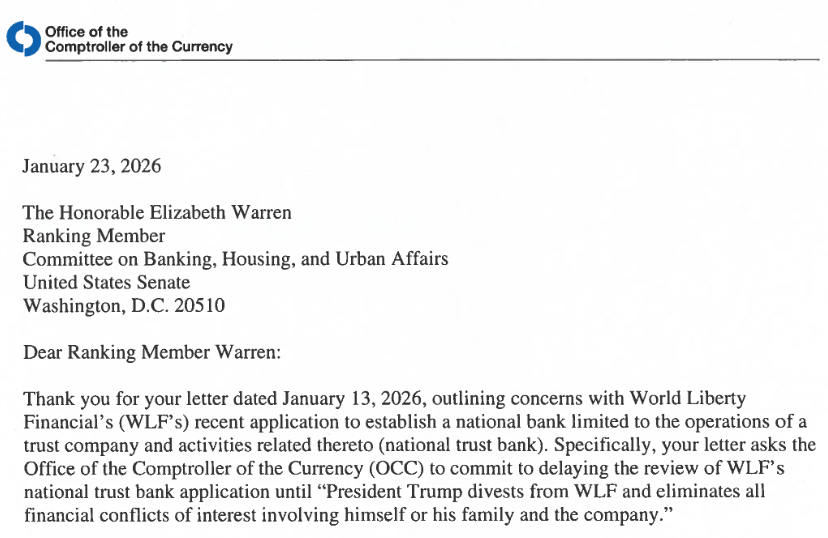

The Office of the Comptroller of the Foreign money has knocked help US Senator Elizabeth Warren’s tell to end the review of World Liberty Monetary’s utility for a national belief bank charter, a circulate she sought till US President Donald Trump divests his stake in the crypto platform.

The OCC’s Jonathan Gould confirmed on Friday that WLF’s utility will possible be evaluated below existing regulatory standards whereas emphasizing that no political or personal monetary ties will impact the procedural review of the bank charter.

“The OCC intends to behave in step with this accountability in preference to your question,” he stated essentially based on Warren’s Jan. 14 letter.

“The OCC charter utility route of wishes to be, and below my leadership will possible be, an apolitical and nonpartisan route of.”

Gould added that WLF’s utility could perchance presumably be self-discipline to a “rigorous review,” cherish any utility it receives.

Warren’s criticisms had been in step with the President and his sons Eric, Donald Trump Jr, and Barron being listed as World Liberty founders, and the platform bringing in billions of greenbacks in paper wealth for the household.

WLF submitted the utility on Jan. 7 to have higher its crypto operations, in conjunction with enabling it to self-discipline, custody and convert its USD1 (USD1) stablecoin in-condominium, in preference to rely on third-occasion suppliers akin to BitGo.

Linked: BitGo’s IPO pop turns risky as shares shuffle below offer effect

USD1 is already widely old for unfriendly-border payments, settlement, and treasury operations and has become the sixth-biggest stablecoin with a market capitalization of $4.2 billion since launching in March 2025.

Crypto trade has struggled to exact banking charters

National belief banking charters had been laborious to exact for crypto corporations in the past.

Nonetheless, a step forward came in December when the OCC awarded five conditional approvals to Circle, Ripple, Constancy Digital Resources, BitGo, and Paxos, signaling the currency regulator’s willingness to have higher crypto companies and products into TradFi.

Journal: A ‘tsunami’ of wealth is headed for crypto: Nansen’s Alex Svanevik