Issues are getting aloof — genuinely aloof — elevating concerns about whether or now not right here is mild a bull market for the extremely volatile crypto ecosystem. Whereas this answer lies in Bitcoin (BTC) efficiency and altcoin prices, historical data and fresh developments can predict the purpose at which the cycle is.

In this diagnosis, BeInCrypto examines predominant on-chain metrics that suggest the bull market started about two years within the past and would perhaps presumably furthermore hold reached 50% completion.

History Presentations the Cycle Is Manner Beyond Bears

The three hundred and sixty five days 2022 became a namely complicated time for the crypto market, which had beforehand thrived in 2021. The alternate saw predominant corporations love FTX, Celsius, and Three Arrows Capital (3AC) collapse, triggering frequent bankruptcies and causing principal declines in cryptocurrency prices.

By November 21, 2022, Bitcoin (BTC) had plunged to $15,409, Ethereum (ETH) became buying and selling at $1,065, BNB at $248.60, and Solana (SOL) had dropped to $7.70. These phases were the bottom these resources had considered in practically two years.

Given this downturn, it looks that evidently November 2022 marked the backside of the endure market. The stable discover restoration in early 2023 helps the inspiration that January became the open of a original bull cycle. Traditionally, crypto market cycles span roughly three years (1,047 to 1,278 days). Basically basically based on this timeframe, the fresh cycle is round 640 days in, indicating that the bull market is roughly midway through.

Severely, the Bitcoin halving, which most regularly drives huge discover increases, came about earlier this three hundred and sixty five days. Interestingly, Bitcoin reached a original all-time high even sooner than the halving, driven largely by the approval of plight ETFs. Despite the fresh corrections and periods of consolidation, on-chain metrics suggest that BTC has now not yet reached the height of this cycle. This leaves room for seemingly additional increase because the bull market progresses.

As considered above, the put up-halving rally started within the fourth quarter (Q4) of every halving three hundred and sixty five days. Thus, if we high-tail by that recurrence, then a big upswing would perhaps presumably furthermore open round October. Interestingly, CryptoQuant’s CEO, Ki Young Ju, also appears to be like to believe the sentiment.

“Within the last Bitcoin halving cycle, the bull rally started in Q4. Whales won’t let Q4 be tedious with a flat YoY efficiency,” Young Ju highlighted on X.

Bitcoin, ETH, and Altcoin Prices Quiet Contain Room to Grow

Traditionally, Bitcoin’s discover has now not lower than doubled at some stage in every halving three hundred and sixty five days. In 2012, BTC’s discover surged by 2.52x, followed by a 2.26x lengthen in 2016, and a 4.05x jump in 2020. At the open of 2024, Bitcoin became buying and selling round $42,208. Even after reaching $73,750 in March, the details suggests the bull cycle is now not yet over.

To compare past halving performances, Bitcoin’s discover would hold to rise additional, focused on between $80,000 and $85,000 sooner than this cycle peaks. The historical developments gift room for more increase in 2024.

Now, to a quantity of issues — starting up with ETH. At some stage within the 2021 bull bustle, the second most treasured cryptocurrency gave BTC a bustle for its money, outperforming it for a long duration.

Despite the plight Ethereum ETF approval, ETH hasn’t mirrored its efficiency from three years within the past. On June 20, Ethereum’s dominance became 18.80%. As of now, it has dropped to 15%, signaling that the altcoin has yet to copy its impressive 2021 bustle.

Bitcoin dominance, on the a quantity of hand, is over 57%. Furthermore, ETH’s underwhelming efficiency has also been attributed to the lengthen in this cycle’s altcoin season.

It’s value noting that the cryptocurrency’s rally became one among the predominant components that drove many completely different altcoins to not seemingly peaks last time. But these days, BNB looks to be the completely high altcoin from the last cycle that had surpassed its outdated all-time high.

Meme Cash, Celebs Already Tasted the Bull Market

Whereas altcoins continue to underperform, two principal events suggest that this bull market would perhaps presumably furthermore be midway through. The predominant one is the not seemingly returns from meme coins. Closing time, loads of meme coins on Ethereum and the Binance Natty Chain produced many out-of-the-blue millionaires.

This time, the blockchains offering such seem like Solana and, most these days, Justin Sun-led Tron. 2nd on the checklist is the involvement of celebrities. In 2021, stars love Logan Paul, Paris Hilton, and Snoop Dogg, amongst others, sold into the NFT hype.

Meanwhile, the NFT craze looks to be over, but celebrities hold also been fervent with the market. Folks love Andrew Tate and Iggy Azalea hold launched DADDY and MOTHER meme coins, respectively.

