Toncoin (TON) has surged enormously in mountainous transaction quantity in the final 24 hours, signaling necessary whale activity despite a $482 million market sell-off all the plan thru the crypto sector. On-chain records exhibits an elevate in TON transactions valued at over $100,000, indicating that mountainous holders are actively gathering or redistributing their holdings.

The crypto market prolonged its sell-off from Tuesday’s session into Thursday, with crypto positions price $482 million liquidated in the final 24 hours, in step with CoinGlass records. The gigantic liquidations all the plan thru pretty a number of crypto resources judge the selling tension that has affected the large majority of digital resources.

Bitcoin slipped for the third consecutive day, down 2.26% in the final 24 hours. Most other necessary tokens slid as successfully. Dogecoin changed into down 3.83%, while Cardano (ADA) fell 6.83%.

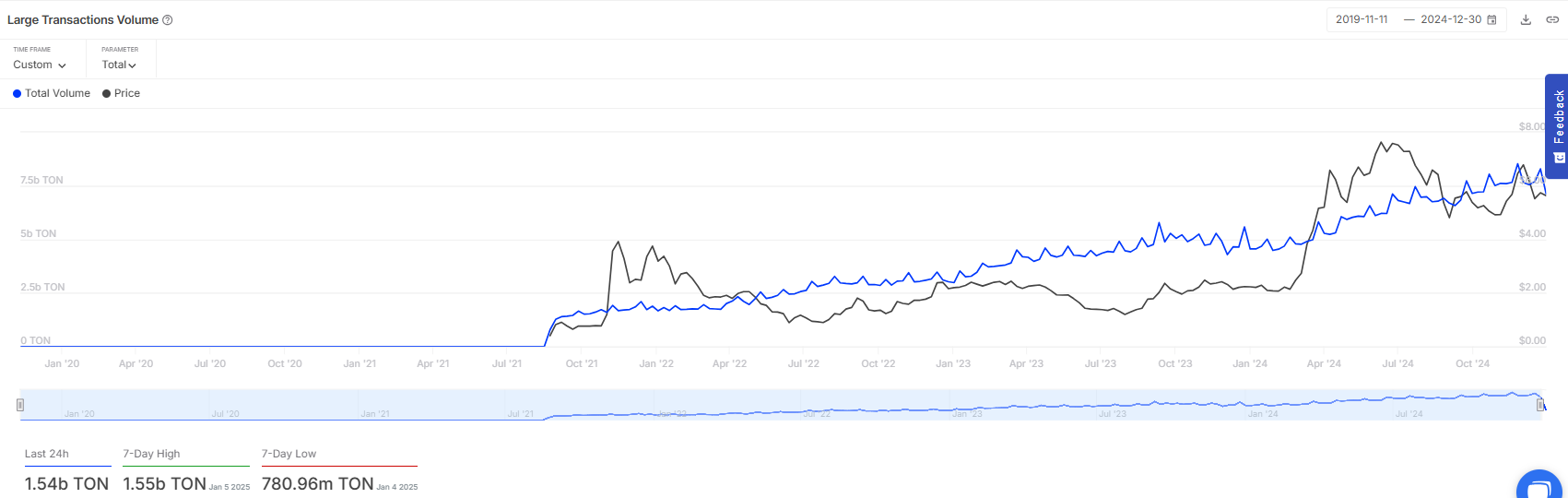

Amid this, Toncoin has reflected a surge in mountainous transaction volumes, which, in step with IntoTheBlock records, come in in at $8.21 billion, or 1.54 trillion TON in crypto terms, representing a 94% elevate in the 24-hour time physique. An elevate in mountainous transaction quantity most steadily depicts a surge in whale activity, either purchasing for or selling.

On the time of writing, TON changed into displaying initial indicators of rebound, up 0.09% in the final 24 hours and down 7.49% in the previous week.

Inflation considerations stoke market sell-off

The crypto market prolonged its sell-off as merchants weighed the Federal Reserve’s December Assembly minutes released on Wednesday. Fed officials hinted precise thru the assembly that the fling of curiosity rate cuts might maybe unhurried this year, elevating considerations about inflation.

“Nearly all participants judged that upside dangers to the inflation outlook had elevated,” in step with the assembly minutes. “As reasons for this judgment, participants cited latest stronger-than-anticipated readings on inflation and the in all probability results of doable modifications in trade and immigration policy.”

A slew of job records has been released this week, and merchants are eagerly waiting for the nonfarm payrolls document on Friday — thought to be one of many final serious pieces of records to be published forward of the Fed’s assembly at the smash of January.