This week, predominant files has captured the honour of crypto investors and enthusiasts alike. A potential region Ethereum substitute-traded fund (ETF) approval, the upcoming US CPI files unencumber, and other most indispensable events are place to form the crypto market.

These traits can also hold a ways-reaching implications, prompting market contributors to take care of vigilant and informed.

Predominant Crypto Regulations Faces Key Vote in Congress

This week, US lawmakers will vote on H.J. Res. 109, aiming to overturn the controversial SEC Workers Accounting Bulletin 121 (SAB 121). Home Majority Leader Steve Scalise’s weekly agenda suggests that the resolution would possibly perhaps per chance be regarded as on Tuesday or Wednesday.

This bulletin requires monetary institutions to checklist their prospects’ digital property on their steadiness sheets. Critics argue that this rule keeps digital property delivery air the US monetary procedure.

Both the Home and Senate well-liked the repeal of SAB 121 in Also can. Quiet, President Joe Biden vetoed the bill, emphasizing his administration’s commitment to no longer supporting “measures that jeopardize the smartly-being of customers and investors.” Many alternate experts and investors believe this would possibly perhaps be a in point of fact crucial vote for the broader crypto alternate.

Space Ethereum ETF Approval on the Horizon

Market watchers are abuzz with expectations surrounding the functionality approval of region Ethereum (ETH) substitute-traded funds (ETFs). After quite a lot of asset managers updated their S-1 kinds, experts predict these ETFs can also launch soon.

Bloomberg Intelligence’s ETF analysts, James Seyffart and Eric Balchunas, imply that these ETFs “can also potentially checklist later subsequent week or the week of July 15.” Nate Geraci, president of ETF Retailer, echoes this sentiment.

“Can be worried if region ETH ETFs are no longer procuring and selling interior the subsequent 2 weeks. Later subsequent week is a likelihood, but I mediate the week of July 15 is extra likely,” he famed.

The SEC’s approval route of stays serious for these ETFs to launch procuring and selling. Whereas the SEC has well-liked the 19b-4 kinds, issuers silent need their S-1 kinds well-liked to proceed.

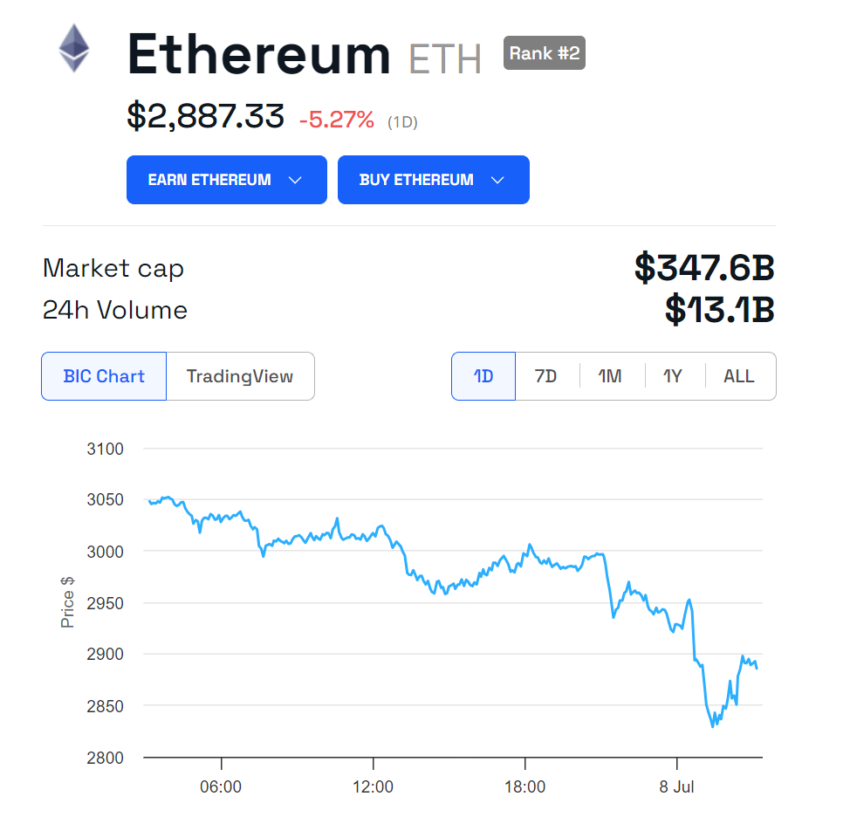

Despite the optimism surrounding the final approval of those ETFs, the associated rate of ETH has decreased drastically since the approval of the 19b-4 kinds in gradual Also can. In step with BeInCrypto files, ETH is now procuring and selling at $2,865, marking a almost 27% lower since the preliminary approval date.

Read extra: Ethereum ETF Defined: What It Is and How It Works

US CPI Records Originate and Its Market Implications

One more serious occasion this week is the US User Imprint Index (CPI) files, scheduled for unencumber on July 11. The outdated CPI files for Also can showed no month-to-month prolong, which offers some respite to inflation considerations.

Projections from the Federal Reserve Monetary institution of Cleveland imply that the monthly prolong in headline CPI inflation for June will be 0.08%, with core CPI inflation, other than meals and energy, at 0.28%. Despite the indisputable truth that these estimates are no longer always right, they are on the total upright in indicating where monthly inflation figures would possibly perhaps well land.

Alternatively, the Federal Reserve will closely note the upcoming figures to gauge inflation traits and safe informed policy choices. This files will be regarded as on the central monetary institution’s subsequent policy assembly on July 30-31.

Decrease inflation figures can also prove financial balance, potentially boosting investor self belief and riding capital into riskier property like cryptocurrencies. Conversely, if inflation exceeds expectations, the Federal Reserve can also neutral opt to shield or carry hobby charges, injecting uncertainty into the markets.

