Swiss Metropolis St. Gallen will inform a $113 million three-year digital bond the spend of the SIX Digital Alternate (SDX). The bond can be settled the spend of Switzerland’s wholesale central bank digital currency (CBDC) or tokenized euros.

Swiss metropolis St. Gallen joins the Canton of Zurich, the Metropolis of Basel, and Lugano in issuing tokenized bonds in an effort that is section of Switzerland’s CBDC trial.

SDX Targets Bonds for Smaller Companies

With a maturation duration of three years, St. Gallen’s digital bonds can be settled the spend of the Swiss Franc CBDC or tokenized euros. Cherish the bonds the bogus three areas issued, St. Gallen’s can be section of a trial to check CBDC transactions between institutions. The major managers for the bond issuance are Kantonalbank, UBS, and J. Safra Sarasin.

A bond is a debt an organization or authorities points to borrow money from the investing public. Most bonds have maturation home windows of three months and thirty years, after which the establishment most ceaselessly repays the money. Lope bond vehicles have a cut rate, an interest rate that the lender can recoup many times sooner than the bond matures.

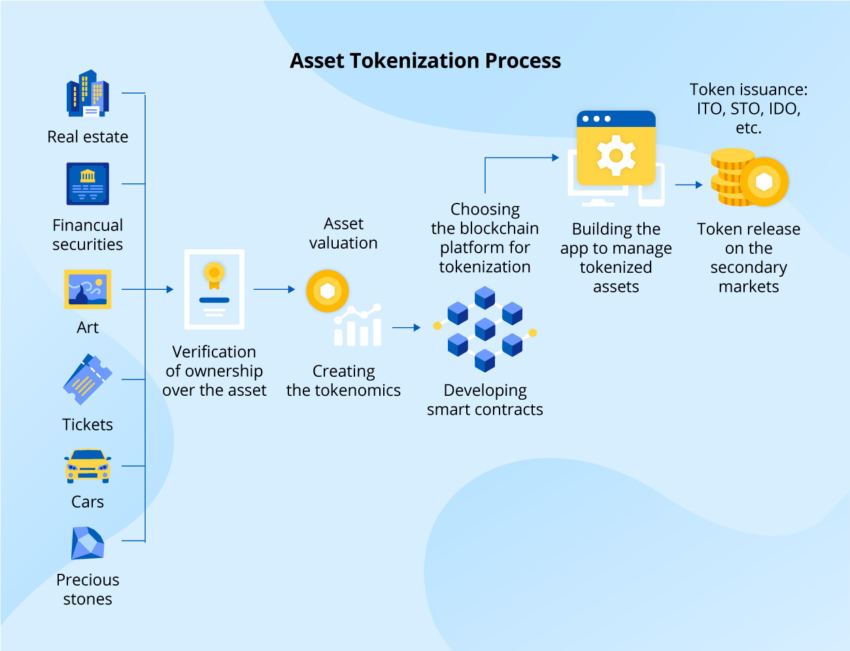

Tokenized bonds are merely bonds that issuers can opt on blockchain infrastructure. An organization comparable to SDX converts the bond into an possession certificates that a blockchain can realize. This company can then living up its issuance and settlement the spend of disbursed ledger skills, which is a non-trivial project, in step with researchers at the Universitat Politècnica de València in Spain.

“Designing a tokenized platform involves diverse primary components, collectively with scalability, security, and user experience. Scalability is key as the platform will have to soundless be ready to tackle a huge possibility of transactions with out experiencing efficiency points. High-efficiency computing infrastructure, comparable to cloud computing services and efficient consensus algorithms comparable to proof-of-stake or sharding are needed in reaching this,” acknowledged Angel A. Juan et al.

Read more: What’s Tokenization on Blockchain?

SDX, the digital arm of the SIX stock substitute, has issued bonds for foremost institutions, collectively with SIX, UBS, and the four Swiss areas. It might perchance be focusing on smaller firms drawn to issuing digital bonds.

Global Regulators Welcome Tokenization

European regulators have been at the forefront of legalizing actual-world asset actual-world asset (RWA) tokenization. Switzerland’s Financial Market Supervisory Authority gave the SIX stock substitute a license to open SDX in 2021. The regulator became among the first globally to inform two licenses, allowing SIX to operate a stock substitute and a blockchain-primarily primarily based depository establishment.

Final year, Goldman Sachs helped Germany’s Siemens AG open a $65 million tokenized bond on a public blockchain. The bond issuance complied with Germany’s Electronics Securities Act.

Regulators within the Center East are also making waves. The monetary watchdog of the Abu Dhabi Global Markets region drafted legislation allowing Bridgewater and Deus X Capital to living up an institutional blockchain industrial. The $250 million platform supplies institutional crypto staking with delegated assets.

Read more: What Is Crypto Staking? A Handbook to Earning Passive Profits

Southeast Asian governments have also made major strides. The Financial Authority of Singapore gave the local division of Switzerland’s Sygnum Financial institution a crypto brokerage license quickly sooner than Hong Kong’s Securities and Futures Commission hinted that it became engaged on tokenization regulations. BeInCrypto has contacted the Swiss metropolis of St. Gallen for comment but has no longer heard lend a hand at press time.

Disclaimer

In adherence to the Belief Mission guidelines, BeInCrypto is committed to fair, clear reporting. This info article targets to produce excellent-wanting, timely files. On the bogus hand, readers are suggested to examine info independently and consult with a talented sooner than making any choices in response to this grunt material. Please present that our Terms and Prerequisites, Privacy Protection, and Disclaimers have been updated.