage and protect monetary assets to stabilize the dollar. Would possibly perchance Bitcoin be included? It’s imaginable, however Deaton said it would probably be challenged in court docket.

One other doable option is the World Emergency Financial Powers Act (IEEPA). If Trump declared the $36 trillion nationwide debt an economic emergency, he would possibly well maybe tell the IEEPA to interpret Bitcoin purchases by executive action.

Nonetheless that would require printing money to salvage Bitcoin, which would possibly well well make a complete new design of complications. Then there’s the Defense Production Act. If Trump declared Bitcoin mining critical to nationwide safety, the govt.would possibly well maybe start up mining and procuring Bitcoin straight away. Deaton known as this thought “insane,” however legally, it’s no longer off the table.

One amongst the simplest strategies for the govt.to develop its Bitcoin holdings is by those felony seizures. When authorities seize Bitcoin from fraudsters, they time and again public sale it off. Trump’s executive divulge would possibly well maybe mean conserving it as an substitute. This would possibly well push law enforcement to crack down even more challenging on crypto-linked crimes, and oh there are plenty and hundreds that also going down lawful now.

One other manner is taxing Bitcoin miners in BTC. The US is house to about a of the area’s most gripping Bitcoin mining operations, they on occasion would possibly well very effectively be required to pay a microscopic fragment of their mining rewards to the govt. In return, they’d earn tax breaks or regulatory advantages.

The IRS and Commerce Division would possibly well maybe also start up accepting Bitcoin for federal funds. Folks paying taxes, fines, and funds in Bitcoin wouldn’t lawful be converting it to bucks—the govt.would possibly well maybe protect a fraction in the reserve. This would possibly well enable the US to salvage Bitcoin naturally over time.

An extremely aggressive system is requiring federal land and vitality rent funds in Bitcoin. Companies mining coal, lithium, or drilling for oil on federal land would possibly well very effectively be required to pay section of their royalties in BTC. This would possibly well salvage Bitcoin a nationwide asset while giving mining and vitality firms an instantaneous stake in its success.

Deaton also instructed that: “Partnering with U.S. Tech & Finance Companies by growing incentivized partnership the place firms admire Coinbase and Ripple benefit salvage and organize Bitcoin reserves and digital asset stockpiles.”

Swapping gold for Bitcoin, Bitcoin-essentially based bonds, tariffs in BTC, and quite a lot of extra funds-neutral tips for procuring extra Bitcoins

Trump’s executive divulge didn’t existing gold reserves, however that doesn’t mean they’re off-limits, in particular if you’ve got in mind Crypto-loving Senator Cynthia Lummis proposal in the BITCOIN Act, which if truth be told first launched the premise of a Bitcoin strategic reserve.

The US govt holds over 8,100 hundreds gold in reserves. In the occasion that they swapped even a microscopic fragment for Bitcoin, they’d make a giant BTC stockpile in a single day.

One other possibility is tokenized US Treasury bonds. The govt. would possibly well maybe distress Bitcoin-backed securities that merchants buy with BTC, which would possibly well well enable the US to salvage Bitcoin while soundless financing operations by debt devices.

Deaton said, “Trump would possibly well maybe impose a “Bitcoin Tariff” as an substitute of USD Tariff on Obvious Imports. Right here is combining Tariff and BTC coverage. To illustrate, on high-tech items, uncommon earth metals, or semiconductors, which are critical to nationwide safety or on electronics imported from China, given its dominance in world supply chains.”

This obviously comes as Trump is imposing tariffs on Canada, Mexico, and China almost every other week since taking benefit the Oval on January twentieth.

One other option Deaton gave was once Bitcoin-pegged export credit ranking. The Commerce Division would possibly well maybe make export incentives the place US firms salvage BTC credit ranking when promoting items out of the country. Foreign merchants paying a fraction in Bitcoin would enable the govt.to realize reserves with out recount market purchases.

Deaton said the US would possibly well maybe also strike vitality gives the place countries admire Saudi Arabia (oil) or Canada (natural gasoline) web US exports at a low cost in exchange for BTC funds. This would possibly well push international ask for Bitcoin transactions intriguing the US govt.

One other thought is that the US would possibly well maybe distress Bitcoin-backed bonds tied to vitality reserves, kind of admire El Salvador’s Bitcoin bonds. These bonds would possibly well very effectively be linked to future oil, gasoline, or federal land rent revenues, giving merchants publicity to both Bitcoin and US vitality manufacturing, said Deaton.

Trump’s executive divulge doesn’t stop inside most firms or participants from donating Bitcoin to the US reserve. A tax incentive for BTC donations would possibly well maybe support participants to ship Bitcoin to the govt.with out recount spending.

Federal contractors would possibly well maybe also pay in Bitcoin, with a microscopic fragment going straight away into the reserve. This would possibly well enable the US to salvage Bitcoin while soundless paying contractors as standard.

Even standard taxpayers would possibly well very effectively be incentivized. If the govt.equipped capital features tax breaks for folk paying taxes in Bitcoin, Ethereum, or XRP, it would possibly well perchance perchance maybe support crypto holders to pay straight away in BTC. A microscopic share of every price would possibly well very effectively be saved in the reserve, progressively growing holdings over time.

“Therefore, the EO we got is as aggressive as a President can attain, absent invoking emergency powers. I’m stunned BTC isn’t $120K already. As for the MultiCoin debate and participants disenchanted, BTC has ALWAYS led the market. Which that it’s doubtless you’ll despise it, however it indubitably’s actuality,” Deaton said in his X post.