HBAR, the native cryptocurrency of the Hedera Hashgraph community, has considered a meteoric upward push of over 180% within the previous week. It currently trades at $0.13, a tag high closing seen in April 2024.

Nonetheless, this like a flash ascent has pushed the token’s tag into overbought territory. This overextension suggests that a tag correction can also very neatly be imminent for the HBAR token.

Hedera Merchants Overextends Its Designate

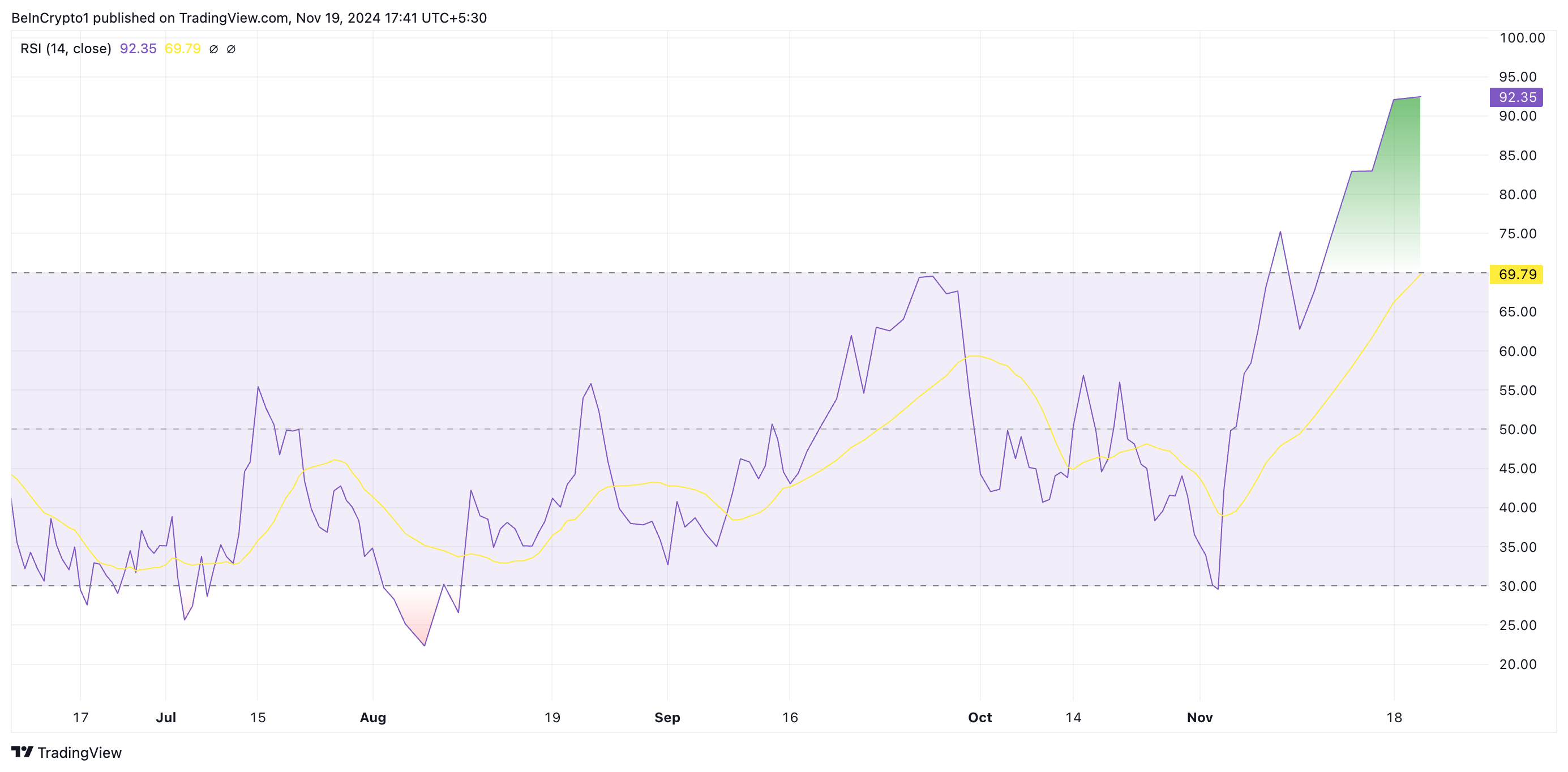

Readings from HBAR’s Relative Power Index (RSI) verify that its market is overheated. As of this writing, the indicator stands at 92.35, its all-time high.

The RSI measures an asset’s overbought and oversold market stipulations. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a decline. In distinction, values below 30 imprint that the asset is oversold and could presumably maybe maybe expertise a rebound.

HBAR’s RSI studying of 92.35 indicates that it’s in extraordinarily overbought territory. It suggests that HBAR investors occupy tremendously outpaced sellers, utilizing the tag to an unsustainable stage. Whereas the asset’s tag can proceed rising within the short term, this kind of high RSI ceaselessly precedes a correction or pullback.

Further, HBAR’s tag has breached the larger band of its Bollinger Bands indicator, furthermore confirming that it’s overbought amongst market contributors.

The Bollinger Bands indicator measures market volatility and identifies doable aquire and promote signals. It contains three main ingredients: the center band, the larger band, and the decrease band.

The center band is a 20-duration transferring life like that serves as a baseline for the tag pattern. The upper band is calculated because the center band plus two popular deviations of the tag, accounting for tag volatility above the transferring life like. The decrease band is the center band minus two popular deviations of the tag, representing volatility below the transferring life like.

When the tag trades above the larger band, it ceaselessly suggests that the asset is overbought, as it has moved tremendously elevated than its life like tag. This could perchance presumably even imprint the likelihood of a tag pullback.

HBAR Designate Prediction: A Pullback Is Drawing end

As soon as investors’ exhaustion units in, HBAR’s tag will expertise a pullback. At its latest tag, it trades above abet fashioned at $0.12. When buying rigidity begins to travel, this could occasionally presumably even take a look at this tag stage. Must it fail to abet, the token’s tag can also plummet toward $0.11.

Nonetheless, if the uptrend continues, the HBAR token will reclaim its cycle height of $0.15 and strive to rally previous it, invalidating the bearish projection above. A profitable spoil above this stage will residing HBAR on the trek to buying and selling at its twelve months-to-date high of $0.18.