Toncoin (TON) demonstrates rising signs of accumulation that counsel market recordsdata indicates upcoming adjustments to its model circulate.

Meanwhile, the market model decrease of Toncoin shows signs that promoting stress is also reaching its height. Persevering with present market patterns ends in indications that recovery can also materialize.

Accumulation Traits Counsel Market Positioning

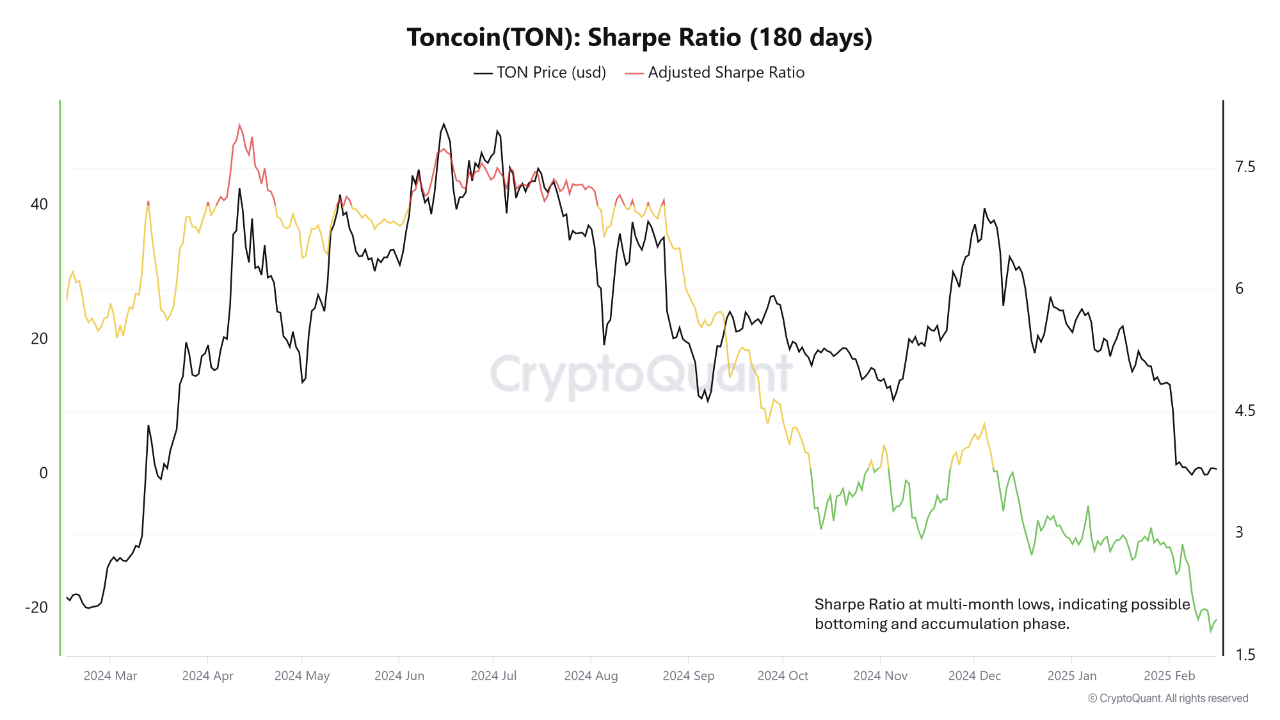

Recent CryptoQuant recordsdata shows that TON’s 180-day Sharpe Ratio indicates ongoing accumulation. A protracted downtrend suggests hypothesis has slowed, permitting investors to create positions at decrease model ranges.

Adjustments in decentralized replace (DEX) squawk and consistent total model locked (TVL) in lending extra pork up this trend.

The prices correlated with abnormalities in each and each the Medium-Time duration Normalized Threat Metric (NRM) and volatility during December 2024 and February 2025.

Attributable to real prices blended with declining volatility, the market is also showing signs of reduced dealer squawk.

The upcoming market stipulations can also result in a model rebound on story of assign a query to shows signs of express.

