Hedera Hashgraph (HBAR) imprint is relief within the highlight after a keen surge that saw its imprint jump almost 34% interior days. Typically overshadowed by bigger altcoins, HBAR imprint has quietly constructed bullish momentum, catching many traders off guard as it broke previous key resistance ranges. With day to day candles flashing inexperienced and RSI ranges pushing into overbought territory, investors are now wondering: is this a exact breakout or correct one other short-lived pump?

In this text, we’ll dive into Hedera imprint most up-to-date day to day chart, decode the technical patterns, assess momentum indicators, and calculate that that it is most likely you’ll presumably presumably believe targets in holding with Fibonacci extensions. Whether you is probably going to be a transient dealer or prolonged-term investor, working out Hedera imprint sleek setup is main to protect some distance flung from being left within the support of—or caught in a entice.

HBAR Be conscious Prediction: Why Is Hedera Be conscious Surging Ideal Now?

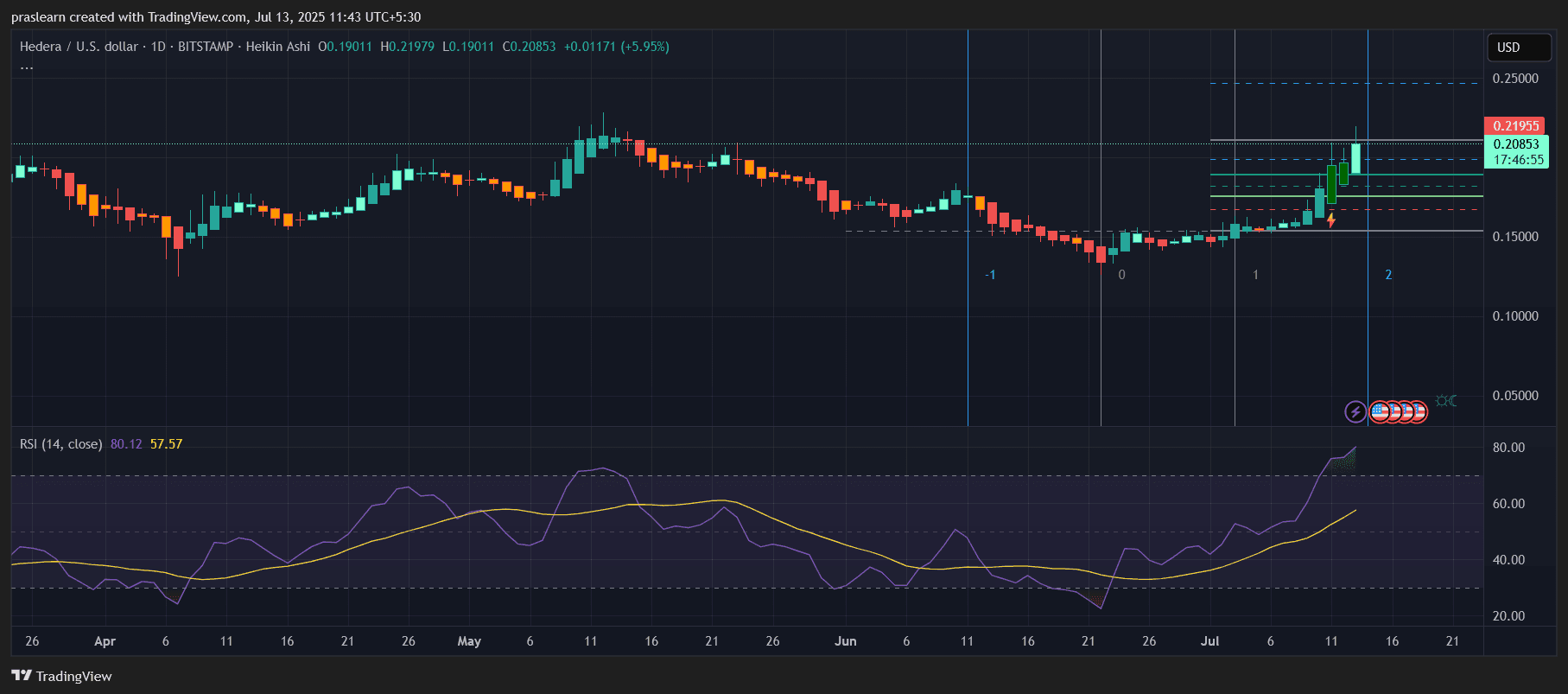

Hedera (HBAR) imprint has seen a sturdy rally within the previous week, closing at $0.2085 after touching highs of $0.2195—marking a +34% set from its sleek low of around $0.155. This explosive pass has caught dealer consideration, especially since it is breaking above consolidation ranges that capped allege for quite lots of of June and early July.

The rally aligns with a bullish Heikin Ashi candle sequence and a breakout from a rounded bottom pattern, on the total knowing-a few professional bullish reversal formation. Solid shopping rigidity is clearly visible from the candle physique size and sequence. The RSI (Relative Strength Index) hitting 80.12 signals horrid bullish sentiment—nonetheless additionally hints that warning can be warranted.

