The crypto market had solid momentum heading into 2025, with a complete capitalization up bigger than 40% year-to-date (YTD), fueled by bullish developments across major sources.

On the other hand, the tailwinds cooled off for the length of the first quarter, inflicting the general market cap to drop by with regards to 19% sooner than rebounding all yet again in the 2nd quarter.

Supported by regulatory readability in the U.S., landmark stablecoin funds, and rising institutional adoption, the renewed momentum most continuously persevered in the summer season.

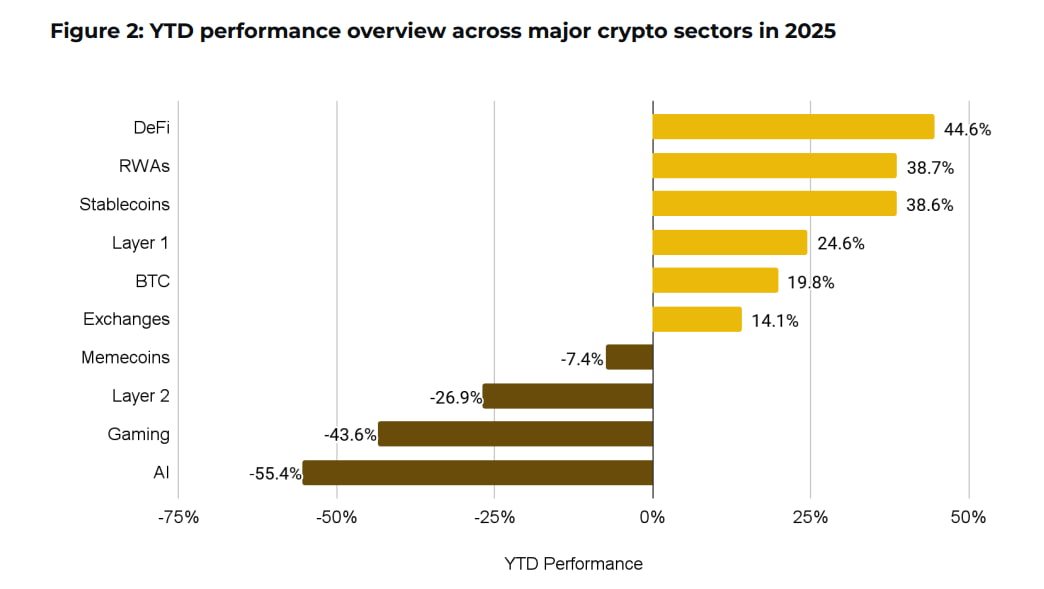

While the general image does seem sure, the info naturally vary amongst assorted sectors, with about a of them exponentially outperforming the others YTD and almost carrying the market, per records published by Binance Analysis on August 28.

DeFi, tokenized equities, and stablecoins dominate

This year, stablecoin offer rose 35%, hitting a document $277.8 billion amid renewed inflows and expanding utilize cases.

Company treasuries are also accelerating adoption, with public company Bitcoin (BTC) holdings reaching 1.07 million BTC, spherical 5.4% of circulating offer, across 174 firms. Overall, stablecoins won 38.6% YTD.

