Korea Digital Asset (KODA), South Korea’s leading institutional crypto custodian, reported a nearly 250% expand in its crypto sources beneath custody within the latter half of 2023.

This surge is closely linked to the rising excitement over the capability initiating of local space Bitcoin commerce-traded funds (ETFs).

Why South Korea Expects Native Area Bitcoin ETFs

In accordance with IBT, KODA’s crypto sources swelled to roughly 8 trillion Korean won (~ $6 billion), up from roughly 2.3 trillion Korean won (~ $1.7 billion) on the year’s midpoint. Furthermore, this inform spurt in crypto holdings coincided with a international uptick in crypto market enthusiasm.

This was as soon as basically due to the the US Securities and Trade Price’s (SEC) actions against approving space Bitcoin ETFs. Sooner than the SEC’s nod, Bitcoin’s price had already jumped by 40%. Following the SEC’s approval of 11 space Bitcoin ETFs, Bitcoin’s price further escalated, surpassing the $50,000 milestone.

Furthermore, KODA has solidified its market presence by managing over 200 crypto wallets and serving spherical 50 institutional customers. By mid-2023, the firm claimed an 80% local market share.

To boot, the Financial Supervisory Carrier (FSS) of South Korea has printed upcoming discussions between its governor, Lee Bok-hyun, and SEC chief Gary Gensler. Scheduled for the 2d quarter of 2024, these talks will level of curiosity on virtual asset regulations and the capability for Bitcoin space ETFs. This capability a forward-thinking capability to crypto regulation and international cooperation.

Be taught more: What Is a Bitcoin ETF?

Nonetheless, the Financial Products and services Price (FSC) of South Korea has entreated local securities companies to tread cautiously. Enticing with out of the country-listed space Bitcoin ETFs also can warfare with the nation’s present virtual asset guidelines and the Capital Markets Act. This caution shows a balanced stance against embracing crypto improvements whereas ensuring regulatory compliance.

“Home securities companies brokering out of the country-listed Bitcoin space ETFs also can merely violate the present executive stance on virtual sources and the Capital Markets Act,” FSC acknowledged.

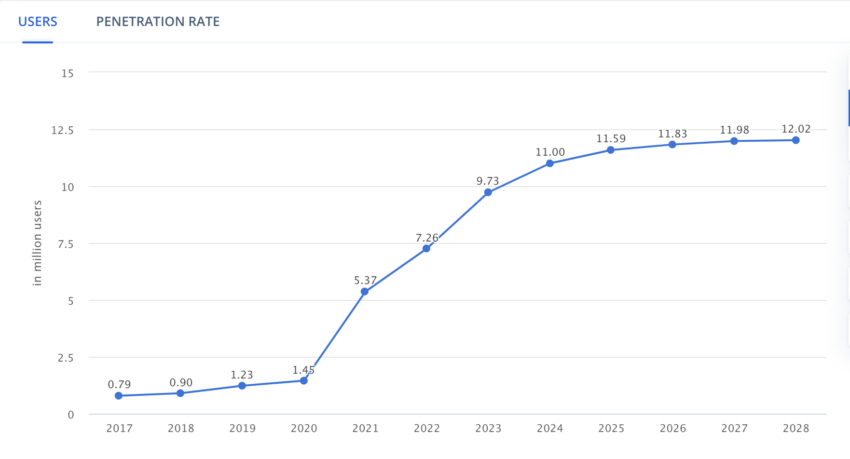

Within the intervening time, the ruling People Energy Event of South Korea is reportedly pondering allowing investments in crypto merchandise current by developed countries, including space Bitcoin ETFs. This pass also can signal a valuable shift within the nation’s investment arena, impacting over 11 million crypto customers.

Simultaneously, South Korea is gearing as much as implement strict crypto regulations. The Digital Asset Person Protection Act, efficient from July 2024, objectives to clamp down on illicit crypto actions.

Be taught more: Crypto Regulation: What Are the Advantages and Drawbacks?

It introduces extreme penalties for main violations, including lifetime imprisonment, emphasizing South Korea’s commitment to a stable and neat crypto market.

Disclaimer

In adherence to the Belief Challenge guidelines, BeInCrypto is devoted to just, clear reporting. This news article objectives to impress staunch, neatly timed data. Nonetheless, readers are informed to verify facts independently and seek the advice of with a reliable sooner than making any decisions in line with this roar material. Please existing that our Phrases and Prerequisites, Privateness Protection, and Disclaimers were updated.