Bitcoin has once again captured the spotlight, registering a staggering 72% price amplify 365 days-to-date. Opening the 365 days at $42,560 and breaking all-time highs to now commerce at $73,000, BTC finds itself in price discovery mode. Without a historical price resistance or toughen, the market is tasked with establishing novel benchmarks sooner than the halving.

No matter this impressive rally, there are indicators suggesting that Bitcoin may perhaps well be on the verge of a cost correction.

Bitcoin Whales Are Booking Profits

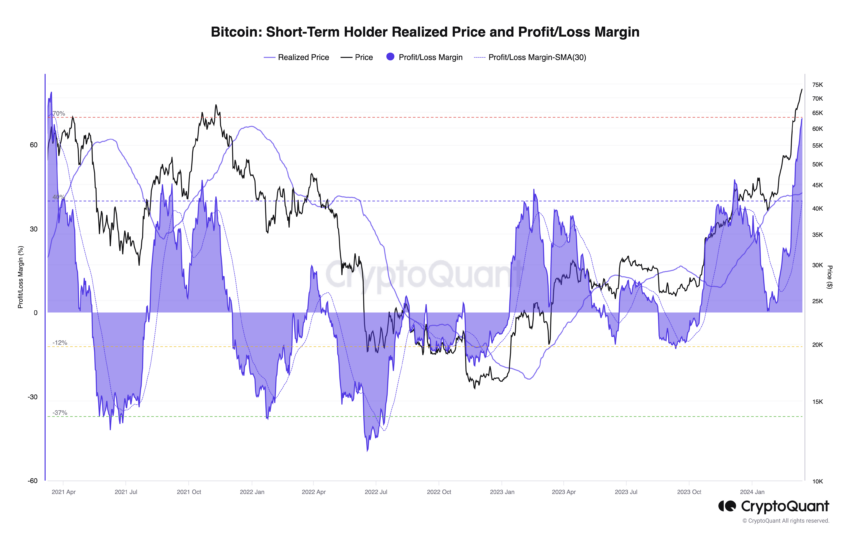

A indispensable metric, the Brief-Term Holder Realized Price and Income/Loss Margin indicator, reveals that quick holders are for the time being sitting on 70% profits in their Bitcoin holdings. This stage of unrealized profit, unheard of within the final three years, hints at a doable sell-off.

This indicator, which tracks the average price at which money held by quick holders, no longer up to 155 days, were final moved, suggests a fundamental a part of these holdings are in profit.

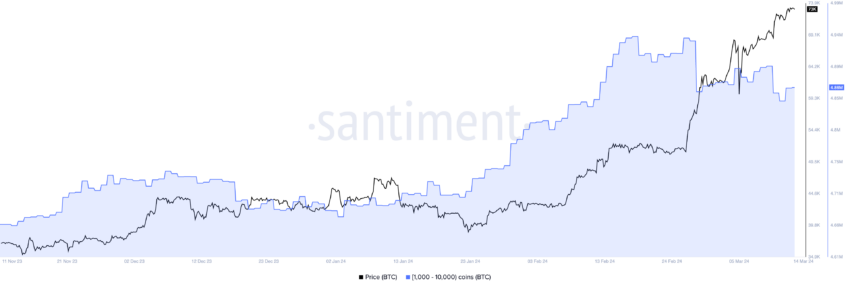

Whereas quick holders seem reluctant to know profits, numerous whales enjoy begun to cut relief their Bitcoin holdings sooner than the halving.

On-chain recordsdata presentations that Bitcoin whales, or natty-scale investors maintaining between 1,000 and 10,000 BTC, enjoy offloaded over 80,000 BTC within the previous month, equating to roughly $4.96 billion. If it persists, this selling rigidity will also instructed a cost correction by encouraging quick holders to e book profits, doubtlessly accelerating a downward style.

Read more: The put To Alternate Bitcoin Futures: A Whole Manual

BTC Price Prediction: A Dip Ahead

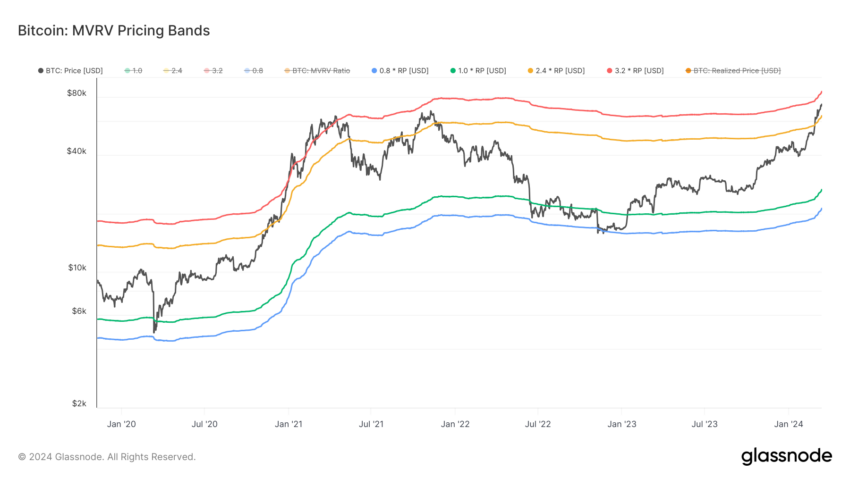

Per the MVRV Pricing Bands indicator, a cost correction will also push Bitcoin to test the 2.4 MVRV stage, for the time being come $61,700.

The MVRV Pricing Bands are graphical representations that map the MVRV ratio over time, delineating varied market sentiment levels. They can gauge how essentially the most up to the moment price compares to historical realization costs and signal doable market reversals or continuations.

Read more: Bitcoin Price Prediction 2024/2025/2030

On the different hand, amid these bearish indicators, a bullish factor emerges with the scorching influx to Bitcoin ETFs. These monetary devices enjoy been collecting at an unheard of rate, buying 433,843.58 BTC since their inception, which translates to about $31.67 billion at most up to the moment costs.

This fundamental buying vitality, moreover Grayscale’s GBTC, will also doubtlessly counteract the bearish outlook.

Also can mild these ETFs proceed their aggressive accumulation and Bitcoin maintain a day after day halt above $74,000, it goes to also fair invalidate the bearish point of view. Any such declare will also trigger a bullish price breakout sooner than the halving, propelling Bitcoin to test the 3.2 MVRV stage at $85,000.