TRX, the native coin of the Tron blockchain, has maintained a downtrend since August 25. Exchanging hands at $0.14 as of this writing, the coin’s charge has since plummeted by 13%.

With a increasing bearish bias in opposition to the tenth-greatest cryptocurrency by market capitalization, its technical setup suggests that TRX is poised to elongate this decline.

Tron Derivatives Traders Quiz Away

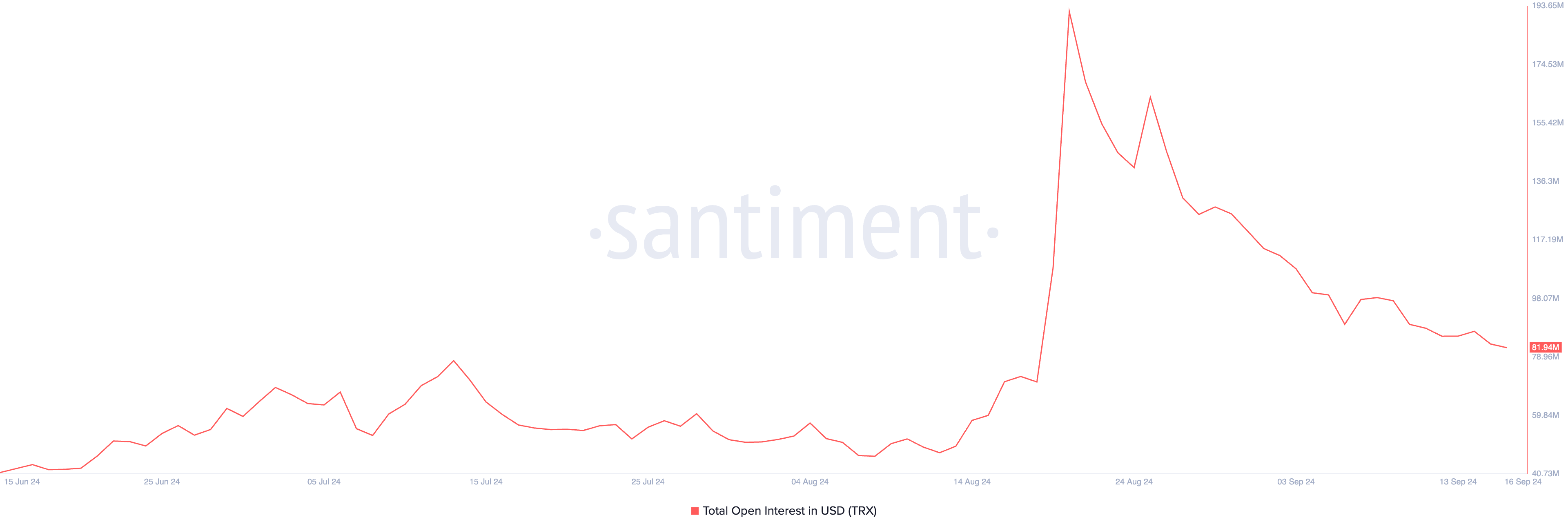

The drop in TRX’s derivatives market exercise signals a clear decline in search files from for the altcoin. Its Initiate Interest, which measures the total quantity of eminent futures or alternatives contracts that like yet to be settled or closed, has been trending downward since reaching a yr-to-date excessive of $191 million on August 21.

As of press time, TRX’s Initiate Interest stands at $82 million, reflecting a 57% decline since August 21.

When an asset’s Initiate Interest decreases, it typically signals reduced buying and selling exercise or waning investor interest. This additionally displays a loss of self belief in the asset’s sure stamp momentum, which is evident in TRX’s negative funding rate.

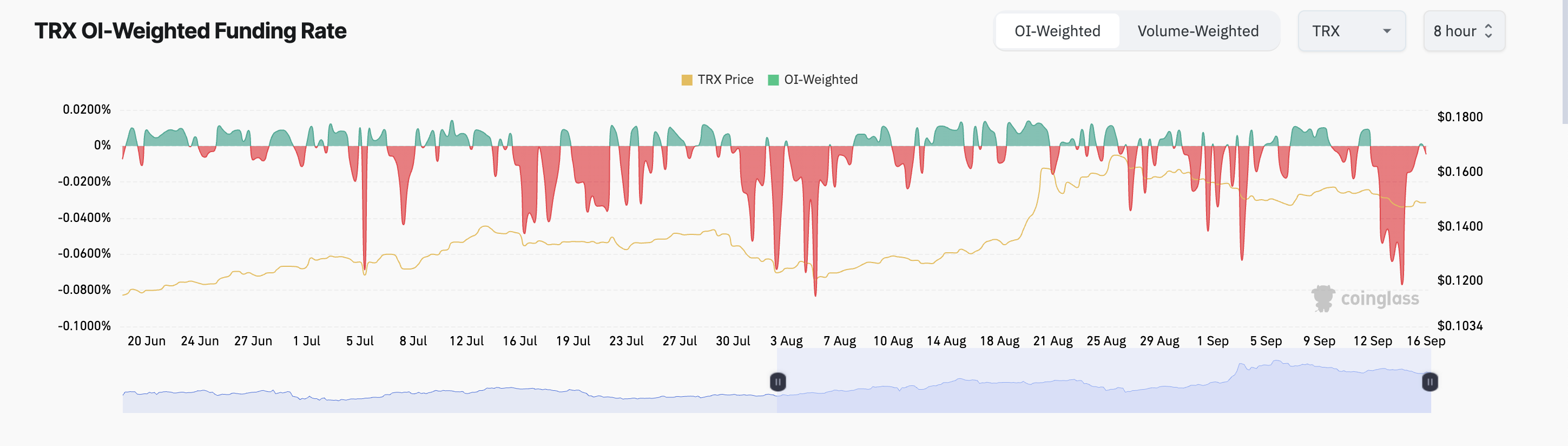

On-chain files reveals that TRX’s funding rate has been predominantly negative over the past month. The funding rate, which is the associated charge to retain the contract stamp aligned with the gap stamp, stands at -0.0047% at press time.

