Financial markets shimmered with cautious optimism as U.S. equities closed positively Friday, with the Nasdaq Composite rising 2.06% and the digital asset sector vaulting 3.72% to a $2.63 trillion valuation. Publicly listed bitcoin miners likewise loved a rebound, as nine of the tip twelve main corporations by market capitalization evolved.

Publicly Traded Bitcoin Miners Pop Friday—But YTD Losses Level-headed Lower Deep

Publicly traded bitcoin miners closed the week on an upward trajectory, with a dominant share of these corporations posting particular returns following a volatile stretch. After consecutive declines spurred by U.S. President Trump’s tariffs, the Nasdaq climbed 2.06%, the NYSE obtained 1.84%, the S&P 500 evolved 1.81%, and the Dow Jones Industrial Common added 1.56% relative to the U.S. greenback.

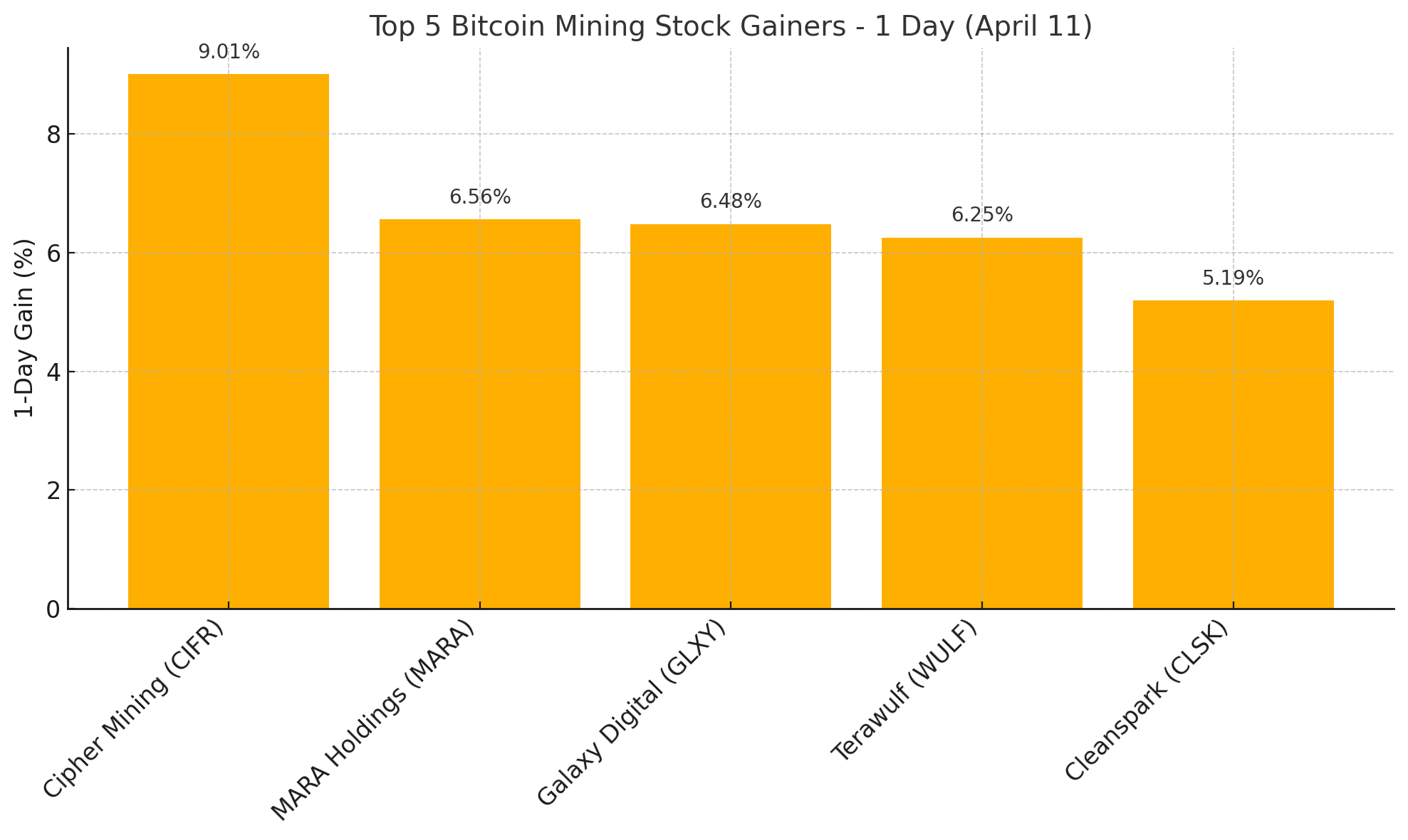

This equities revival propelled nine of twelve bitcoin mining entities into particular territory, with share prices rock climbing decisively. Bitcoinminingstock.io metrics sigh Cipher Mining (CIFR) claimed the highlight Friday with a 9.01% jump, outpacing MARA Holdings (MARA), which secured a 6.56% uptick. Galaxy Digital (GLXY) notched a 6.forty eight% appreciation, paralleled by Terawulf (WULF), whose shares ascended 6.25%.

Concluding the higher echelon of April 11’s market triumphs, Cleanspark (CLSK) achieved a 5.19% elevation, solidifying its sinful as the fifth-most prolific advancer. BTDR, RIOT, CORZ, HUT, and APLD likewise registered advances on Friday, ranging from 3.12% to 4.61%. Over the five-day span, nonetheless, merely seven of the twelve main bitcoin miners by market capitalization posted particular returns.

GLXY dominated the weekly efficiency with a 15.77% appreciation, carefully trailed by CIFR, which notched a 15.23% possess larger. No subject fleeting rallies, 2025’s year-to-date metrics for bitcoin miners sigh a pervasive downward trajectory. Cleanspark (CLSK: -18.56%) and MARA Holdings (MARA: -25.40%) anchor the much less extreme losses, whereas Rebel Platforms (RIOT: -30.85%) and Applied Digital (APLD: -30.75%) replicate steeper declines.

Galaxy Digital (GLXY: -36.94%), Hut 8 (HUT: -40.65%), and IREN (IREN: -42.66%) compound the pattern, with Northern Data (NB2: -47.34%), Cipher (CIFR: -47.84%), Core Scientific (CORZ: -49.67%), Terawulf (WULF: -57.95%), and Bitdeer (BTDR: -63.31%) epitomizing the sphere’s starkest contractions this year.