In a fresh file, TRM Labs sustained that natural adoption dominates shopping and selling volumes, as stablecoins dangle change into a key driver for Venezuelans navigating economic instability and exclusion from inclined global settlements and payments platforms, even in an ecosystem with structural risks.

TRM Labs: Venezuela’s Natural Crypto Adoption Surpasses Illicit Exercise

TRM Labs, a world blockchain forensics and analytics agency, has discussed the fresh converse of the cryptocurrency ecosystem in Venezuela in opposition to a backdrop of elevated sanctions.

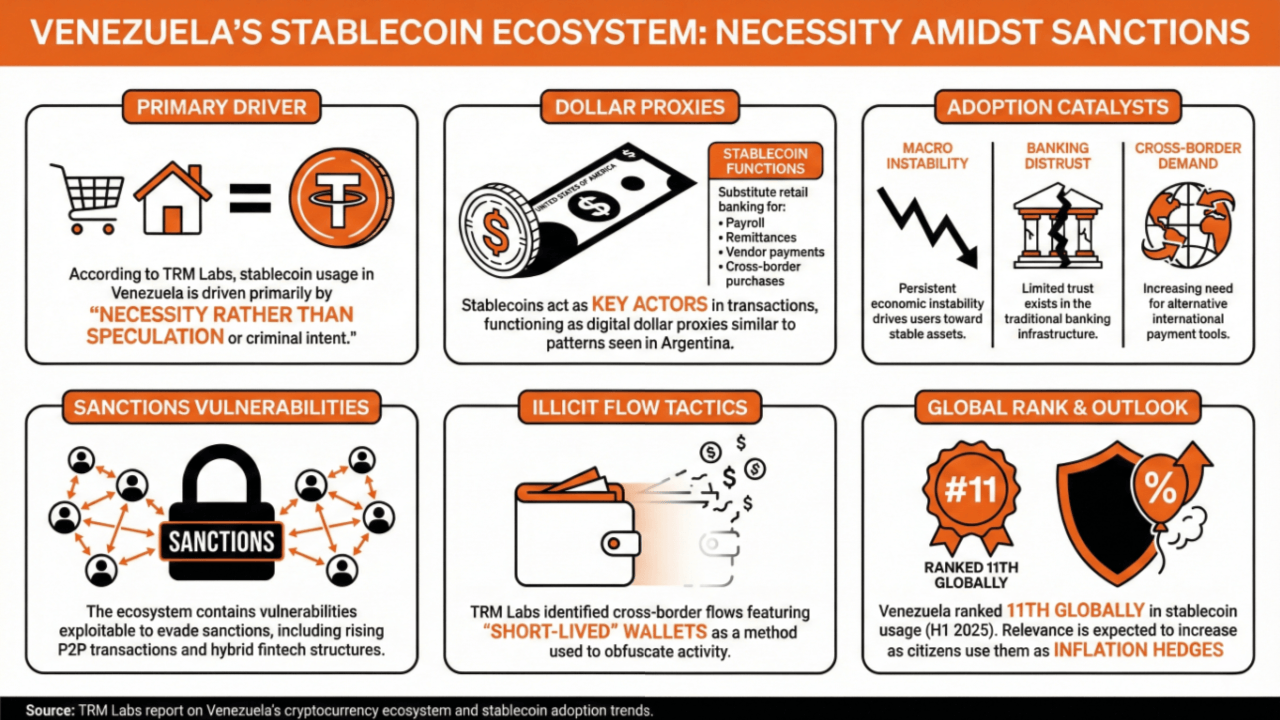

In a fresh article, the agency acknowledged that, even with renewed global compliance concerns, the utilization of stablecoins stays essentially pushed by “necessity moderately than speculation or criminal intent.”

TRM Labs stumbled on that stablecoin adoption in Venezuela follows a the same sample seen in international locations love Argentina, turning into key actors in both family and commercial transactions as dollar proxies.

For the agency, three aspects act as drivers of stablecoin adoption within the fresh Venezuelan economic context: power macroeconomic instability, a tiny belief in inclined banking infrastructure, and an increasing seek files from for alternative rank-border cost tools.

TRM Labs acknowledged:

Stablecoins now operate as a change for retail banking — facilitating payroll, family remittances, vendor payments, and rank-border purchases within the absence of consistent home monetary products and services.

Alternatively, TRM Labs moreover identified lots of vulnerabilities for the interval of the Venezuelan ecosystem that would perhaps well be exploited to lead clear of unilateral sanctions. These consist of the rising recognition of P2P (ogle-to-ogle) transactions, the utilization of hybrid fintech structures that combine banking products and services with blockchain wallets, and the existence of rank-border flows that comprises “rapid-lived” wallets.

The TRM Labs’ file comes because the U.S. authorities no longer too lengthy within the past confiscated a tanker containing Venezuelan oil, an motion that was labeled as “piracy” by Venezuelan authorities.

Earlier reports dangle linked the sale of Venezuelan oil to third occasions to stablecoin transactions, though no official statements dangle been made, neither confirming nor denying these allegations.

Within the extinguish, TRM Labs concludes that, if nothing adjustments, the relevance of stablecoins in Venezuela is anticipated to preserve increasing, as everyday citizens proceed to rely on these tools as inflation and devaluation hedges.

The agency’s maintain stablecoin crypto adoption file ranked Venezuela because the 11th nation with basically the most stablecoin utilization for the duration of the main half of of 2025.

Read Extra: Economist: USDT Leveraged to Resolve Crude Oil Sales in Venezuela

FAQ

-

What fresh insights did TRM Labs present about cryptocurrency utilization in Venezuela?

TRM Labs highlighted that stablecoin utilization in Venezuela is essentially pushed by necessity attributable to elevated sanctions and economic instability. -

What patterns of stablecoin adoption dangle been seen?

Stablecoin adoption in Venezuela mirrors traits in Argentina, serving as a dollar proxy in both family and commercial transactions. -

What components are riding stablecoin utilization in Venezuela?

Three key drivers consist of macroeconomic instability, an absence of belief in inclined banking, and rising seek files from for alternative rank-border cost suggestions. -

What future traits are anticipated for stablecoins in Venezuela?

TRM Labs anticipates that stablecoins will change into more and more linked as Venezuelans proceed to rely on these digital sources to hedge in opposition to inflation and devaluation.