TRON’s market momentum has eased after a recent rally that pushed its tag above $0.365, with the asset now shopping and selling at $0.355, representing a 1.76% tumble over the past 24 hours.

This consolidation follows a standard climb in most up-to-date weeks that saw the community’s transaction exercise and derivatives info map increased analyst consideration.

In conserving with CryptoQuant contributor Burak Kesmeci, the fresh TRX futures market stays in a impartial map, suggesting that the asset can also just peaceable peaceable have faith room to advance sooner than drawing advance a local top.

Futures Market Indicators and Historical Context

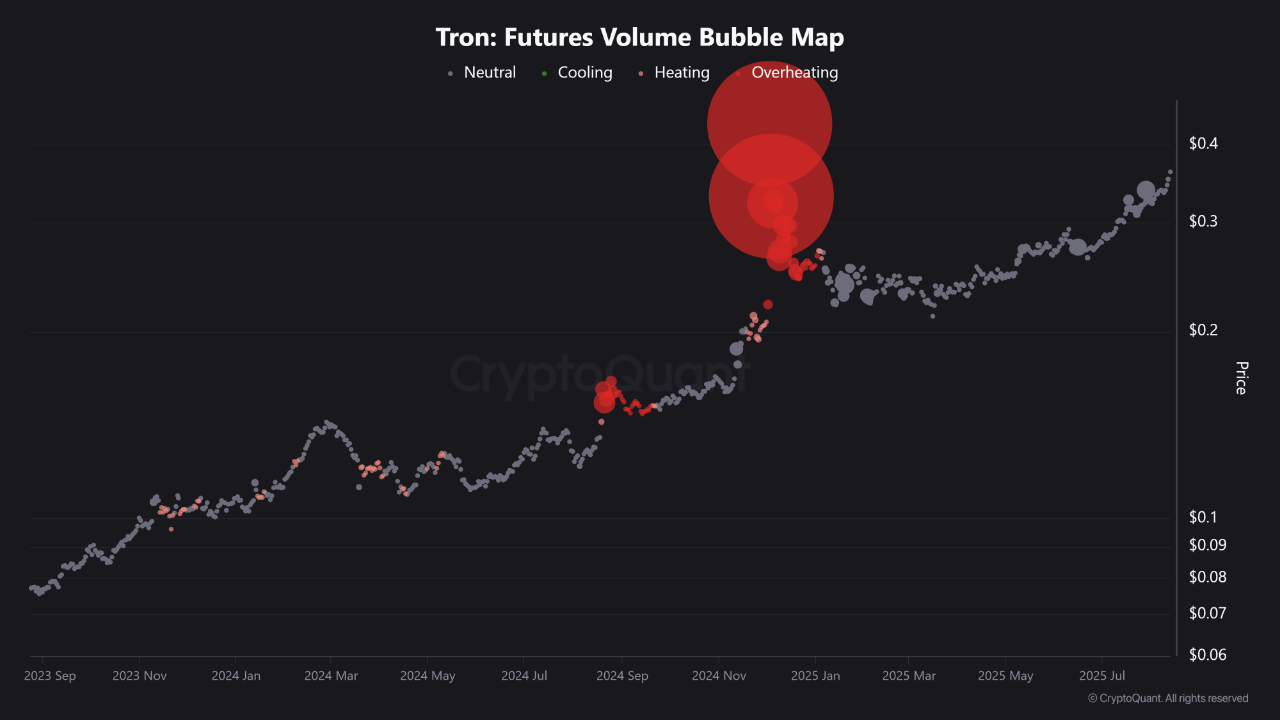

Kesmeci’s analysis centers on the TRON Futures Quantity Bubble Design, a metric aged to gauge periods of overheating in the futures market. Historically, this tool has flagged heightened likelihood when crimson-toned “bubbles” seem, marking moments of low speculative exercise. The final indispensable occasion happened in early December 2024, when TRX rose from $0.26 to $0.forty five sooner than hitting a local top.

For the time being, Kesmeci notes that the indicator has no longer entered the excessive-likelihood zone, which device TRX has no longer but reached ranges of speculative saturation. This, in principle, leaves map for additional tag increases if fresh market trends persist.

Futures market analysis cherish this customarily helps traders differentiate between rallies supported by organic demand and folks pushed essentially by leveraged hypothesis. The impartial reading suggests that fresh TRX actions can also very effectively be supported by proper shopping curiosity comparatively than low transient leverage.

