Now not as a lot as a month after TradeXYZ deployed tokenized Nasdaq futures (XYZ100) on Hyperliquid, quite a lot of protocols maintain launched TSLA, NVDA, and SPACEX perpetuals over the final 24 hours.

TradeXYZ, the permissionless perpetual arm of Unit, the Hyperliquid tokenization layer, kicked off the gold run the day previous with the start of tokenized NVDA. This day, Felix Protocol and TradeXYZ followed suit with TSLA, and Ventuals launched SPACEX.

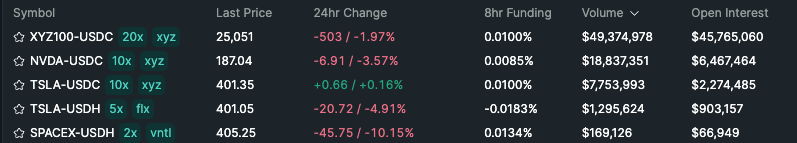

XYZ100 mute leads the HIP-3 sector in whole volume and open pastime by a landslide, but TradeXYZ’s NVDA and TSLA markets are ramping up, producing $26 million in 24-hour volume and nearly $9 million in open pastime between them.

A principal contrast between TradeXYZ’s markets and these deployed by Felix and Ventuals is that the XYZ markets are denominated in USDC, the dominant stablecoin on Hyperliquid, while Felix and Ventuals establish in USDH, Native Markets’ lately launched stablecoin.

This switch marks the indispensable perfect-looking supply of question for USDH, which is in a put of residing to funnel 50% of the yield on its reserves in opposition to shopping HYPE tokens.

All new markets maintain been launched with low open pastime caps, that are anticipated to be raised over time because the groups proceed to video show their efficiency.

Scaling and Distribution in HIP-3 Markets

Charlie, a contributor at Felix Protocol, spoke to The Defiant about new HIP-3 developments, including liquidity fragmentation exact thru markets that signify the identical tokenized fairness, and the design the market can request HIP-3s to grow previous a crypto-native viewers.

He acknowledged there might be on the second an overlap between Unit and Felix, each and every of which provide tokenized TSLA markets. Alternatively, this overlap is determined to diverge as Felix develops separate agencies that attain no longer count factual on Hyperliquid’s UI because the indispensable TSLA/USDH distribution supply.

Charlie added that utilizing USDH affords quite a lot of benefits, including 20% decrease taker prices, 50% elevated rebates, and 20% elevated volume contributions. “This means it needs to be much less pricey and extra liquid so that you can replace the identical market on Felix – furthermore, our price agenda will be decrease as well. So the indispensable differentiator out of the gate between Felix and Unit is cost.”

While HIP-3 perpetual markets are mute of their infancy, even in crypto-native employ situations, groups are taking a ogle to develop the HIP-3 funnel and entice former finance traders as well.

“I mediate this [distribution to non-crypto audiences] will basically come correct down to regulatory clarity and distribution, and the 2 play into one one more. As soon as one major participant begins integrating perps and then fairness perps as a consequence of buyer question, regulatory clarity follows.”

“On the distribution facet, non-crypto-natives seemingly attain no longer want to struggle thru the complexities of wallet administration, and heaps others, to replace these markets. That is the put one thing love a Privy + Hyperliquid builder code integration into a identified interface love Bloomberg bridges the gap,” Charlie concluded.