Bitcoin’s imprint has but to be conscious a willingness for restoration, as the market has did no longer rebound from any improve diploma.

For this reason, issues might per chance maybe maybe earn even worse in the upcoming days.

Technical Evaluation

By Edris Derakhshi

The Each day Chart

On the day-to-day chart, the asset has been tantalizing lower since its rejection from the $64K resistance diploma and the 200-day tantalizing common, positioned around the an analogous assign.

The market has also misplaced the $60K diploma and is for the time being penetrating the $56K improve zone. If this diploma breaks down, an extra drop towards the $52K assign would be forthcoming in the short duration of time. With the RSI also exhibiting particular bearishness in market momentum, a decline looks probable.

The 4-Hour Chart

Taking a have a examine the 4-hour chart, there might per chance maybe maybe tranquil be hope for BTC. The asset has been gradually trending down inner a descending channel above $56K. Nonetheless, the market is for the time being making an strive out the lower boundary of the channel. In case of a bearish breakout, an aggressive fall towards the $52K diploma would be very most likely.

Nonetheless, if the channel holds, merchants would be hopeful for a bullish breakout and a subsequent retest of the $60K diploma.

On-Chain Evaluation

By Edris Derakhshi

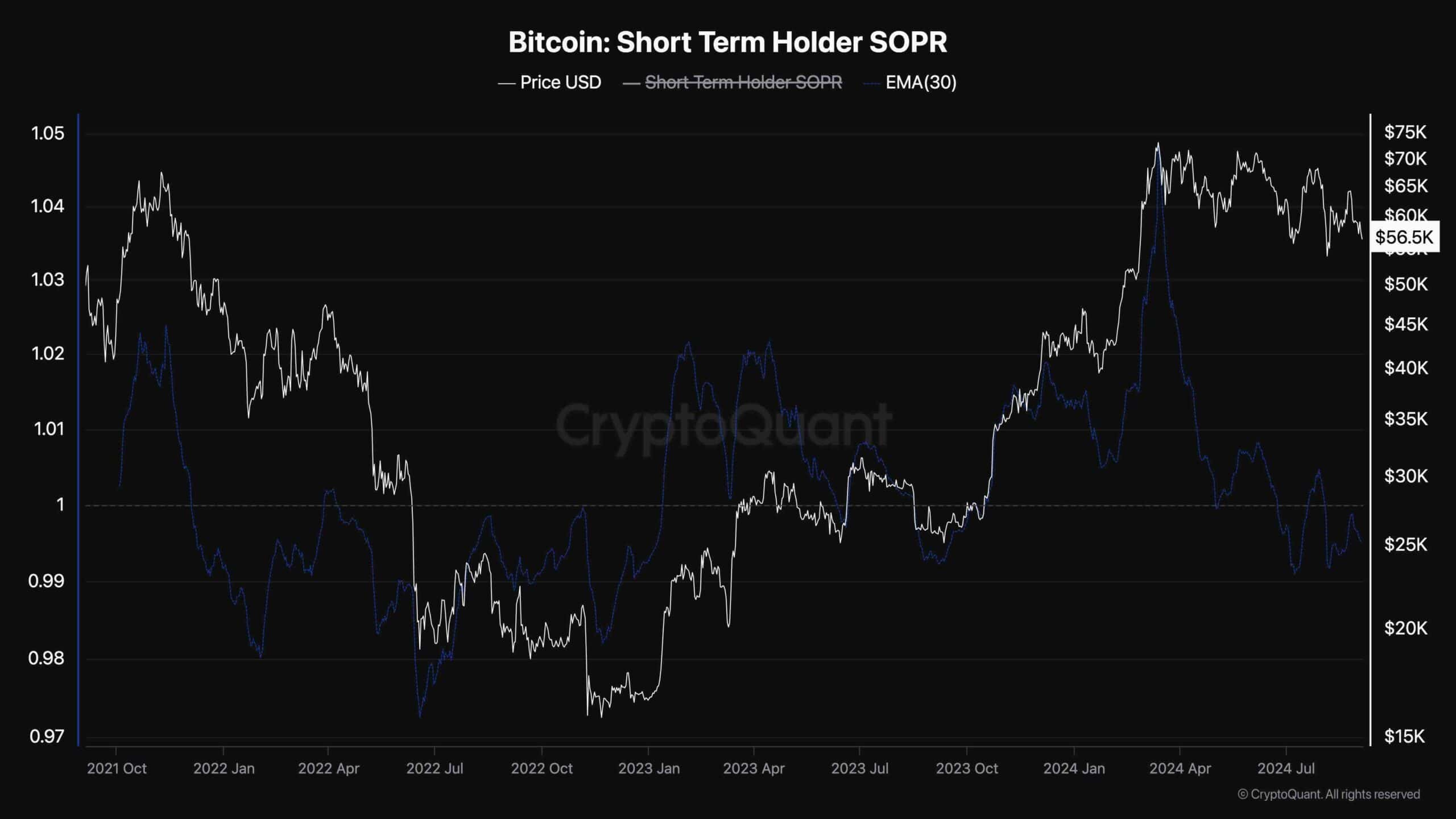

Bitcoin Short-Term Holder SOPR

Whereas technical prognosis is a treasured software program in expecting transient market actions, it would no longer be a sufficient plan for understanding the market dynamics in the support of the dispositions.

This chart gifts the Bitcoin Short-Term Holder SOPR, which measures the ratio of earnings/losses realized by transient market members. Values above 1 indicate income realization, while values beneath 1 are related to losses. Due to the this truth, to have a better overview of the mix inform and sentiment of merchants, the STH-SOPR is barely a precious indicator.

As the chart demonstrates, the 30-day exponential tantalizing common of the STH SOPR metric has been beneath 1 for some time now. This indicates that many transient merchants were realizing losses at some stage in the most modern imprint consolidation. So, if this behavior continues, the ensuing present might per chance maybe maybe overwhelm predict and lead to even lower costs in the upcoming weeks.