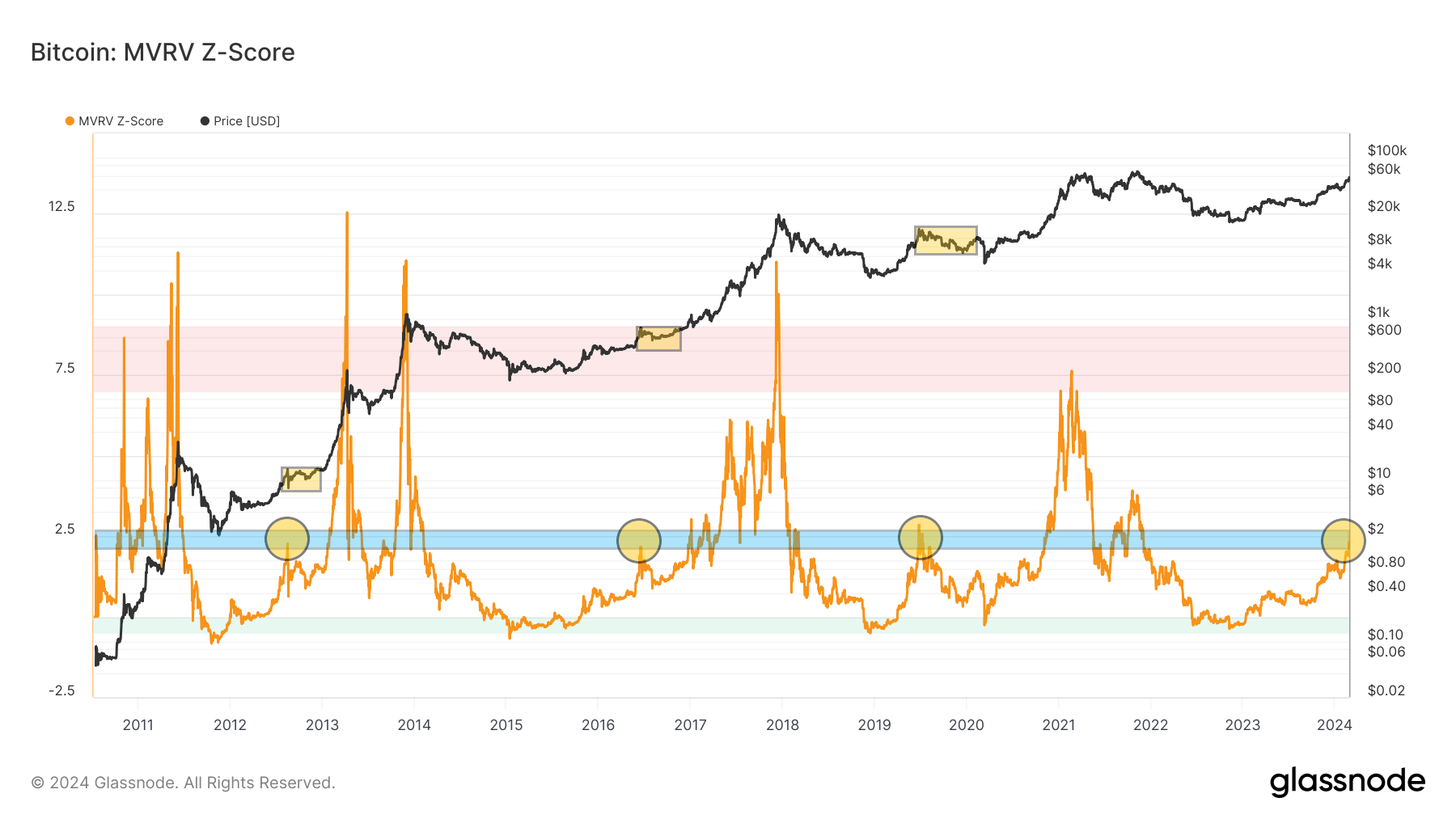

Perfect-searching the day previous to this, BeInCrypto reported that 2 on-chain indicators indicate the initiate of a outmoded phase of the bull market. On the opposite hand, at the present time, one other indicator, the MVRV Z-Accumulate, enters a historically indispensable residing, which has been associated with an inevitable correction of the BTC tag in every previous cycle.