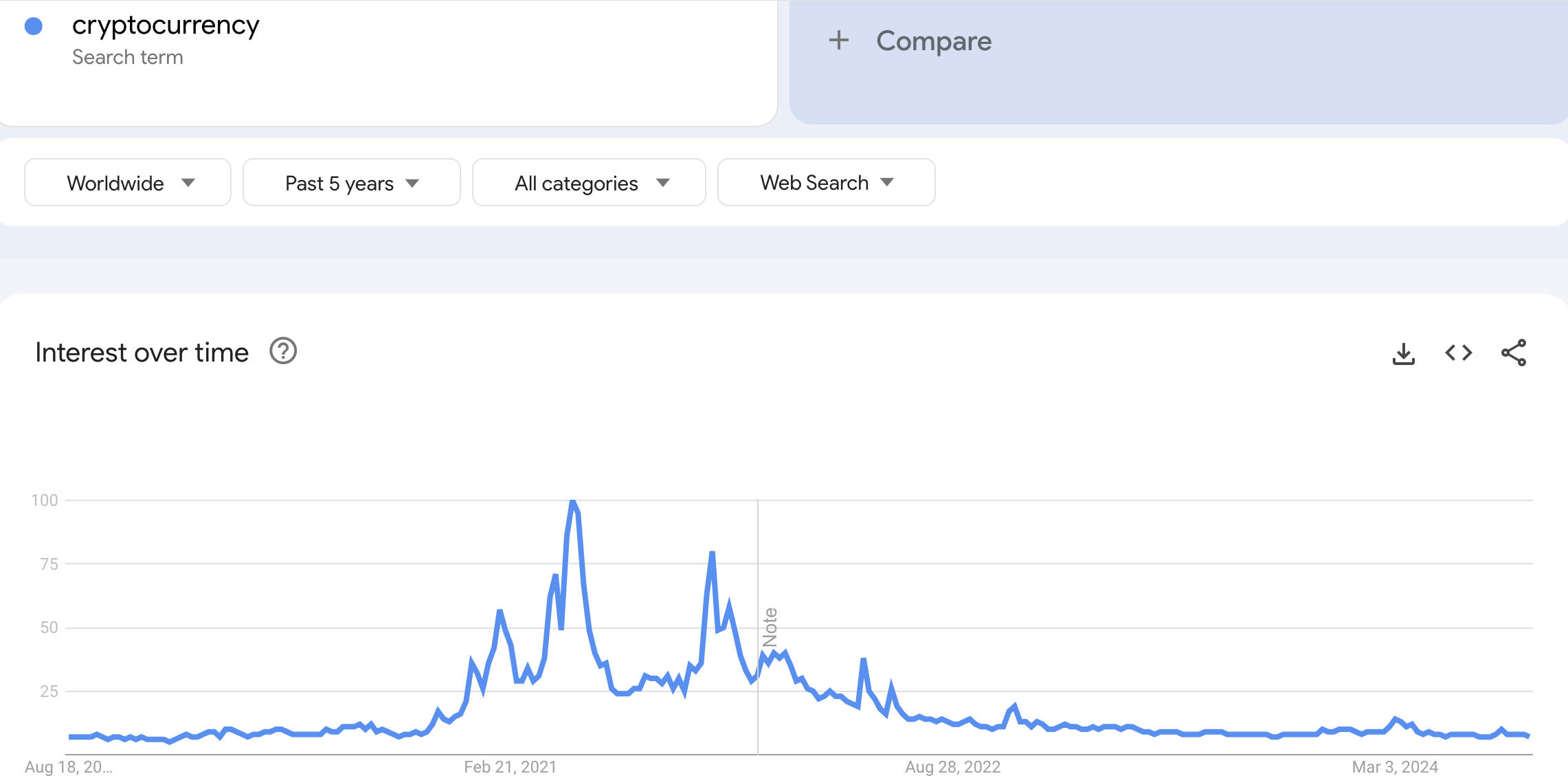

Any other metric to set up finish into yarn for gauging the crypto bull market is retail investor hobby. At any time when retail investor hobby declines, it suggests the bull market is ongoing but hasn’t peaked.

Google Trends data presentations searches for “cryptocurrency” hit their absolute best level in 2021, scoring a supreme 100. On the other hand, searches were consistently lower this three hundred and sixty five days, signaling diminished retail process.

A bull market most regularly sees a surge in retail investors as they force the seek files from. The fresh dip in hobby suggests that this cycle hasn’t reached its height yet. The shortage of frequent retail FOMO parts to more seemingly upside because the cycle matures.

