Tron (TRX) for the time being trades at $0.12, its very top level within the previous 30 days. The altcoin’s fee has risen by nearly 10% within the closing month.

Tron’s ticket surge is attributable to the spike in ask for the altcoin in some unspecified time in the future of the period below evaluation.

Tron’s Rally is Backed By Question

An on-chain evaluation of TRX’s performance revealed that its most up-to-date ticket rally is backed by ask from market people.

As an instance, its Relative Energy Index (RSI) is 66.25 on the time of writing and in an uptrend. This metric measures TRX’s overbought and oversold market stipulations.

It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and attributable to a ticket correction. In incompatibility, values below 30 expose that the asset is oversold and will witness a rebound.

At 66.25, TRX’s RSI signals that virtually all market people desire accumulating more coins than selling their holdings.

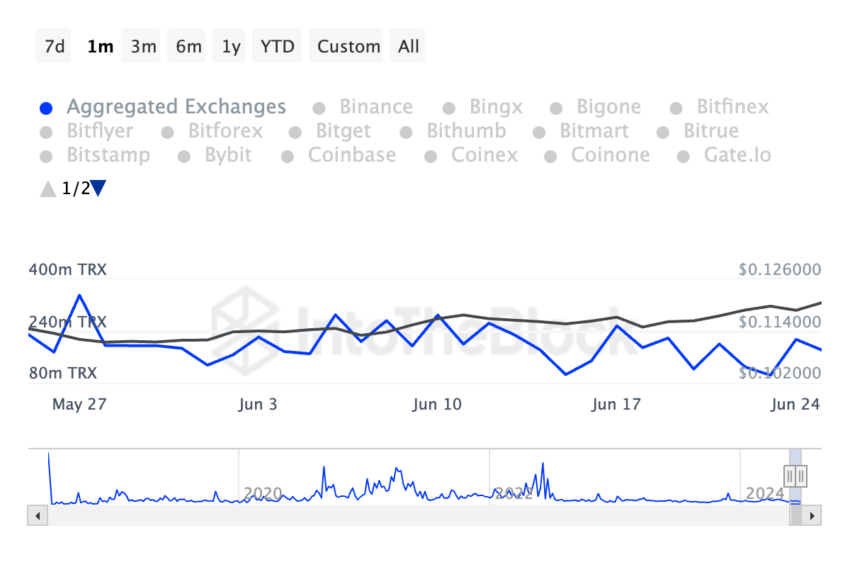

However, some traders own taken good thing about essentially the most up-to-date ticket rally to revenue from distributing some of their TRX holdings. The altcoin’s alternate influx quantity has risen 4% within the previous 30 days.

Learn more: Tron (TRX) Label Prediction 2024/2025/2030

This metric measures the total quantity of an asset being transferred into cryptocurrency exchanges over a particular period. When it rises, it always indicates that more holders are transferring their property to exchanges with the scheme of promoting.

As of this writing, 181.81 million TRX valued at $22 million take a seat all the device in which by cryptocurrency exchanges.

TRX Label Prediction: Earnings-Taking Activity Puts Coin at Menace

With sustained procuring stress in its market, TRX is for the time being trailed by fundamental bullish sentiments. Right here’s confirmed by the space of the dots that fabricate up the coin’s Parabolic Discontinuance and Reverse (SAR) indicator. As of this writing, these dots lie below TRX’s ticket.

The indicator tracks an asset’s ticket trends and identifies seemingly reversal aspects. When its dots relaxation below an asset’s ticket, the market is presupposed to be in an uptrend. It indicates that the asset’s ticket has been hiking and will proceed to discontinue so.

If this pattern continues, TRX might perchance perchance leave the $0.12 ticket level to interchange at $0.13.

However, if the ongoing revenue-taking job positive aspects momentum, this might assign downward stress on TRX’s ticket, invalidating the above projection. It’ll location off the coin’s ticket to interchange at $0.11.