An authorized predominant asset management firm providing Bitcoin alternate-traded funds (ETFs) to its purchasers suggests broadening their point of view on crypto sources by diversifying a fragment of their wealth across your whole asset class, not true dinky to Bitcoin.

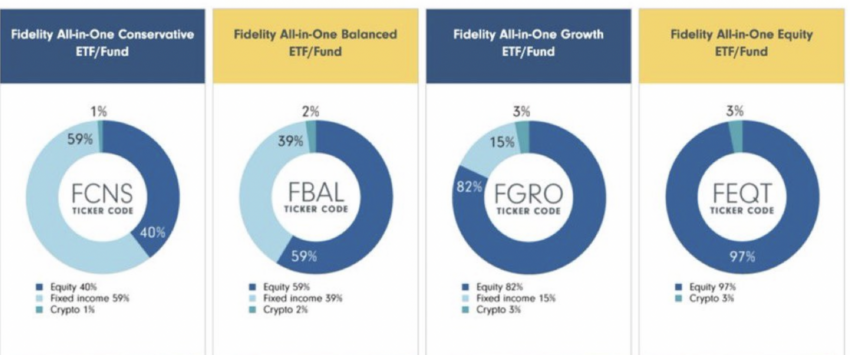

Fidelity Investments advocates for four constructive ETF merchandise categorized by wretchedness levels. The ETF with the lowest wretchedness holds 1% of sources in crypto.

Fidelity Investments Advocates Modest Crypto Allocations

Fidelity Investments is now allowing day to day traders to be triumphant in publicity to the overall cryptocurrency market at their very cling wretchedness alternative, starting from 1% to three%.

The predominant alternative, providing the least publicity to crypto at 1%, is the Fidelity All-in-One Conservative ETF/Fund. It allocates 40% to equity investments, 59% to mounted income, and 1% to crypto.

Read more: 8 Perfect Crypto Platforms for Futures Reproduction Buying and selling

In distinction, the Fidelity All-in-One Balanced ETF fund tilts towards more equity investments at 59%, with mounted income at 39%, and crypto increasing to 2%.

The third possibility, the Fidelity All-in-One Inform ETF, emphasizes equity at 82%, mounted income at 15%, and crypto at 3%. Meanwhile, the fourth possibility, the Fidelity All-in-One Equity ETF, focuses predominantly on equity investments at 97%, with crypto allocation moreover at 3%.

What Invent Assorted Asset Managers Enjoy?

BlackRock moreover demonstrated a bullish stance on digital sources. Its 2022 annual characterize informed purchasers to take into yarn publicity to Bitcoin. In its annual characterize that twelve months, it informed that traders must allocate 84.9% to Bitcoin, 9.06% to shares, and 6.04% to bonds.

Interestingly, this used to be prolonged sooner than the approval of its web issue online Bitcoin ETF (along side 10 others), which within the waste came about on January 10, 2024.

Bitcoin mining firm Blockware’s Joe Burnett agreed with the allocation recommendation:

“If all traders note BlackRock’s optimum BTC allocation, Bitcoin will likely be price more than 5x the total price of all equities, genuine estate, and bonds.”

Read more: 10 Perfect Crypto Exchanges And Apps For Learners In 2024

In its 2024 Enormous Tips characterize, Ark Make investments worthy an optimum Bitcoin allocation for 2023.

“Our diagnosis suggests that allocating 19.4% to Bitcoin in 2023 would cling maximized a portfolio’s wretchedness-adjusted returns.”

SkyBridge Capital founder Anthony Scaramucci has moreover been talking up Bitcoin’s 2024 skill development as a retailer of price asset an identical to gold. In a most up-to-date CNBC interview, the financier highlighted gold’s $16 trillion market cap:

“I’d produce a case that it’s (Bitcoin) better than gold because it’s more uncomplicated to transfer spherical. It is some distance going to replace to not lower than half of that. It’s at a trillion greenbacks excellent now.”

Disclaimer

All the records contained on our net procedure is published in excellent faith and for frequent recordsdata applications handiest. Any circulate the reader takes upon the records realized on our net procedure is precisely at their very cling wretchedness.