Bitcoin ETFs hold already reshaped how merchants engage with crypto, nonetheless 2026 is about to be a definite form of year. Rising institutional appetite, world regulatory clarity, and tighter competitors among asset managers point out these funds will play an very ideal bigger position in how capital flows into Bitcoin.

Why High 5 Bitcoin ETFs Will Matter Even Extra in 2026

Bitcoin ETFs aren’t magnificent a convenience anymore. They’ve turned into the most up-to-date entry point for institutions that need publicity without touching wallets, internal most keys, or the operational mess that includes verbalize crypto custody.

As ETF ecosystems broken-down, just a few traits are taking form:

- Capital from pension funds, hedge funds, and company treasuries retains rising.

- Payment wars among main issuers are riding extra investor-pleasant products.

- ETF inflows and outflows now impact Bitcoin’s quick-term impress extra than retail procuring and selling does.

So in case you take care of to hold a strategy of where elegant money is intelligent, stare the ETF market.

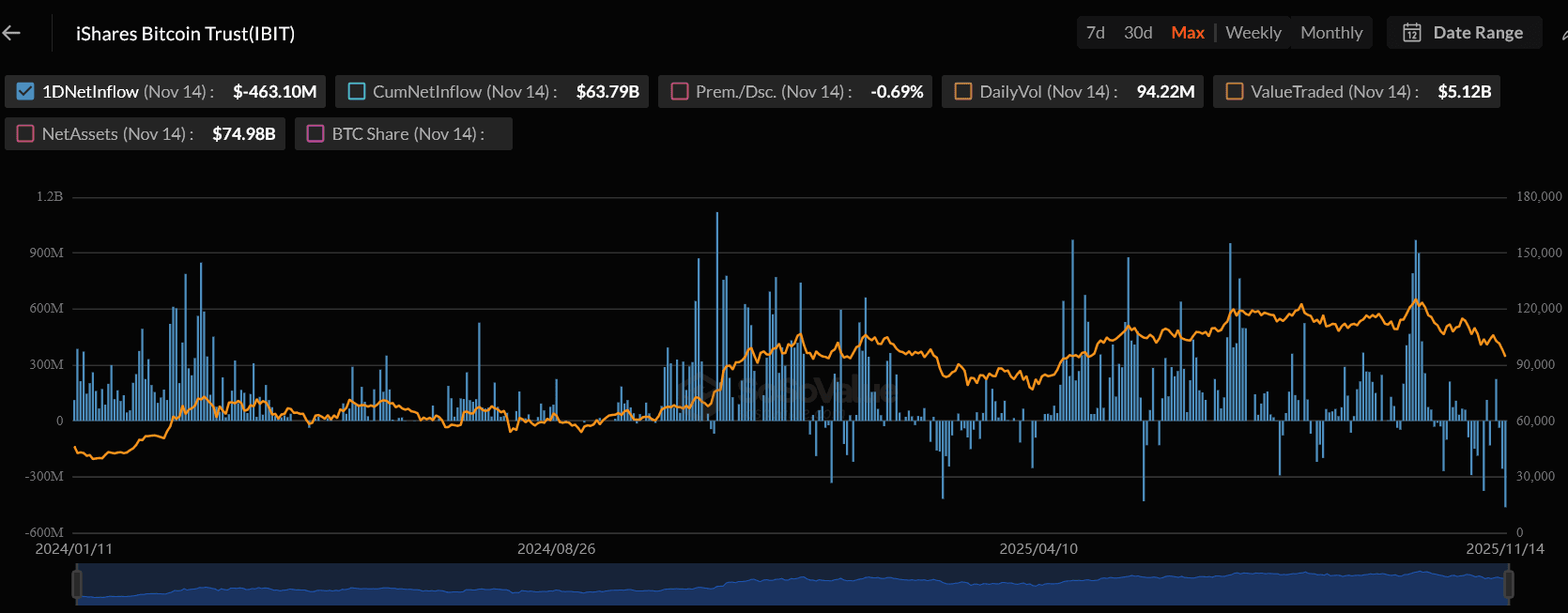

1. iShares Bitcoin Belief ETF (IBIT)

BlackRock’s IBIT is silent the heavyweight champion. With over $74 billion in AUM and the deepest liquidity within the sector, it stays the roam-to ETF for institutions that need scale and stability. If any ETF drives the market in 2026, it’s this one. Even modest influx spikes here can roam Bitcoin’s impress noticeably.

