Telegram-linked Toncoin has skilled a first-rate mark decline one day of the last month. It at point to trades at $3.89, having shed 28% of its value within the previous 30 days.

This dip has pushed TON to a historical low, presenting a potential accumulation part for long-term traders.

Toncoin Falls, Nonetheless There Is a Get

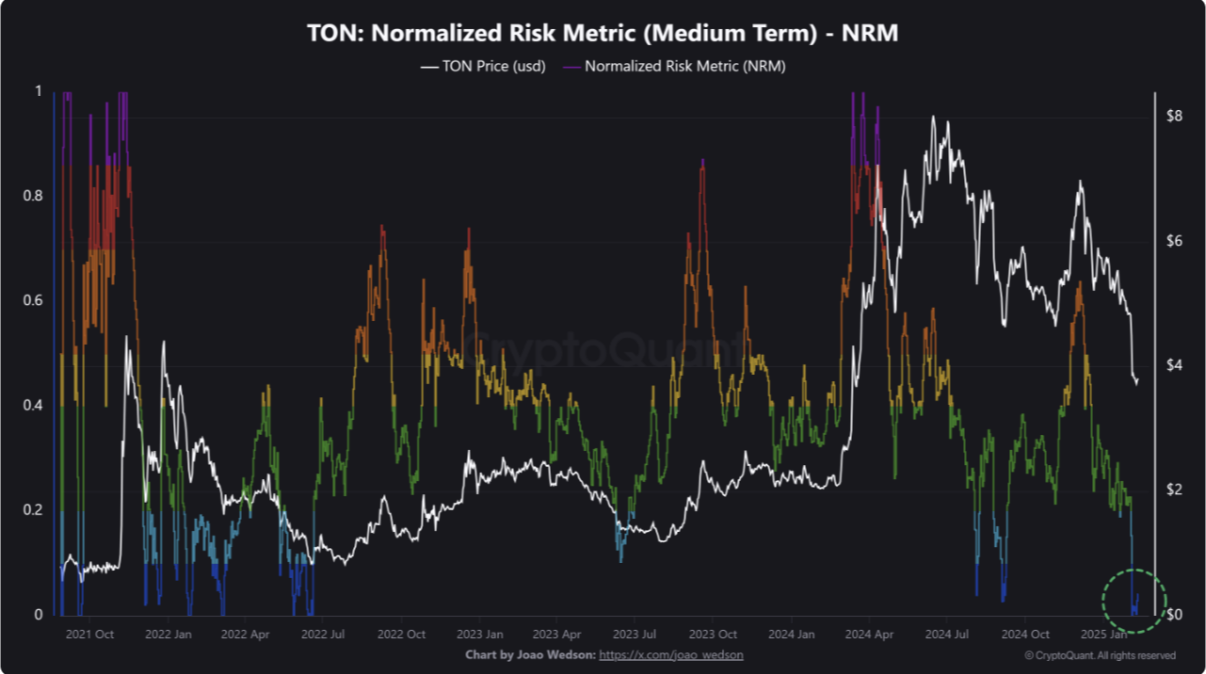

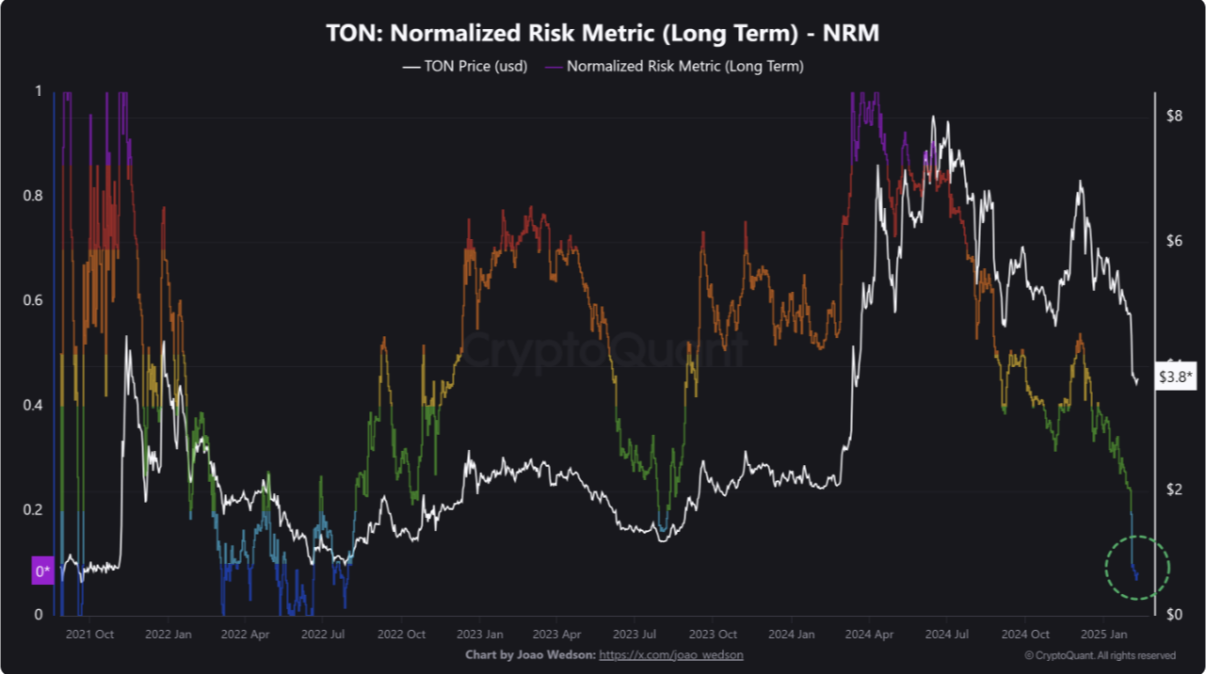

In a new epic, CryptoQuant analyst Joao Wedson notes that TON has reached historically low ranges on the Normalized Agonize Metric (NRM) indicator, presenting a procuring opportunity for long-term traders.