A balanced outlook, however, would also bear in mind that futures market conditions can shift like a flash. If shopping and selling quantity or start curiosity begins to upward thrust sharply alongside tag, the likelihood of a pullback can also grow. For now, the impartial futures atmosphere combined with sensible map market exercise affords a cross for ability incremental gains.

TRON On-Chain Details Exhibits Exchange-Linked Transfer Spike

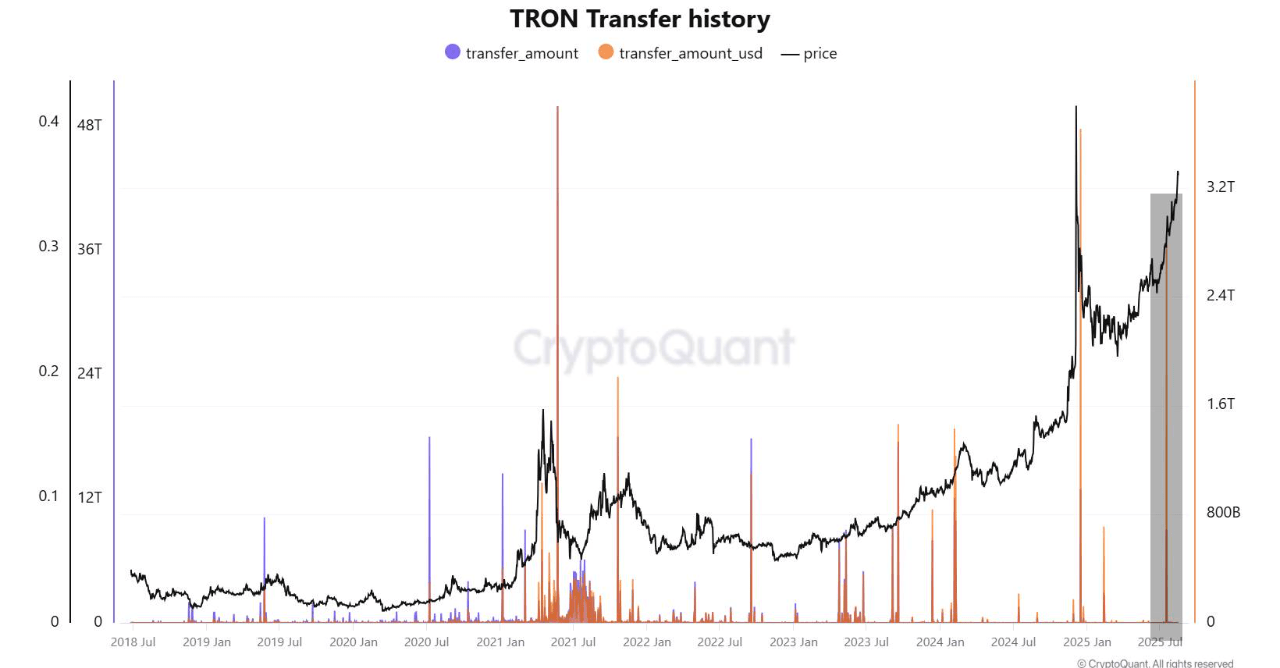

In a separate commentary, CryptoQuant analyst CryptoOnchain highlighted abnormal community exercise on July 19, 2025, when extra than 3.426 billion TRX, valued at roughly $1.11 billion, moved across the blockchain in a single day.

A more in-depth breakdown of those transactions signifies that this surge used to be no longer the tip result of organic person demand nonetheless used to be as an alternative tied to operational actions between a tiny personnel of broad wallets.

The guidelines shows that two help-and-forth transfers of 612 million TRX every between two addresses accounted for around 36% of that day’s total price, fitting the pattern of a hot-to-frigid wallet rebalance customarily associated with exchanges.

Extra chains of transfers, including mounted-denomination actions of between 3 million and 7.5 million TRX, also align with popular commerce deposit and withdrawal processing.

Whereas over 85% of the day’s total transfer quantity used to be traced to this interconnected wallet cluster, both Arkham and Tronscan list no official possession labels for the addresses.

Nonetheless, the mirrored transaction flows and their structured nature strongly point against centralized custody, likely by an commerce or broad service supplier.

When put next with a connected event in June 2023, the July 19 spike happened within a broader trend of rising transactions per 2nd (TPS) and total transaction quantity in 2025.

This signifies that whereas the event itself used to be operational, TRON’s underlying community exercise continues to expand. CryptoOnchain cautions that such operational spikes can also just peaceable be renowned from proper adoption surges to manual clear of overestimating organic inform.

Featured image created with DALL-E, Chart from TradingView