HBAR’s sleek surge could perchance additionally be directly linked to its pivotal feature in EQTY Lab’s announcement at the RAISE Summit 2025. The concepts published a multi-organization collaboration bright NVIDIA, SCAN UK, Accenture, and Hedera to strength Verifiable Compute for sovereign AI programs the utilization of the NVIDIA Blackwell structure.

Hedera’s allotted ledger is being ancient as the cryptographic backbone to register and set apart in power compliance of AI workflows, which methodology every AI agent’s actions—especially in excessive-stakes public sector environments—are now cryptographically stagger and recorded on Hedera’s community. This significantly strengthens Hedera’s exercise case as the bound-to platform for mission-main, regulated environments, particularly for defense, health, and public sector AI governance.

This valid-world challenge-grade adoption account has dramatically boosted investor self perception in HBAR’s prolonged-term viability. The technical rally coincides with the EQTY announcement, which highlights Hedera as the underlying DLT infrastructure for cryptographic verification and sovereign compliance in self enough AI.

In a time when markets are hyper-centered on AI and verifiability, HBAR stands out now not correct as a speculative asset nonetheless as a core infrastructure associate for slicing-edge applied sciences. The consequence is a surge of every volume and imprint action, as the market begins to cost in Hedera’s rising relevance in excessive-assurance, excessive-performance AI workflows. If this adoption expands across governments and defense sectors, HBAR’s sleek rally could presumably correct be the initiate of an improbable bigger revaluation.

What Is the Technical Setup Saying?

On the day to day chart, HBAR imprint has broken above key resistance ranges marked at $0.19 and $0.205, which now act as toughen. Fibonacci retracement ranges drawn from the sleek swing low around $0.145 to the local excessive of $0.219 show subsequent resistance with regards to $0.23 (1.618 extension) and valuable breakout resistance at $0.25.

- RSI Overbought: The RSI at 80.12 is within the overbought zone. Traditionally, HBAR tends to factual when RSI breaches the 75–80 set apart. A pullback to the $0.195–$0.20 toughen zone would still be wholesome.

- Quantity & Momentum: The consistent upward candles gift energy. With the RSI bullish crossover taking place in early July and still persevering with, we are in a position to infer that momentum stays with the bulls—though a transient consolidation is probably going.

How High Can HBAR Be conscious Slide This Month?

Let’s calculate the that that it is most likely you’ll presumably presumably believe upside targets the utilization of Fibonacci projections:

- Swing Low (June 24): $0.145

- Swing High (July 13): $0.219

- Top of pass: $0.219 – $0.145 = $0.074

Now projecting upward:

- 1.618 extension: $0.219 + (0.074 × 1.618) = $0.338

- 2.0 extension: $0.219 + (0.074 × 2.0) = $0.367

These ranges act as speculative prolonged targets if Hedera imprint breaks above $0.25 with solid volume. For a more conservative upside within the next 2 weeks, a retest of $0.23–$0.25 is extremely probable.

Is a Correction Coming Earlier than One other Rally?

Given the overbought RSI, HBAR could presumably believe a short pullback. If it retraces:

- First toughen lies at $0.20

- Stronger toughen sits with regards to $0.185–$0.19 (outdated resistance zone)

- If these ranges relief, investors could presumably step in a single more time for the next leg up

If HBAR imprint drops below $0.185, this sleek breakout could presumably fail, and imprint could presumably revisit $0.16.

HBAR Be conscious Prediction: What’s Subsequent for Hedera Be conscious ?

Short-Term (Subsequent 7 Days):

Hedera imprint could presumably consolidate between $0.20–$0.23. A day to day close above $0.23 could presumably trigger a bullish continuation toward $0.25 and beyond.

Mid-Term (Subsequent 2–4 Weeks):

If bulls protect administration and Bitcoin stays stable, HBAR imprint could presumably take a look at $0.27–$0.30, with a max speculative target of $0.33–$0.34 in holding with Fibonacci extensions. On the different hand, this could perchance require sustained volume and market-huge bullish momentum.

Hedera imprint has convincingly broken out of a multi-week consolidation, and indicators gift solid bullish vitality. But traders will must live cautious which skill of overbought RSI ranges. A wholesome dip could presumably provide an even bigger entry point ahead of the next rally toward $0.25+. If the breakout sustains, HBAR imprint is probably going to be on note for its simplest monthly close in over a three hundred and sixty five days.

Having a seek to Aquire HBAR? Are attempting OKX

OKX is a first-rate choice to purchase HBAR. With low shopping and selling costs, huge token listings, and an intuitive interface, it’s a most neatly-most in trend platform for quite lots of crypto traders across Europe.

Particular Promotion – Restricted Time

Till September 14, 2025, OKX is internet hosting an outlandish McLaren F1 Team giveaway:

–>Obtain a complimentary McLaren F1 Team cap<--

Enter to in finding a VIP trackside expertise in Zandvoort (Aug 29–31)

This provide is initiate to all contemporary European users who haven’t but traded on OKX. Don’t wait – claim your reward presently time!

$HBAR, $HBARPrice, $Hedera