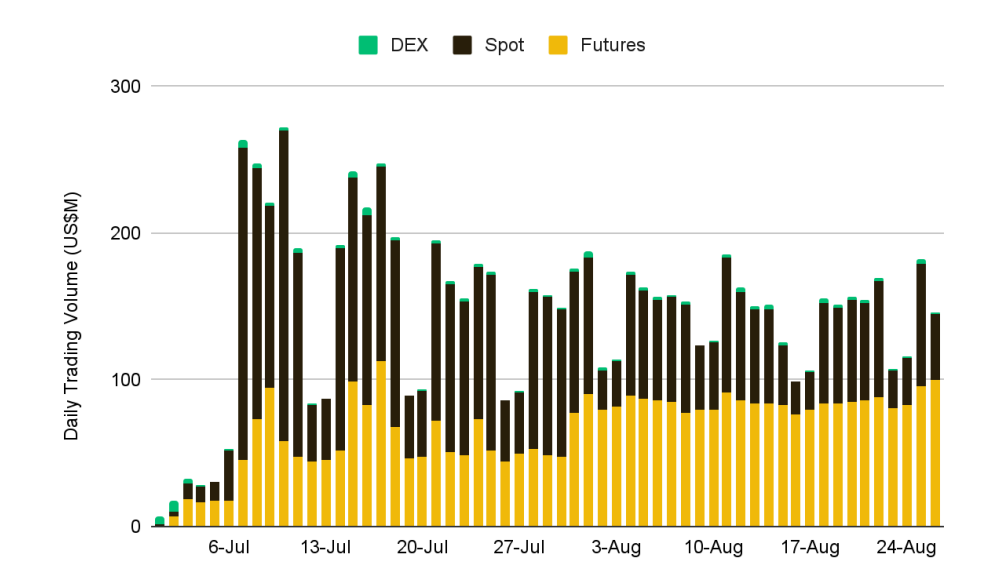

Decentralized exchanges (DEXs) also hit a document market half, now accounting for bigger than 23% of space and 9.3% of futures volumes, though their moderate every single day quantity remains comparatively low at $1.9 million as of August.

Extra significantly, decentralized finance (DeFi) lending climbed some 65%, reaching $79.8 billion in complete ticket locked, whereas tokenized equities are drawing strategy $350 million, pushed by stronger issuer infrastructure and clearer legislation.

The enhance is showing no brand of slowing down, with the selection of active on-chain holders with regards to tripling from 22,400 in July to 66,500 in August.

In complete, DeFi won 44.6% YTD, whereas staunch-world tokenization (RWA) saw 38.7% returns over the same length.

Bitcoin and Ethereum still preserving solid

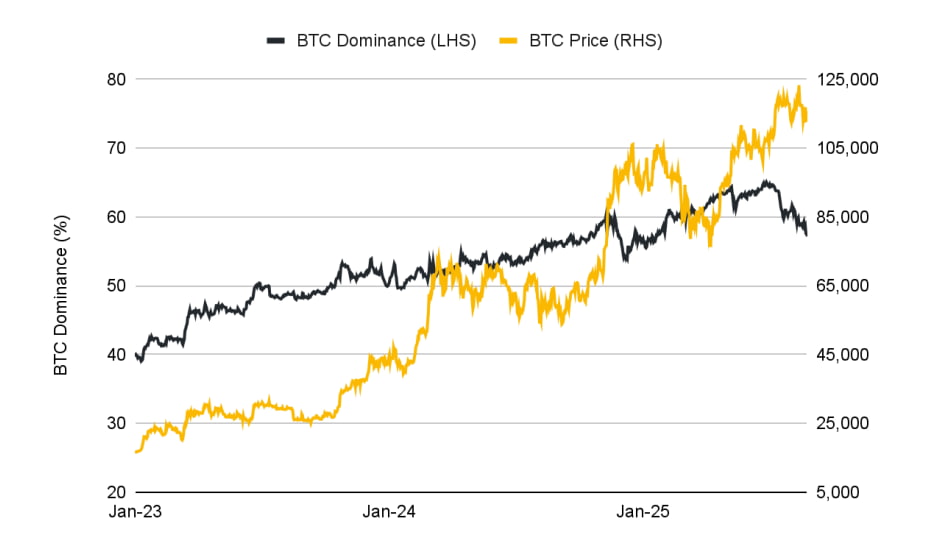

Bitcoin has outperformed venerable benchmarks this year, delivering 19.8% YTD.

Exchange-traded funds (ETFs) possess emerged as a number one catalyst, with U.S. space BTC and Ethereum (ETH) products drawing $28 billion in net inflows.

Composed, it bears pointing out that capital rotation toward altcoins has picked up as Bitcoin dominance dropped to 57.2% from June highs of 65.1%.

Within the length in-between, Ethereum staking hit a document 35.8 million ETH, with regards to 30% of the provision. Overall, layer-1 (L1) protocols possess considered a 24.6% return YTD.

Conversely, meme coins possess performed moderately poorly, losing 7.4% YTD, as possess layer-2 (L2), gaming, and synthetic intelligence (AI) oriented initiatives, which saw 26.9%, 43.6%, and 55.4% in losses, respectively.

Featured image by the usage of Shutterstock