Bitcoin’s (BTC) note is most likely within the heart of a bull trot, and it will also proceed the rally following the halving tournament.

Here is extra substantiated by the investors holding on to their BTC, which is a testomony to their conviction, stronger than in 2021.

Bitcoin Merchants Indicate Self belief

After posting a novel all-time high this month, Bitcoin’s note halted the rally because the market cooled down. Whereas many notion to be this to demonstrate a market top, this would maybe maybe be its mid-level. The motive within the wait on of right here’s the conviction confirmed by investors.

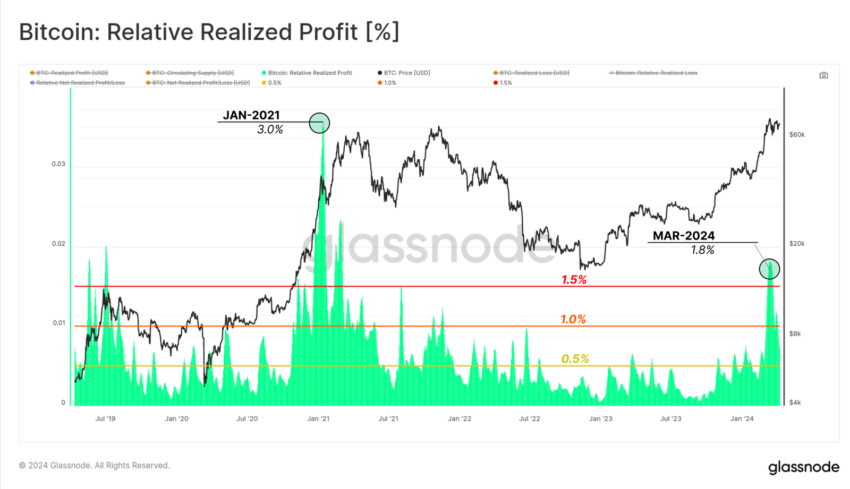

Here is evident from the Relative Realized Earnings. Evaluating the unique bull cycle’s profit-taking to the 2021 cycle’s, it turns into evident that investors are grand extra anchored this time round. In 2021, all over the all-time high of $64,500, the realized earnings had been at 3%.

Nonetheless, for the time being, the the same metric is peaking at 1.8%. This implies that 1.8% of the market cap became as soon as locked in as profit over a seven-day period. Merchants possess no longer been selling their holdings as grand as they did wait on in 2021, exhibiting conviction.

Be taught More: What Came about at the Most attention-grabbing Bitcoin Halving? Predictions for 2024

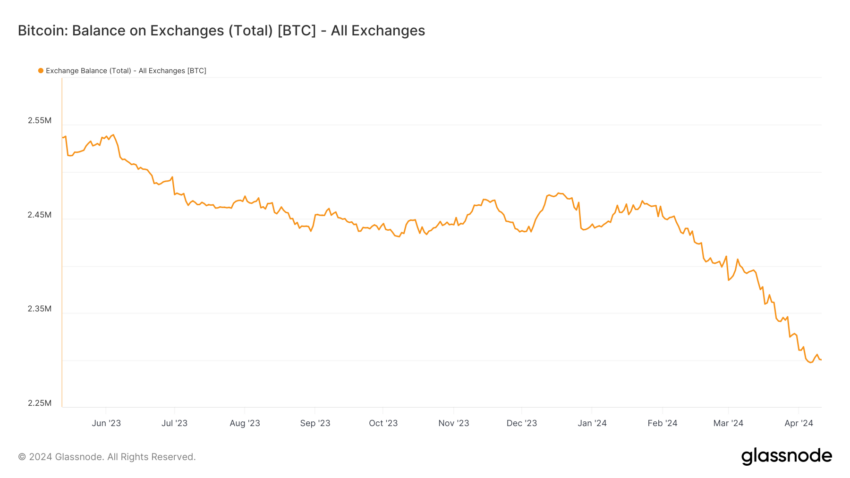

Here is supported by the constant accumulation illustrious since February. Merchants possess been majorly including to their wallets, and within the final 11 days of April alone, over 10,284 BTC price over $728 million possess been equipped from exchanges.

Accumulation indicates self belief among investors because it shows that they are expecting extra note development. This sentiment is in overall validated because the bullish halving tournament takes build.

BTC Impress Prediction: Rally Awaits

Bitcoin’s note over a 3-day timeframe validates a Wyckoff pattern. The Wyckoff pattern is a trading methodology that analyzes market trends, quantity, and price action to name accumulation and distribution phases.

Be taught More: 7 Most attention-grabbing Bitcoin Halving Promotions to Take a look at Out in 2024

Nonetheless, if Bitcoin’s note falls underneath this enhance stage, a decline could maybe very successfully be observed to $63,159. Losing this enhance flooring would invalidate the bullish thesis, ensuing in a correction to $60,000.