Discerning the onset of the precise altcoin season is such as predicting the following wave in a tempestuous sea. Yet, determined indicators indicate the market is on the cusp of a fundamental shift, transferring from Bitcoin’s dominance to a broader altcoin season.

Eminent analysts adore Michaël van de Poppe and Josh Olszewicz present insights into the mechanics of this transition. They emphasize the role of market cycles, technological upgrades, and financial occasions in catalyzing the altcoin rally.

When Altcoin Season Will Open

Bitcoin’s latest dash from $25,000 to $Fifty three,000 has captured the market’s consideration, signaling a seemingly peak and subsequent rotation in opposition to altcoins. Van de Poppe much the strength in Ethereum as a harbinger of this shift, highlighting the upcoming Dencun toughen and the seemingly of a region alternate-traded fund (ETF), which would possibly maybe vastly decrease transaction charges and magnify Ethereum’s utility.

This technological leap would possibly maybe invigorate the Ethereum ecosystem, making it a incandescent searching hub for investment.

“The valuation of Ethereum as a complete wishes to acquire up because it ought to be at $3,800-4,200 if it’s at the the same stage as Bitcoin’s heed within the mean time. Bitcoin will consolidate, and money will rotate in opposition to Ethereum,” van de Poppe acknowledged.

The thought that of altcoin season, or “altseason,” has evolved since its inception in 2017. It’s a long way now not accurate a pair of primary market upturn but contains selective investments in ecosystems showing promise. Solana, Injective Protocol, and Render Protocol were identified as frontrunners, making essentially the many of the latest market dynamics.

In holding with Van de Poppe, the altcoin season following the Bitcoin halving will doubtless select these ecosystems, seriously Ethereum, given its latest underperformance and upcoming enhancements in latest years.

“We’re facing an Ethereum Altseason… In every cycle, the dominance of Bitcoin has peaked sooner than the halving. Very comprehensible, as investors are rotating their income from maintaining Bitcoin in opposition to other sources to generate a elevated ROI as there’s no match that’s going to push self perception inner Bitcoin at all,” van de Poppe added.

Read extra: 11 Finest Altcoin Exchanges for Crypto Trading in February 2024

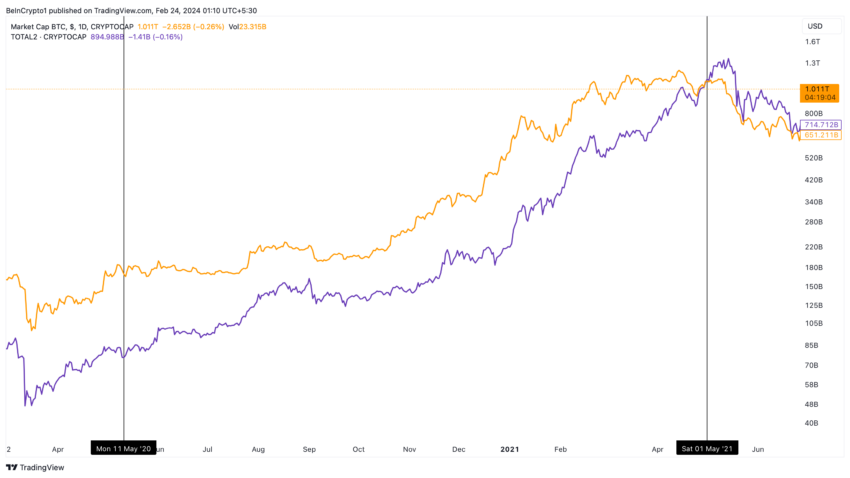

Likewise, Olszewicz pointed to the sample observed in past cycles. The total market capitalization of altcoins, excluding Bitcoin, tends to acquire up and surpass Bitcoin’s market cap put up-halving. This phenomenon is fundamental because it illustrates a shift in investor sentiment and allocation of capital correct via the crypto market.

The halving match, which reduces the reward for mining Bitcoin by half, historically precedes elevated efficiency for altcoins. Right here’s partly since the lowered Bitcoin reward time and all as soon as more leads investors to witness elevated returns within the extra unstable altcoins.

“You’ll leer historically that the crimson line or the altcoins line catches as much as Bitcoin put up halving. Despite the indisputable truth that Bitcoin is definitely doing extraordinarily well put up-halving based mostly on market cap and in opposition to the very conclude, which is a mountainous signal to leer,” Olszewicz emphasized.

Olszewicz additionally highlighted the significance of “the crypto wealth conclude.” He rapid that the influx of capital into Bitcoin across the halving match within the cease finds its manner into altcoins. This transition is facilitated by Bitcoin’s elevated liquidity and profitability, which, when it begins to stabilize in volatility put up-halving, encourages investors to diversify.

In holding with Olszewicz, the anticipation of Ethereum ETFs would possibly maybe further catalyze this shift. Therefore, redirecting ETF capital from Bitcoin to altcoins and amplifying the “crypto wealth conclude.”

Read extra: 13 Finest Altcoins To Make investments In February 2024

Despite the speculative nature of cryptocurrency investments, the insights from Van de Poppe and Olszewicz underline a calculated methodology to navigating the market. Essentially the most important to leveraging the upcoming altcoin season lies in recognizing the indicators of Bitcoin’s consolidation, the affect of technological traits in Ethereum, and the broader financial indicators influencing market cycles.

Disclaimer

In holding with the Trust Venture guidelines, this heed diagnosis article is for informational functions most efficient and would possibly merely calm now not be regarded as financial or investment advice. BeInCrypto is dedicated to honest, self sustaining reporting, but market prerequisites are subject to trade with out leer. Continuously behavior your hold research and search the advice of with a skilled earlier than making any financial decisions. Please display veil that our Terms and Stipulations, Privateness Protection, and Disclaimers were updated.