- TRON is closing in on Ethereum’s USDT dominance resulting from low costs and solid give a boost to from essential exchanges.

- Ethereum aloof attracts institutional hobby, with rising day-to-day active addresses and winning whale job.

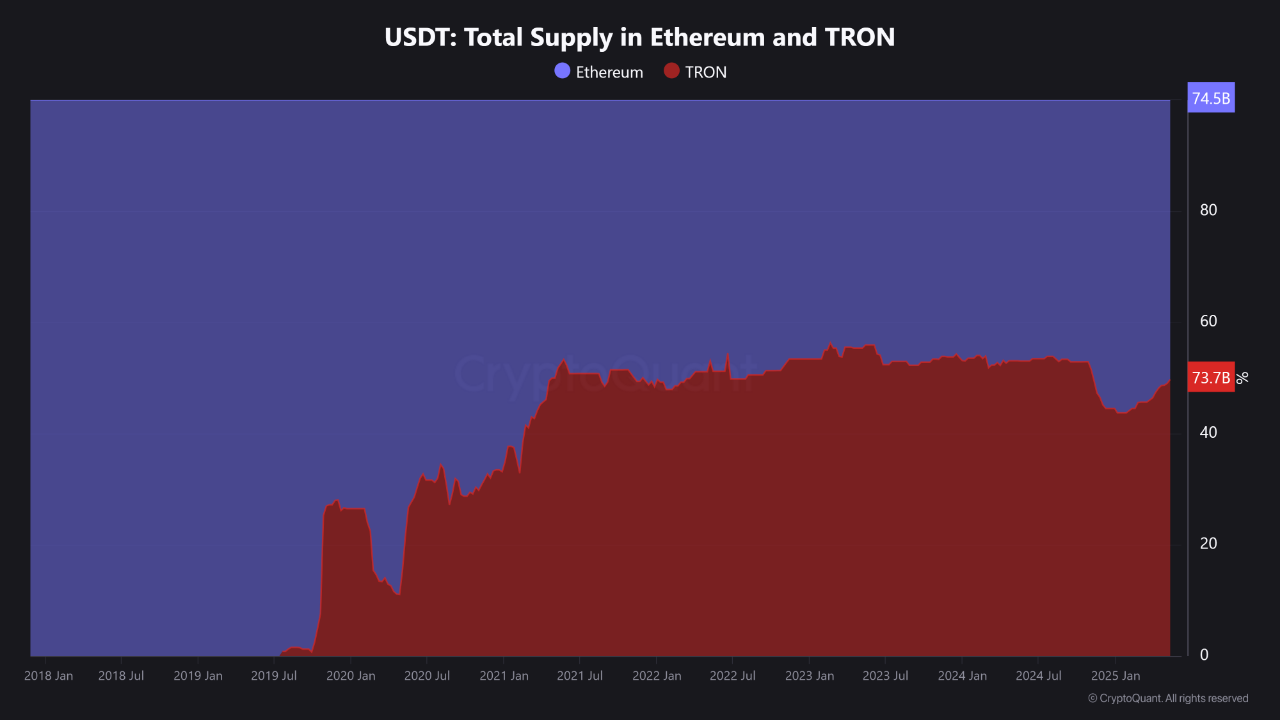

A couple of years ago, Ethereum may well want been the essential home for USDT. However now, the epic is various. The battle has been heating up since 2021, and TRON, without out of the ordinary fuss, is slowly catching up.

At the second, in conserving with CryptoQuant, Ethereum is aloof rather forward with a whole USDT supply of around $74.5 billion. However TRON is carefully following at $73.7 billion. These numbers judge how trade gamers are more and more fervent about efficiency and flee.

Within the support of this shift, there are several things that build TRON a novel alternative for quite lots of contributors. Ethereum’s gasoline costs that may build your pocket snort are no doubt one of many triggers. However no longer handiest that, tall exchanges indulge in Binance, OKX, and Bybit are additionally pushing for the expend of the TRC20 well-liked.

Even in the Asian market, TRON is more and more being feeble for over-the-counter transactions. All these factors build TRON no longer underestimated.

TRON is Getting More Frail, Ethereum is Peaceable Charming

If we look for additional, Ethereum once held nearly all adjust over USDT, in particular in 2019. However now? The proportions are nearly even—Ethereum is around 50.26% and TRON is 49.73%. It’s no longer glorious about who’s bigger, however who’s more agile and ambiance pleasant. Honest appropriate imagine whereas you needed to switch a orderly quantity of stablecoins, and the gasoline price modified into once equal to a like dinner. You’d think twice, glorious?

Furthermore, TRON is no longer glorious about low charges. CNF previously reported that TRON has maintained a day-to-day block production efficiency of ninety nine.7%. This balance is well-known, in particular for a community that is the backbone of stablecoin transactions. Plus, their Tidy Representative (SR) machine reveals wholesome rotation, reflecting moderately competitive governance.

On the many hand, Ethereum is no longer standing aloof. The most up-to-date data reveals a 15% develop in day-to-day active addresses, breaking by 450,000. There modified into once even one ETH whale that managed to turn a $21 million loss correct into a $21.7 million design. His whole asset worth now? $104.5 million. This roughly job indicators that institutional hobby in Ethereum has no longer died down—in fact, it is a long way even burning hotter.

Interestingly, as we previously reported, Ethereum is currently buying and selling above its realized ticket. This implies that many long-term holders—in particular Binance users—are in a delighted converse, aka winning. Binance itself remains a essential liquidity hub for ETH, even all the arrangement by essential portfolio shifts.

Nonetheless, TRON is additionally exhibiting a interesting pattern. Regardless of the most up-to-date decline in unique wallets and transactions, many analysts look for it as an accumulation segment. Slowing job does not imply weakening, however moderately making ready for the next surge.