Long-Time duration Holders Present True Conviction

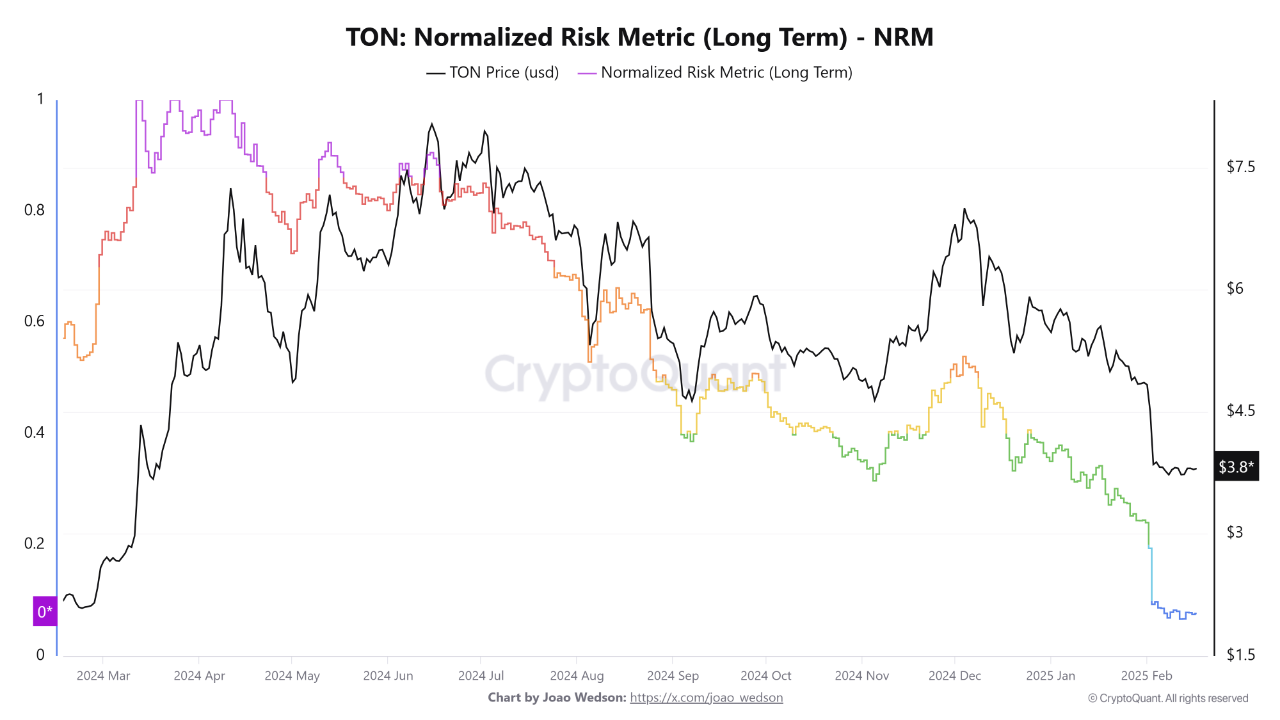

TON’s Normalized Threat Metric shows that investors are constructing positions at a model point that reaches $3.82.

Recent ancient events relish shown that earlier phases most ceaselessly developed sooner than market recoveries occurred.

Long-Time duration NRM done the bottom ranges in ancient past which indicates that lengthy-term investors strategically scheme themselves in anticipation of rising stock model.

Extra indicators additionally point to accumulation. The Likelihood of Exercise metric, which measures the probability of older coins being equipped, remains low. This implies that investors keeping TON for over 400 days are now not actively promoting, signaling confidence within the asset’s lengthy-term doable.

