In 2024, cryptocurrencies faced over 410 safety breaches, inflicting losses of $2.013 billion, with DeFi being the hardest hit. These incidents screen the urgent need for better safety, stricter suggestions, and more believe in digital sources.

2024 used to be a year for cryptocurrency, great safety points and scam projects personal shown that the system wants improvement. Per SlowMist Hacked, there were 410 safety incidents reported in 2024, the build substantial losses account for $2.013 billion.

Per SlowMist document, 2024’s losses, on the opposite hand, stand at 19.02% decrease than in 2023, the build a total of 464 incidents took web web direct and left a lack of $2.486 billion.

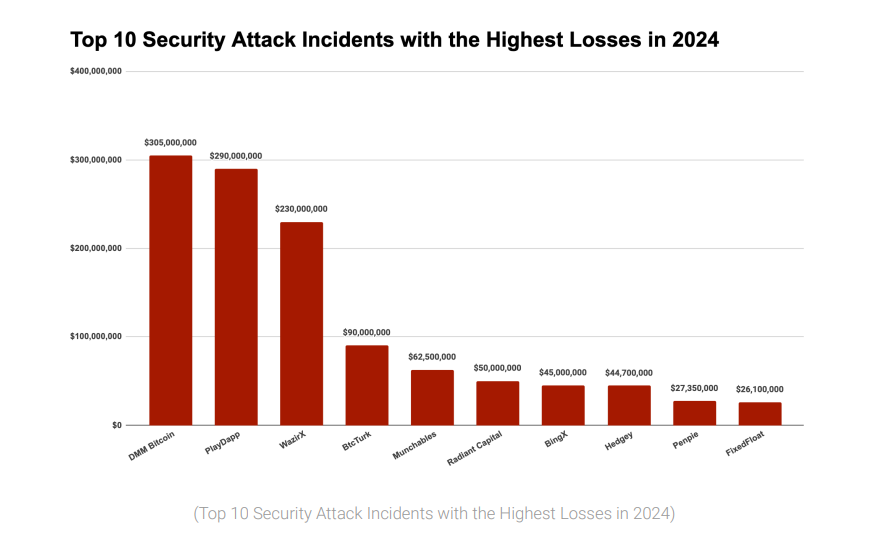

Essential Safety assault incidents of 2024

DeFi used to be basically the most susceptible home with 82.68% of breaches. There were 339 DeFi cases, which resulted in a substantial lack of $1.029 billion. That is 33.12% higher than the 2023 model, which used to be $773 million.

It presentations how stunning decentralized finance has turn into for hackers attributable to pale safety and flaws in attention-grabbing contracts. Primarily the most attention-grabbing loss used to be seen for Ethereum with $465 million loss.

Binance Dapper Chain, or BSC, adopted 2nd with the lack of $87.35 million. On Might per chance well 31, just some of the worst hacks occurred on the Eastern cryptocurrency alternate DMM Bitcoin.

There, hackers deceived users into helping them take 4,502.9 BTC from the alternate’s legit pockets by inflicting about $330 million in losses. It’s miles the seventh most attention-grabbing hack within the historical previous of cryptocurrencies and basically the most attention-grabbing since 2022.

Per the FBI, United States Division of Defense Cyber Crime Center, and the Eastern Nationwide Police Company, North Korean hackers did this as a part of an assault that came to be recognized as the Provider Traitor marketing campaign.

One other great hack fascinating the Indian alternate WazirX. There, a web web direct within the tests on multisig wallets meant higher than $230 million lost.

In February, hackers stole the non-public key of the PLA token attention-grabbing contract on the PlayDapp blockchain gaming platform. With this switch, they managed to mint 1.Seventy 9 billion tokens with the attacker’s permission.

After negotiations and a proposal of a $1 million reward for white-hat hackers, the attackers were mute free to construct more tokens. The exchanges iced over the tokens so they would possibly even no longer be supplied in tremendous portions. It used to be a phishing email posing as a first rate search files from of from a partnership alternate.