Read Extra: 7 Fully Tron Wallets for Storing TRX

A negative funding rate ability extra traders are retaining instant positions, indicating that the next quantity of traders query TRX’s stamp to divulge no in preference to upward push.

TRX Imprint Prediction: Imprint Is Poised to Breach Enhance

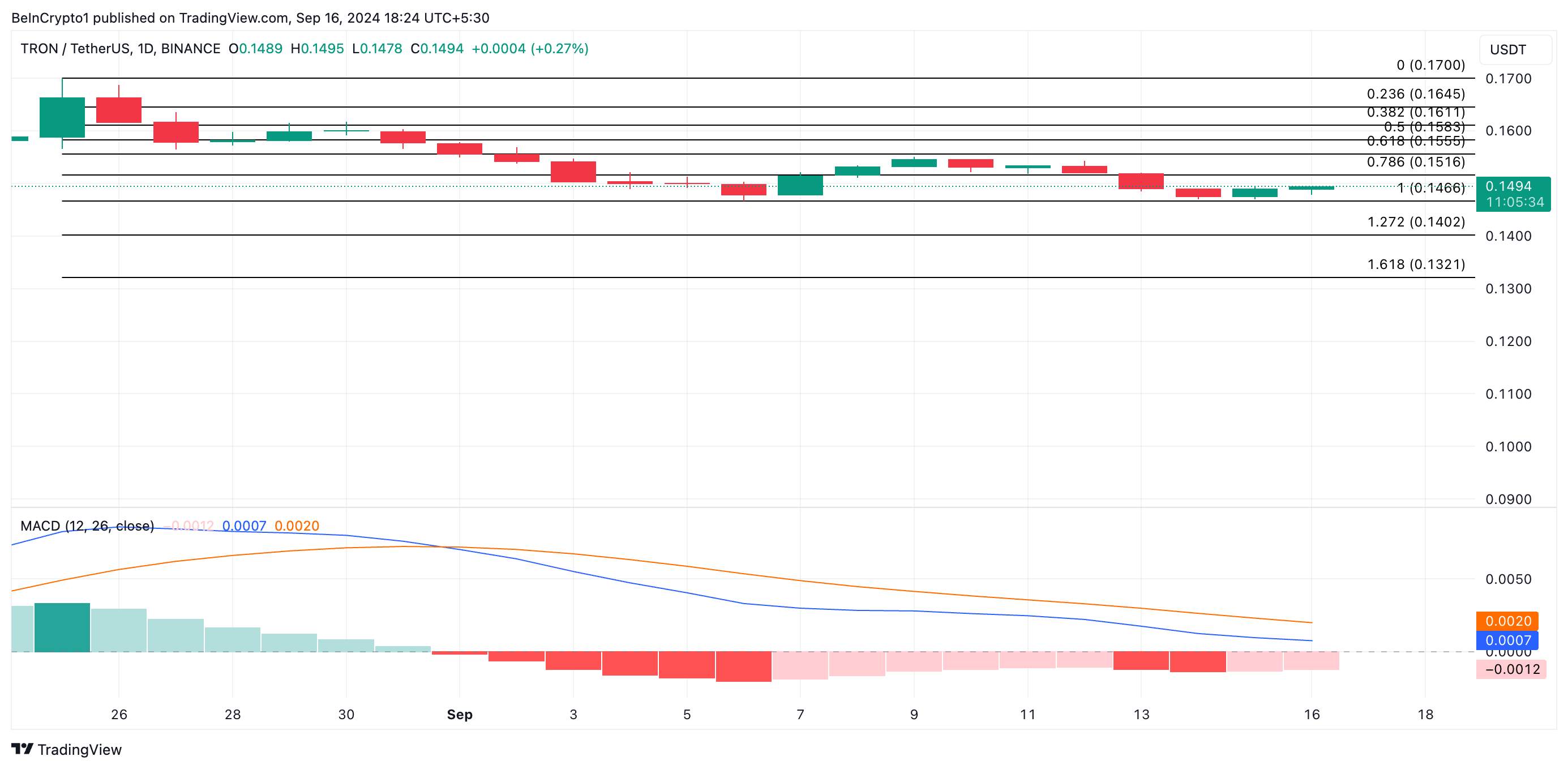

Tron’s stamp decline since August 25 has resulted in the formation of a descending channel, a bearish pattern characterized by decrease highs and decrease lows. The greater line of the channel acts as resistance, for the time being at $0.14 for TRX, while the decrease line serves as crimson meat up, additionally at $0.14.

Readings from Tron’s Fascinating Reasonable Convergence/Divergence (MACD) indicator—which measures trend direction and capacity stamp reversals—existing the likelihood of a persevered decline. At press time, TRX’s MACD line (blue) sits below the mark line (orange) and is trending in opposition to the zero line.

When the MACD line crosses below the mark line, it signals extinct momentary momentum. An additional drop below the zero line confirms a downtrend, increasing the potentialities of an prolonged decline.

Read Extra: How To Buy TRON (TRX) and Every little thing You Want To Know

If search files from for TRX continues to weaken, its stamp will also breach the crimson meat up line, potentially falling to $0.13. Alternatively, if market sentiment shifts and search files from for TRX strengthens, the associated charge will also ruin past resistance, aiming for its fresh excessive of $0.17.