If Bitcoin’s most in vogue cycle “rhymes” with previous ones, the worth of the largest cryptocurrency could maybe maybe soon descend by 47%. This would involve a retest of the $32,000 residing, the validation of which would be a extremely bullish occasion from a technical point of view.

Is the Bitcoin and cryptocurrency market ready for a correction? Or will Bitcoin reach a novel all-time excessive (ATH) for the first time, fueled by the vitality of institutional adoption and field ETFs, even sooner than the April halving?

MVRV Z-Accumulate Indicators Impending Correction

MVRV is in every other case identified as the Market Worth to Realized Worth ratio. It is a long-term indicator of the Bitcoin market. Moreover, it presents a demonstration of when the worth is below the so-known as “graceful worth.”

Meanwhile, its derivative, MVRV Z-Accumulate, assesses when Bitcoin is over priced/undervalued relative to its “graceful worth.” The addition here is the common deviation of all historical market capitalization recordsdata.

On the final, the MVRV Z-Accumulate moves in three ranges. Normally, alternatively, it in transient moves out of them in low bull or undergo market give up prerequisites:

- green residing between 0 and -0.5: interpreted as a trademark of BTC tag below “graceful worth”

- residing between 0 and 7: unbiased vary of “graceful worth”

- the purple residing between 7 and 9 is interpreted as the BTC tag index above “graceful worth”

Within the chart below, we see that the MVRV Z-Accumulate has currently entered residing 2 (blue). Here is occurring for the first time on this cycle. Moreover, in all previous cycles, the first reaching of this residing (yellow circles) change into associated with an imminent correction of the BTC tag (yellow rectangles).

After correcting the BTC tag and the indicator’s decline, both charts generated elevated lows and persevered to climb. If a a similar scenario happens this time, the next 6 months or so most ceaselessly is a length of accumulation within the Bitcoin market. It is miles worth adding that such accumulation could maybe maybe maybe be a fanciful alternative for the growth of quite a total lot of cryptocurrencies and the initiate of the long-awaited altcoin season.

The reaching of this indispensable residing by the MVRV Z-Accumulate change into also infamous by the successfully-identified analyst @PositiveCrypto. On the opposite hand, he ties this residing to a bullish bias, suggesting that the Bitcoin market is unexcited far from overheating.

“Silent an extraordinarily perfect distance to dart sooner than this cycle turns into overheated even supposing. HODL” PositiveCrypto acknowledged.

Will the Bitcoin tag take a look at $32,000 all over again?

Counting the depth of historical corrections and figuring out the residing of toughen to which the BTC tag could maybe maybe tumble is now that you just maybe can imagine. On the long-term chart, residing the declines that occurred after the MVRV Z-Accumulate first reached the two residing.

It turns out that the correction change into moderately deep each time: 50% in 2012, 38% in 2016, and fifty three% in 2020. Thus, within the three previous cycles, the frequent change into 47%.

If one were to superimpose a attainable correction of the BTC tag on the most in vogue chart, attention-grabbing technical correlations seem. A 47% descend in Bitcoin from the most in vogue $59,000 residing would lead to augment terminate to $32,000 (green line).

First, this residing is found virtually exactly at the most important 0.618 Fib retracement of your complete upward motion from the lows of the most in vogue cycle. This retracement is a standard target for deepening corrections in financial markets.

Subsequent, the $32,000 stage has repeatedly acted as macro toughen and resistance since 2021 (blue arrows). In October 2023, the BTC tag decisively broke out above this residing (blue circle). On the opposite hand, since then, it has not ended in its bullish validation as toughen.

If the Bitcoin market were to endure a long-awaited correction within the next 6 months, the $32,000 stage would be a fanciful buying residing. Both technical correlations and the on-chain MVRV Z-Accumulate indicate it.

For BeInCrypto’s most in vogue crypto market diagnosis, click here.

Disclaimer

The total recordsdata contained on our web page is published in factual faith and for common recordsdata capabilities only. Any motion the reader takes upon the suggestions discovered on our web page is exactly at their very comprise risk.