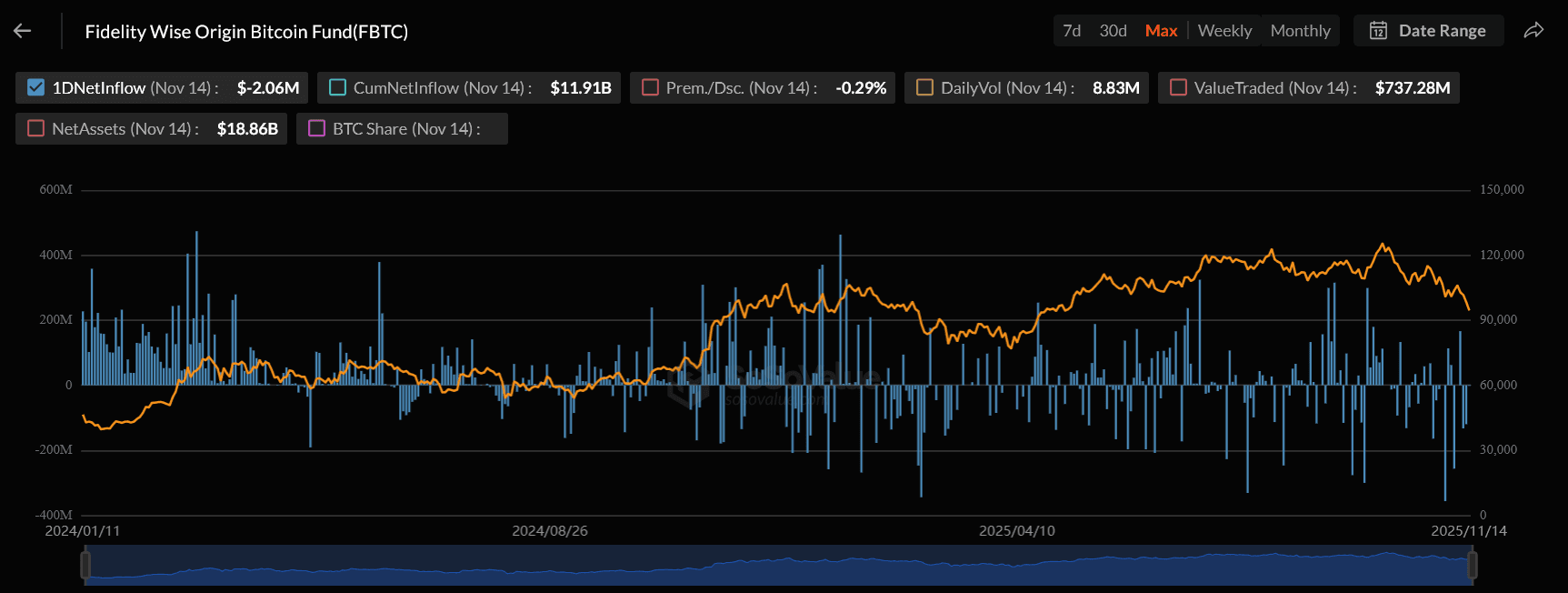

2. Constancy Wise Starting keep Bitcoin Fund (FBTC)

Constancy brings a prolonged-standing popularity that appeals to conservative, oldschool merchants. Search data from FBTC to shine in 2026 if retirement funds and prolonged-horizon institutional gamers construct bigger their Bitcoin allocations. Constancy’s research-driven blueprint and low rate structure construct this ETF a real magnet for inflows.