The NRM indicator tracks an asset’s value by comparing its most contemporary mark to key weighted spicy averages. When NRM is at low ranges admire this, it means that an asset is procuring and selling at a historically undervalued mark relative to its long-term trends.

Based on Wedson, TON’s NRM is at its lowest in both the medium and future, suggesting that the token is at point to in a low-chance accumulation zone. This means that its most contemporary mark is undervalued when put next to historical trends, making it a magnificent entry point for traders who state in its long-term potential.

“For traders, this divulge would possibly maybe represent an consuming opportunity to originate amassing TON, taking wait on of a moment when the chance (or the asset’s “valuation”) is at its minimal, suggesting potential for appreciation within the medium to future,” Wedson said.

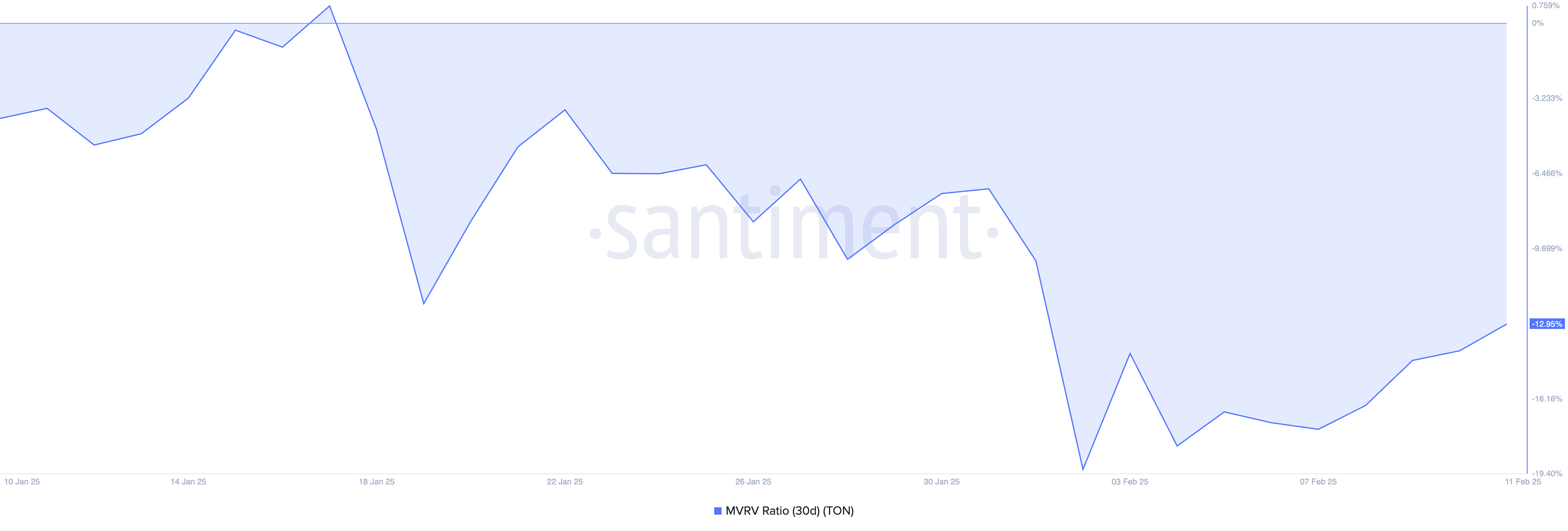

BeInCrypto’s review of the altcoin’s market value to realized value (MVRV) ratio the utilization of a 30-day spicy realistic confirms its undervalued narrate. Based on Santiment, here’s -12.95% at press time.

An asset’s MVRV ratio identifies whether it’s a ways hyped up or undervalued by measuring the relationship between its market value and its realized value. When an asset’s MVRV ratio is easy, its market value is bigger than the realized value, suggesting it’s a ways hyped up.

On the assorted hand, as with TON, when the ratio is damaging, the asset’s market value is decrease than its realized value. This means that the coin is undervalued when put next to what folks firstly paid for it. Historically, damaging ratios admire this most contemporary a procuring opportunity for these trying to “aquire the dip” and “promote high.”

TON Trace Prediction: Can It Retain Momentum and Attain $4.96?

On a day-to-day timeframe, TON has benefited from the broader market rally, noting a 1% mark hike within the previous 24 hours. If market individuals lengthen their token accumulation, TON would possibly maybe objective abet this upward model within the quick term.

If that’s the case, its mark would possibly maybe ruin above the foremost resistance at $4 to alternate at $4.17. If bullish toughen intensifies at this stage, TON’s value would possibly maybe rally extra to $4.96

Conversely, if TON holders chorus from accumulation, the token would possibly maybe lose its most contemporary gains and fall to $2.91.