President Trump is all all over again urging decrease pastime rates after bullish US employment data. Some analysts are hopeful that current fee cuts will generate sure momentum for Bitcoin.

Nonetheless, there are no indicators that Powell will change his mind. If anything, it’s even less seemingly. Tariffs might perhaps perhaps perhaps reason phenomenal chaos, and the financial system doesn’t want fee cuts to outlive precise now.

Can Trump Compel Cuts to US Ardour Charges?

Earlier at the present time, the US Bureau of Labor Statistics released its most widespread jobs file, which appears to be like to be moderately bullish in the face of recession fears.

Entire nonfarm payroll employment elevated by 177,000, far outperforming expectations, whereas unemployment remained precise and wages went up. This introduced on President Trump to position a question to as soon as all all over again for cuts to the pastime fee:

President Trump has continuously requested Federal Reserve Chair Jerome Powell to slash pastime rates. The crypto change has also carefully advocated for this kind of pass, which might perhaps perhaps wait on investment in trouble-on resources.

Nonetheless, both Powell and diverse Fed higher-united stateshave been very determined that tariffs are too unpredictable to allow extra fee cuts.

Powell’s space has been very fixed. Tariffs might perhaps perhaps perhaps severely damage the financial system, and the Federal Reserve needs to retain its powder dry to stave off future cave in. If it slash rates after bullish data, the Fed would absorb one less doable instrument in the tournament of a exact crisis.

Trump even threatened to fireplace Powell over the trudge slash direct, but relented after the markets vexed. He can not legally fire Powell; ousting this kind of excellent regulator would undoubtedly reason chaos.

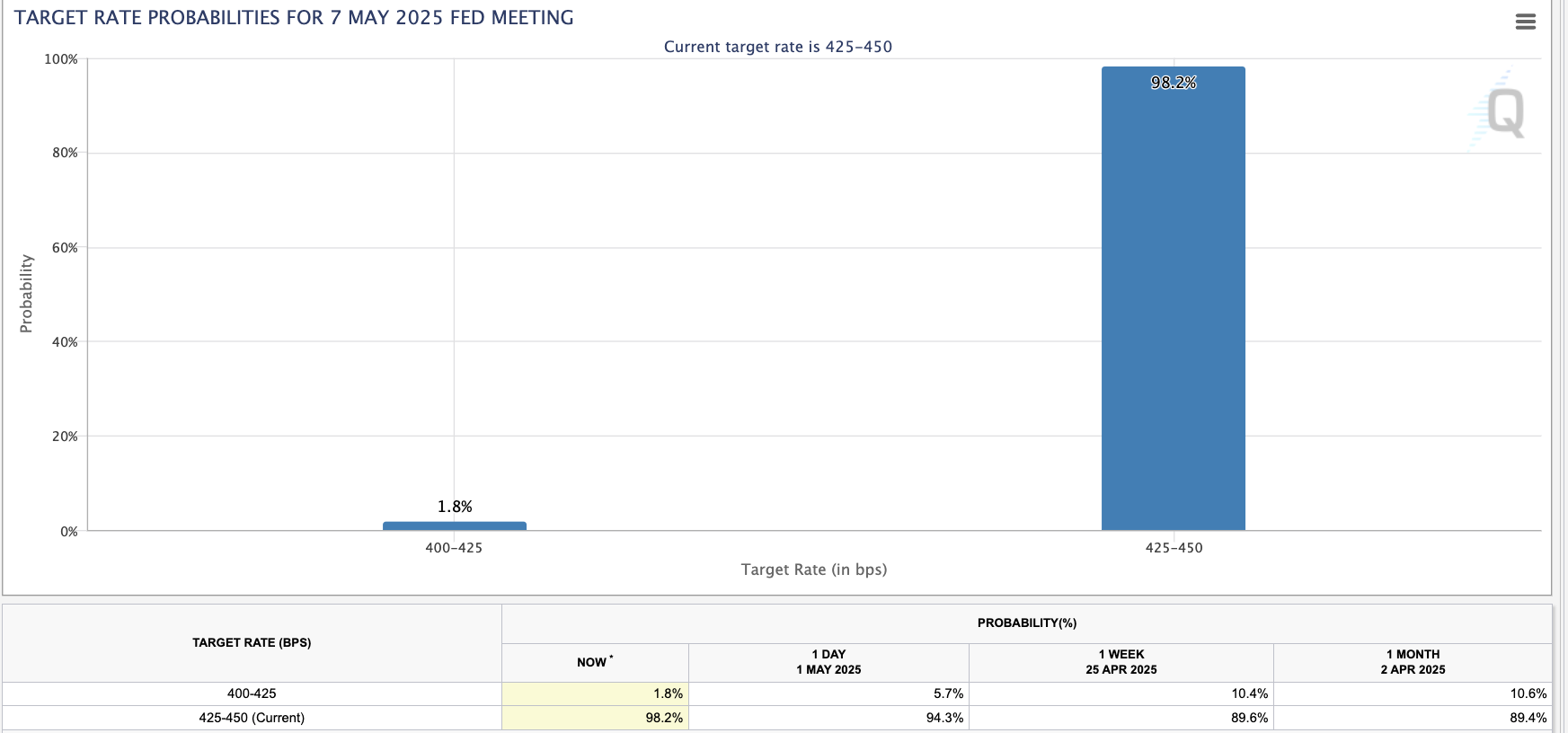

After the roles file came out, the market anticipated fewer fee cuts, and the CME reported that an adjustment in Could perhaps perhaps is when it comes to no longer likely.

To place it bluntly, there might perhaps be a extraordinarily low probability that Trump will obtain his desired fee cuts rapidly. Justin Wolfers, an economist at the University of Michigan, explained why the bullish file genuinely makes fee cuts less seemingly:

“I’m nearly clear that the Fed stays on retain at its subsequent assembly. The exact financial system (to this level) is precise sufficient to no longer warrant a fee slash. And the sizable questions are all dazzling over the horizon. Powell has been determined: He doesn’t ought to bet what’s over that horizon, he needs to wait on & design. The file is the truth is legit. White Dwelling interpretations are a clear direct,” he stated.

President Trump needs these fee cuts, but can’t power the direct with out causing bigger complications. Since the tariffs are so chaotic and unpredictable, fraudulent rumors absorb moved the crypto market on quite quite a bit of most widespread events.

Traders can also simply soundless remain cautious around hypothesis that appears to be like to be too correct to be correct.