As a result of their unstable nature, cryptocurrencies can also undergo most indispensable mark changes in response to these financial indicators. Thus, investors must silent actively note CPI files and the Fed’s choices to navigate the market.

Jupiter’s Provide Cut value Proposal

Jupiter, a Solana-based mostly mostly decentralized substitute (DEX), is place to implement a most indispensable switch in its tokenomics with a proposal to in the cut value of the whole present of its native token, JUP, by 30%. This proposal, shared by the pseudonymous co-founder Meow, involves a voluntary physique of workers cut of 30% from their distributed tokens and a corresponding cut value in Jupuary emissions. The governance vote on this proposal will happen somewhere in July.

Meow emphasised that these changes are imaginable on story of Jupiter does no longer hold roar investors, allowing the physique of workers to procure valorous moves to optimize the platform’s tokenomics. The proposed changes goal to take care of high emissions stages, streamline the platform’s monetary structure, and hold interaction the neighborhood extra deeply in Jupiter’s long-timeframe imaginative and prescient.

Vela V2 Originate and Upgrades

Vela, an Arbitrum-native perpetual DEX, will launch its Vela V2 on July 8. This model brings upgraded tokenomics, a brand contemporary procuring and selling rivals, and enhanced aspects to the platform.

Vela V2 involves versatile vesting alternate choices, governance voting, and a simplified staking page. Moreover, to incentivize participation and reward intriguing users, Vela V2 will introduce a 500,000 ARB prize pool in Huge Prix Season 3.

Xai and Various Predominant Token Unlocks This Week

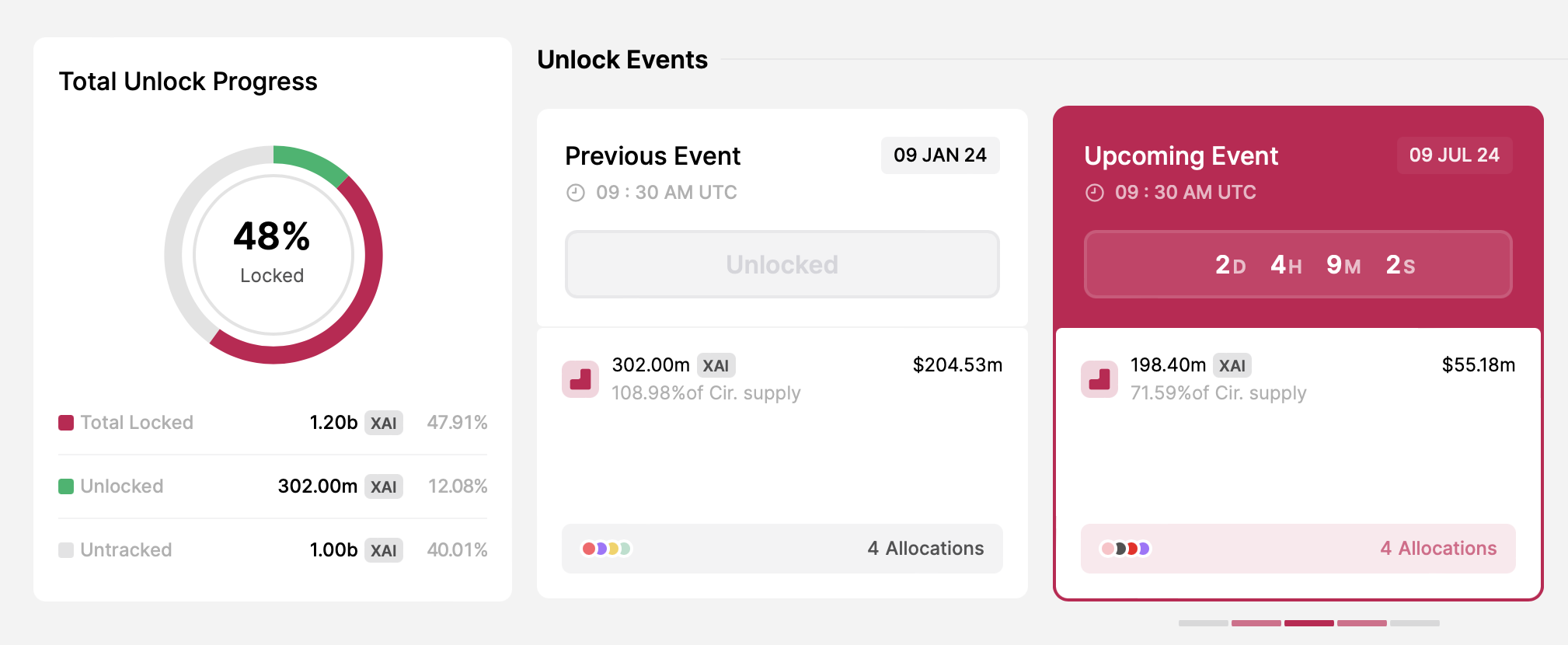

Xai, a layer-3 (L3) resolution designed for AAA gaming, will free up almost 200 million XAI tokens on July 9. The amount, value around $55.18 million, accounts for 71.59% of its circulating present. Therefore, this token free up has sparked discussions among the crypto neighborhood about its potential impact on XAI’s mark.

Moreover, Aptos will free up a most indispensable amount of its native token, APT. TokenUnlocks files presentations that the layer-1 (L1) blockchain will distribute 11.3 million APT among neighborhood contributors, core contributors, and investors on July 12. This figure represents 2.49% of its circulating present, valued at approximately $62.88 million in line with the contemporary market mark.

Various tasks like Immutable (IMX) would possibly perhaps even shield token unlocks over the identical period. Read this article for added detailed files on predominant crypto token unlocks this week.