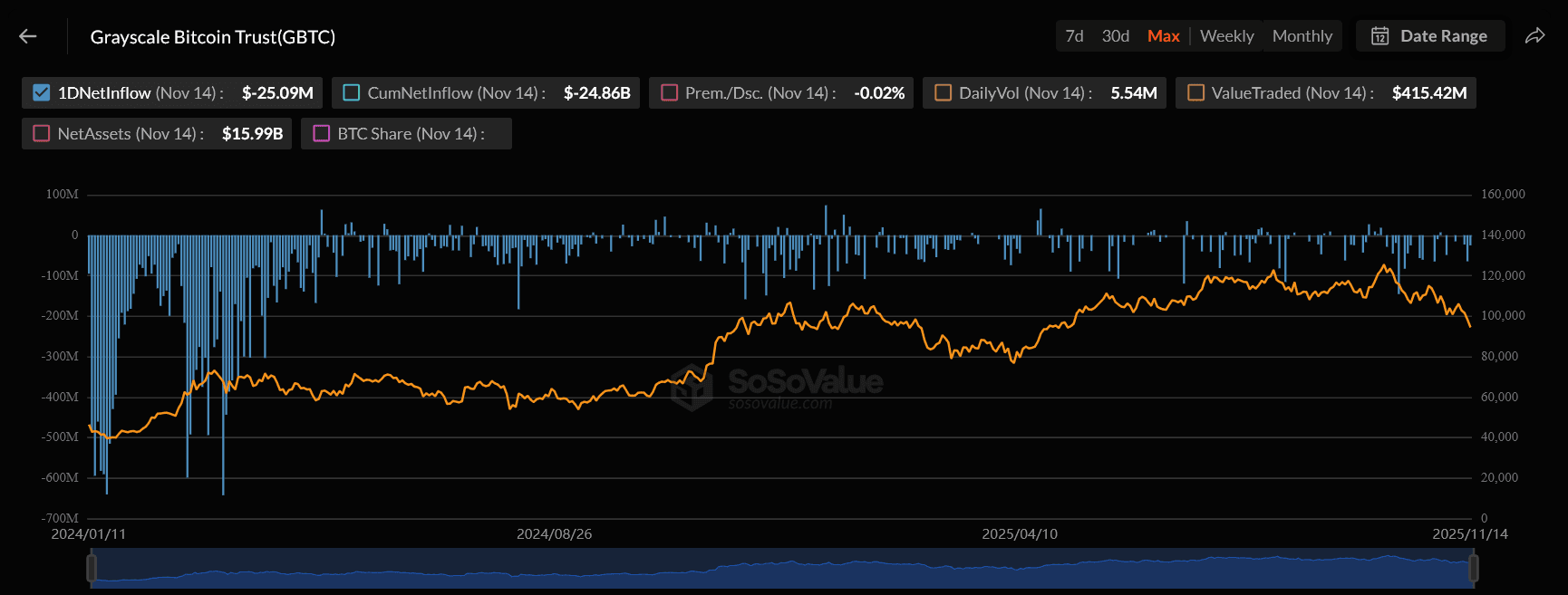

3. Grayscale Bitcoin Belief ETF (GBTC)

GBTC turned into as soon as as soon as the linchpin of institutional Bitcoin publicity sooner than ETFs had been celebrated. Despite the fact that others hold overtaken it, GBTC’s massive final asset imperfect silent affords it impact. In 2026, its impact will depend on whether or no longer Grayscale continues lowering costs and modernizing the structure to defend competitive.

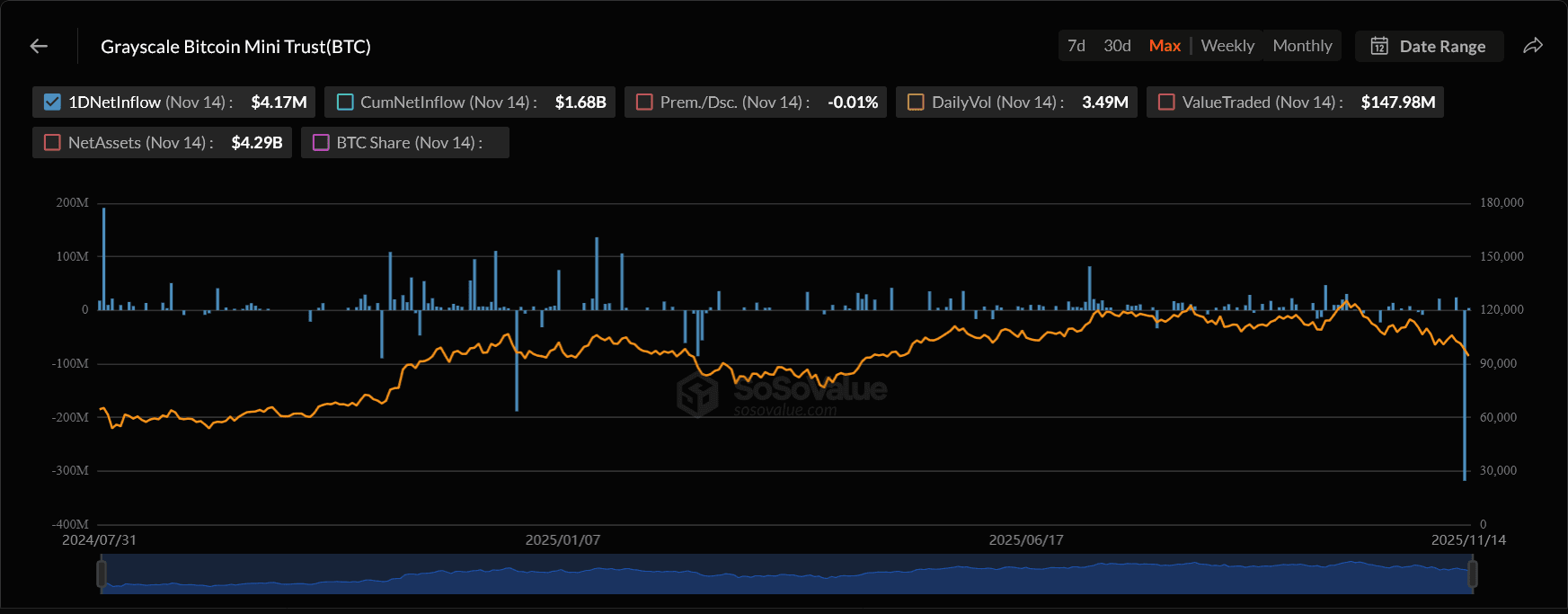

4. Grayscale Bitcoin Mini Belief (BTC)

The Mini Belief is designed to be leaner and more inexpensive than GBTC, and that simplicity has helped it acquire its maintain target market. As rate competitors heats up subsequent year, this ETF would possibly per chance per chance per chance additionally see a noticeable surge from impress-conscious merchants and smaller institutions entering the Bitcoin marketplace for the first time.