Across the identical time, Turkey’s BtcTurk lost $90 million when hackers acquired unauthorized in finding entry to to its sizzling wallets in June, and Binance iced over $5.3 million in stolen sources.

Some of basically the most attention-grabbing incidents were that of Singapore-based fully fully alternate BingX, which had reportedly suffered loss by means of unauthorized in finding entry to to nearly $forty five million in September.

One other used to be Sexy Capital in October with an estimated lack of about $50 million. Hedgey Finance will most seemingly be within the list, shedding about $44.7 million, and it’s resulting from input validation points. Penpie lost nearly $27.35 million from malicious attention-grabbing contracts and flash loan attacks within the liquidity rewards.

For this motive, there have to be an improvement within the safety component for platforms. Rug pulls are the build rogue teams advertise projects for money and run off with it.

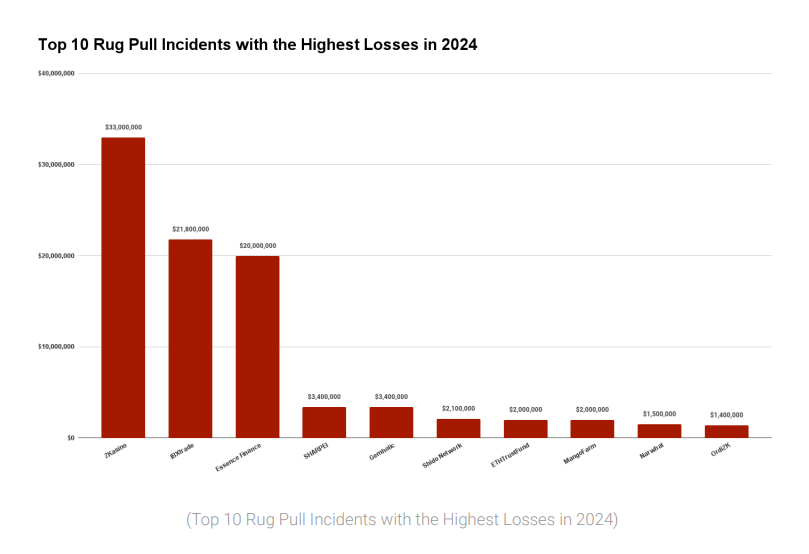

Essential Rug Pulls

In 2024, fifty-eight cases of rug pulls occurred, main to a lack of $106 million. Primarily the most attention-grabbing rug pull within the zkSync system used to be $36.95 million. Primarily the most rug pulls occurred within the BSC system, at 28 in total. Primarily the most new one used to be SHARPEI. It used photography of Shar Pei dogs and celebrities to force its model to $54 million. It used to be supplied after this for $3.4 million, with a lack of 96% for the token.

The nature of such incidents calls for factual regulation and foremost safety measures over the fleet-increasing business of cryptocurrency. Some proposals are for compulsory auditing of attention-grabbing contracts, tightening retain watch over over KYC and AML, and also the provision of insurance coverage swimming pools from which an account will seemingly be withdrawn within the case of breach.

One other tendency has been successfully-known the build worldwide locations launch up taking collective steps to fight cyber threats at worldwide levels.

The SEC will potentially play a enticing great role within the Trump administration since it’s an point out for cryptocurrencies. As Congress is basically controlled by Republicans, it would potentially point of curiosity on obvious suggestions encouraging new suggestions however on the identical time maintaining investors.

Even if there are such quite a lot of issues, it will most seemingly be ready to assemble a safer and stronger system. With the abet of cryptocurrency give a rob to from the Trump administration to construct safety better with clearer suggestions, it is going to also enter a brand new time of creativity in believe in digital sources.

All of it relies on how regulators and builders work with the neighborhood to remedy issues that can perchance even arise in 2025.