Prolonged-Term Records Presentations the Uptrend Would possibly presumably perhaps Kick Off Yet again

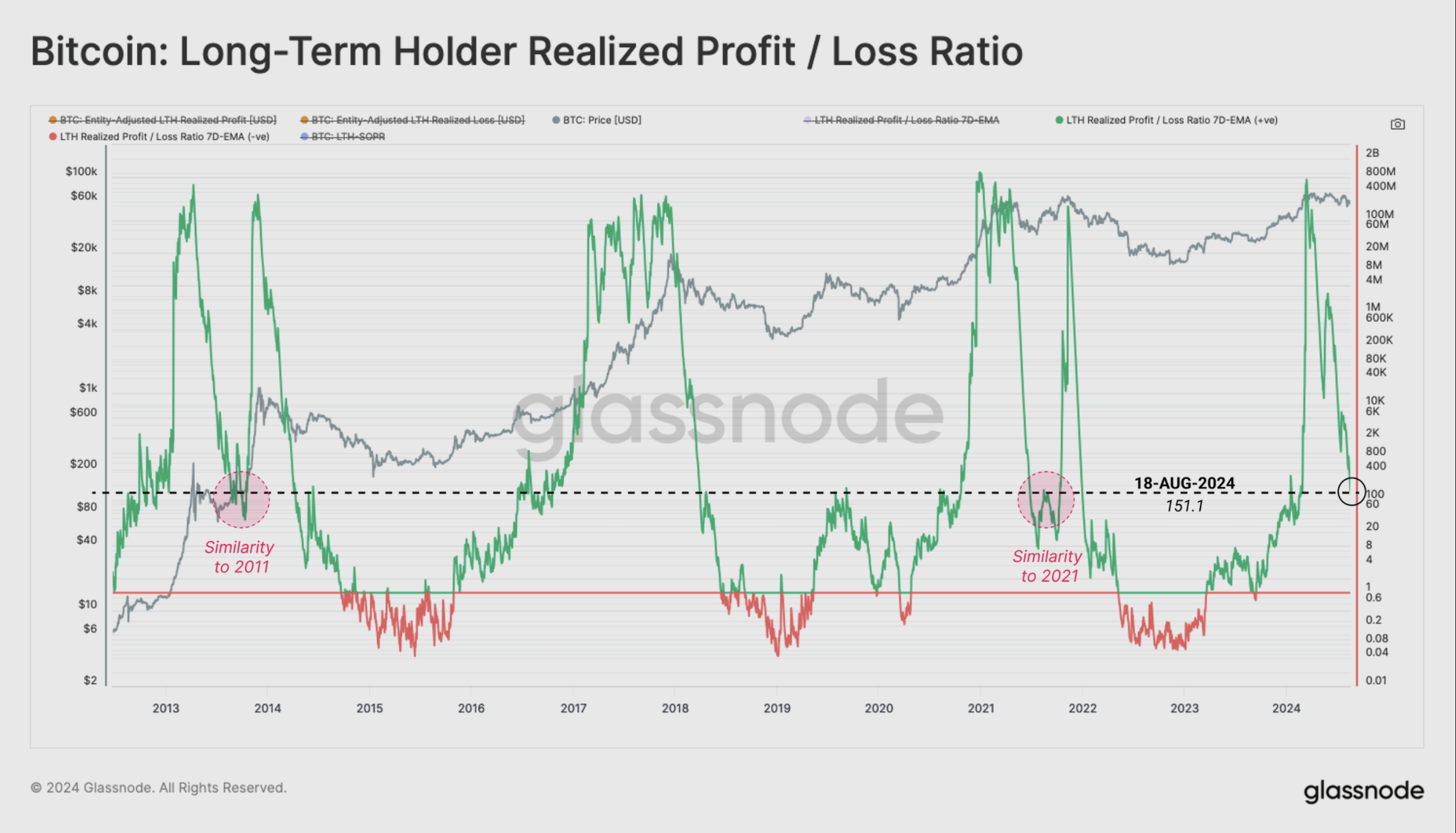

Additionally, Glassnode-equipped Prolonged-Term Holder Realized Earnings/Loss Ratio comes into play. As the title suggests, this metric tracks the habits of long-term holders, telling if they’re reserving profits or enduring losses.

As of this writing, this metric has declined from its height in March, indicating that holders hold diminished profit-taking process. This autumn is equivalent to the 2021 cycle when Bitcoin’s discover went down sooner than restarting one other uptrend.

Due to this truth, if past performances affect future developments, then BTC, apart from a quantity of cryptos, would perhaps presumably furthermore attain original highs. The on-chain analytic platform also has the same opinion in its document dated August 20.

“Severely, at some stage within the March 2024 ATH, this metric reached a a similar altitude to prior market tops. In both the 2013 and 2021 cycles, the metric declined to a similar phases sooner than resuming an uptrend in discover,” Glassnode stated.

In summary, whereas some investors dwell skeptical relating to the fresh market cases, loads of indicators expose this mild being a bull market despite fresh volatility. The diagnosis suggests that prices would perhaps presumably furthermore continue to rise, pushing Bitcoin, Ethereum, and a quantity of altcoins to original highs and fueling additional momentum in this cycle.

On the other hand, caution is mild commended. Heightened volatility and periodic drawdowns can lead to surprising discover shifts. If realized losses persist and dominate the market, the fresh cycle would perhaps presumably furthermore transition into a endure fragment.