Leverage and Threat Exposure within the Market

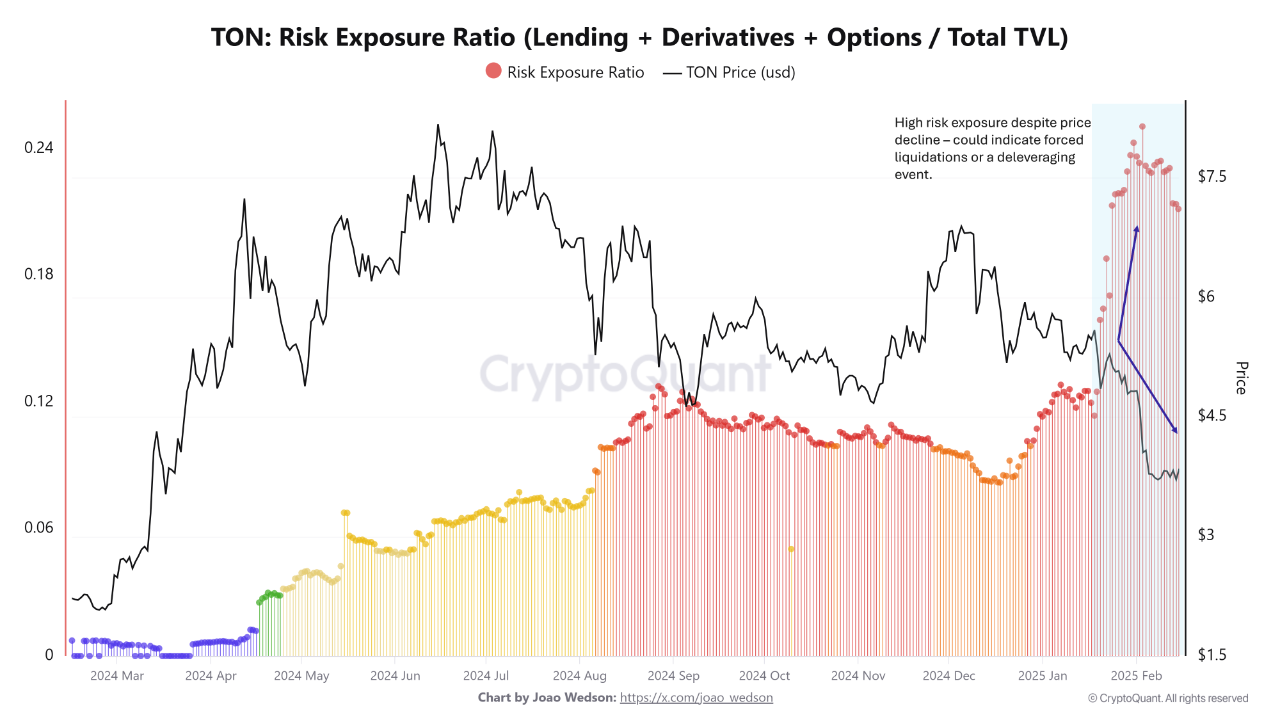

The Threat Exposure Ratio showing leveraged positions against total TVL surpassed 0.24 in the course of the open of 2025.

Evolved positions through leveraged investments form a appreciable section of the DeFi actions on TON.

Market stability can also lend a hand while model movements change into more healthy when this ratio starts trending downward.

Position gross sales of short- to medium-term holders seem to happen right this moment while lengthy-term holders preserve their investments standard. The present market hiss suits ancient accumulation patterns which feeble to be adopted by lengthy sessions of detrimental returns sooner than recovery.

The market indicators a doable alternate on story of reducing risk publicity combines with ongoing accumulation from lengthy-term holders.

Toncoin’s Diminished Volatility Hints at a Likely Breakout

The market model of TON has shown reduced model swings during most standard trading days. Per crypto analyst Ali Martinez, the tightening Bollinger Bands on the 12-hour chart veritably predicts drawing conclude well-known model fluctuations.

“Sessions of low volatility continually lead to swift model movements,” Martinez notorious.

Alternatively, it remains unsure whether or now not the next transfer will most seemingly be upward or downward.

TON looks vulnerable to trip a reversal on story of procuring for assign a query to remains real while promoting stress becomes much less intense. The market awaits sturdy signs of a doable breakout during upcoming weeks.