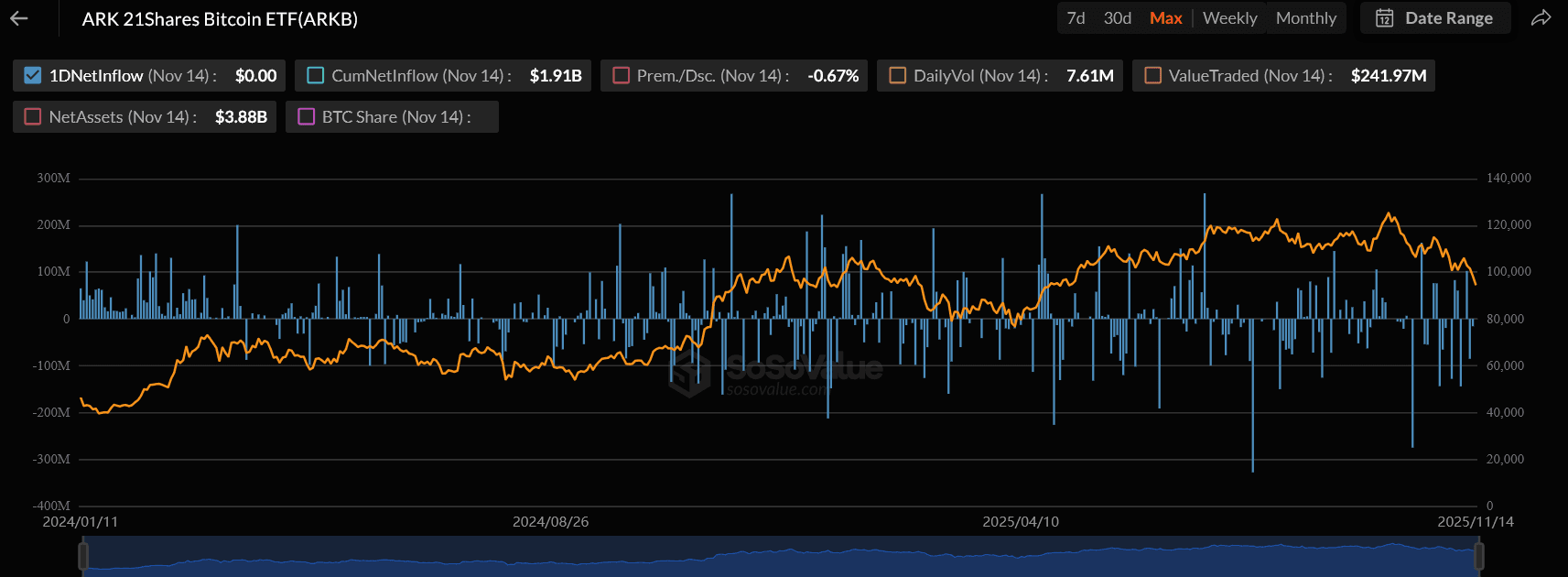

5. ARK 21Shares Bitcoin ETF (ARKB)

ARK Invest has built a stamp around innovation, and ARKB fits that theme perfectly. Cathie Wood’s constant bullish outlook on crypto attracts growth-focused merchants who need extra than magnificent passive publicity. If Bitcoin enters but any other growth segment in 2026, ARKB is probably going to outperform in inflows ensuing from its target market and approach.

High 5 Bitcoin ETFs: What This Manner for Merchants in 2026

Looking at these ETFs isn’t magnificent about incandescent where the mountainous money sits. It’s about discovering out the market’s mood. Inflows most continuously hint at rising institutional self belief. Outflows most continuously signal caution. And because ETFs now defend this type of immense portion of circulating Bitcoin, their actions can construct bigger each rallies and corrections.

Whether or no longer you’re procuring and selling quick term or thinking future, paying attention to the ETF panorama affords you a right advantage. These five funds will form the account in 2026 extra than any others.

The Backside Line

These high 5 Bitcoin ETFs hold turned into the bridge between oldschool finance and digital assets. In 2026, that bridge gets even busier. IBIT devices the tempo, Constancy brings credibility, Grayscale fights to retain its legacy, the Mini Belief retains charges competitive, and ARKB taps into the innovation crowd.

Even as you take care of to hold a transparent picture of where institutional capital is heading subsequent year, open by watching these five ETFs closely.