- Bitcoin payment would per chance per chance per chance also manufacture a 12% plunge to the weekly imbalance zone earlier than reclaiming its ATH.

- Ethereum payment seemingly to plunge 10% earlier than ETH turns into dazzling for investors.

- Ripple payment would per chance per chance per chance also lengthen the plunge with a bearish divergence in play, amid a hidden continuation sample.

- Volatility has elevated available within the market earlier than Fed ardour payment resolution.

Bitcoin (BTC) payment slipped below the $65,000 threshold on Tuesday, bringing down with it Ethereum (ETH) payment apart from Ripple (XRP) payment. Volatility stages like also elevated, as markets terminate wide awake for Wednesday Federal Open Market Committee (FOMC) policy meeting.

Nonetheless, with expectations of an ardour payment quit, and additional ardour payment hikes off the desk, crypto market contributors like reason to inquire of a rally in Bitcoin and altcoins. A quit would tag on the Fed taking a extra accommodative stance in direction of the economic system, doubtlessly leading to elevated risk bound for meals amongst investors, which would per chance per chance be bullish for crypto.

Also Learn: Bitcoin payment attracts additional a long way off from its all-time excessive of $73,777 with BTC halving one month away

Bitcoin payment would per chance per chance per chance also plunge 12% to the weekly imbalance diagram

Bitcoin payment has fashioned a Head-and-Shoulders sample on the day by day timeframe, forecasting a 12% plunge if the technical formation performs out. The market is leaning in direction of the downside, with the Relative Energy Index (RSI) nose-diving to signify momentum is falling.

The Awesome Oscillator (AO) will most likely be edging in direction of the indicate stage with its histogram bars flashing purple. If the bears like their advance, BTC payment would per chance per chance per chance also plunge into the weekly imbalance, stretching from $52,985 to $59,005.

BTC/USDT 1-day chart

On the opposite hand, if the bulls are in a keep apart of residing to flip the neckline of the Head-and-Shoulders sample into encourage, Bitcoin payment would per chance per chance per chance also lengthen north to disclose the bearish thesis above the $69,000 threshold.

Also Learn: Bitcoin payment gives one more decrease purchasing opportunity 30 days to BTC halving

Ethereum payment eyes a 10% plunge

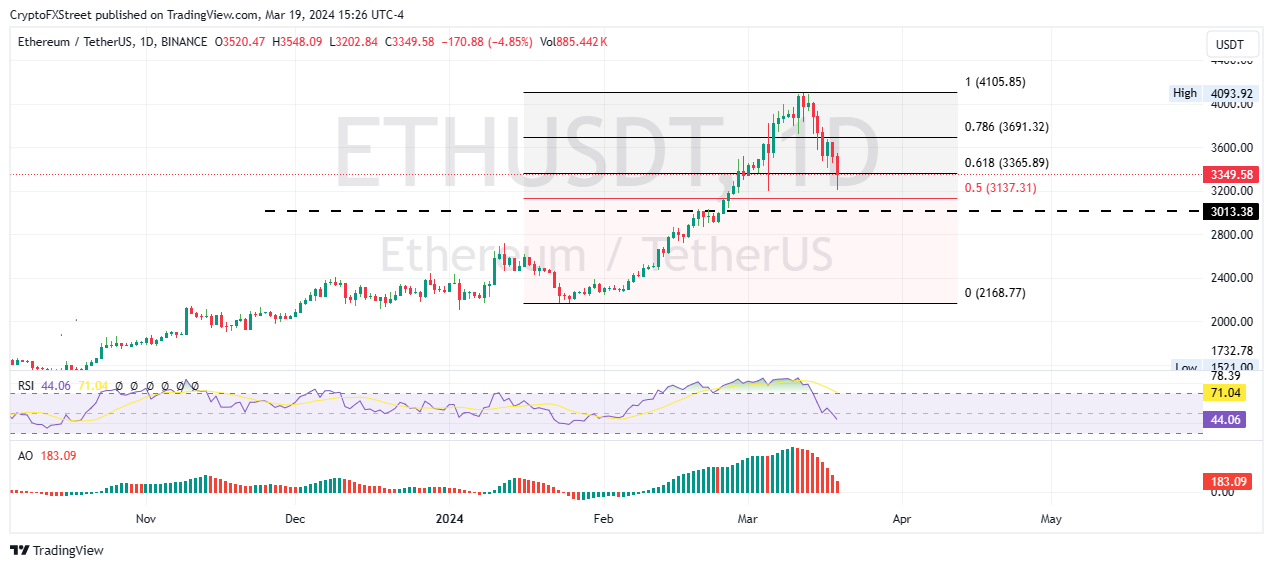

Ethereum payment has slipped below doubtlessly the most serious Fibonacci retracement stage, 61.8% at $3,365, with eyes now peeled on the 50% Fibonacci placeholder at $3,137.

With the RSI nose-diving below the indicate stage as momentum falls quickly, coupled with the AO histogram bars drawing in direction of negative territory, Ethereum payment would per chance per chance per chance also plunge 10% to search out inflection spherical $3,013 earlier than ETH is dazzling for purchasing.

ETH/USDT 1-day chart

Conversely, if the bulls develop their purchasing force at unusual stages, Ethereum payment would per chance per chance per chance also pull north, breaching resistance attributable to the 78.6% Fibonacci retracement stage of $3,691.

A flip of this roadblock into encourage would encourage the slack bulls to buy ETH, with the ensuing purchasing force sending ETH payment north to file a better excessive above the pinnacle of the market fluctuate at $4,105. This is in a position to recount a 25% climb above unusual stages.

Also Learn: Ethereum L2 bridge deposits skyrocket after Dencun Give a steal to

This bearish divergence would per chance per chance per chance also send XRP payment decrease

Ripple payment has recorded better lows, whereas the RSI has produced decrease lows, culminating in a attainable weakening momentum or a pattern reversal. It suggests the bullish momentum in XRP payment is dropping energy because the RSI is showing decrease stages.

Increased selling force would per chance per chance per chance also stumble on Ripple payment plunge below the ascending trendline, doubtlessly going as low as $0.5500, or in a dire case, lengthen a leg decrease to take a look at the $0.5368 encourage stage. This is in a position to recount a plunge of spherical 11% below unusual stages.

XRP/USDT 1-day chart

Conversely, a recovery by the bulls would per chance per chance per chance also stumble on XRP payment restore above the 50% Fibonacci placeholder at $0.6152. Enhanced purchasing force above this stage would per chance per chance per chance also stumble on the pricetag confront the 61.8% Fibonacci retracement stage of 0.6460, where stiff resistance is anticipated.

Overcoming this stage would per chance per chance be the signal the skeptics would per chance per chance should always reach in en masse and push XRP payment additional north. This would per chance per chance also send XRP payment to the pinnacle of the market fluctuate at $0.7457, denoting a 24% climb above unusual stages.

Also Learn: XRP trades with modest losses below key $0.60 stage