A brand fresh peek conducted by Charles Schwab, a number one publicly traded US brokerage managing over $9 trillion in consumer property, has shown that forty five% of respondents expressed intentions to make investments in Bitcoin and crypto ETFs over the next 365 days.

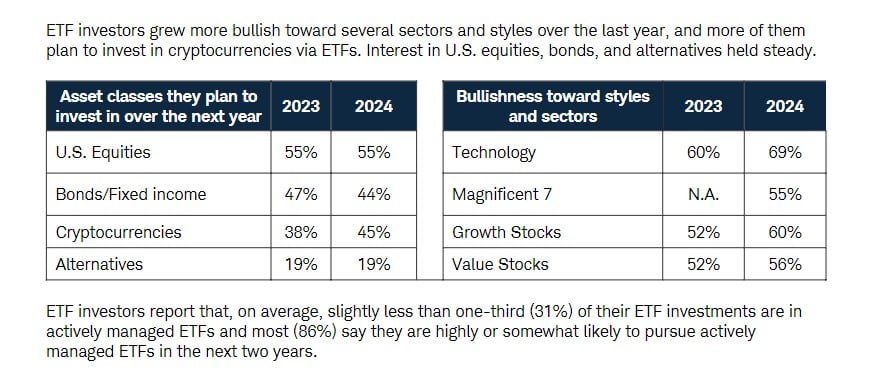

Bullish sentiment in direction of crypto property has increased amongst ETF merchants when when compared with the old 365 days. In 2023, totally 38% of respondents acknowledged they deliberate to make investments in crypto ETFs within the next 365 days.

The shift in ETF funding traits shows growing investor self belief in crypto property. Quiet, US equities are merchants’ top picks, with 55% planning investments in 2025. In the meantime, hobby in bonds remains reasonably staunch, with 44% of merchants announcing they knowing to pour money into bond ETFs.

Investment strategies also diverge amongst generations, in keeping with the findings. Millennials exhibit a increased propensity for risk with 62% of respondents on this crew planning to make investments in crypto ETFs over the next 365 days.

Gen X also showed hobby in crypto ETFs, with 44% of respondents planning to make investments in these products. In distinction, totally 15% of Boomers care about these ETFs.

The millennial generation will be more inclined to make investments with their values and customize their portfolios. In comparison to a form of generations, they’re more inclined to make investments in dispute indexing subsequent 365 days attributable to their increased hobby in dispute indexing.

The surge in crypto ETF hobby comes at a time when the ETF market has loved instant adoption, seemingly influenced by the initiating of US situation Bitcoin and Ethereum ETFs. These ETFs occupy reported growing holdings over the last eight buying and selling months.

These authorized crypto ETFs provide merchants with an extra regulated avenue to form exposure to Bitcoin. In accordance with Bloomberg ETF analyst Eric Balchunas, BlackRock’s iShares Bitcoin Have confidence (IBIT) and Constancy’s Bitcoin ETF (FBTC) despicable amongst the tip 10 ETF launches this 365 days.