In 2024, several altcoin initiatives dangle secured plentiful funding, showcasing growing investor self belief within the cryptocurrency market.

These initiatives are additionally attracting consideration for their monetary backing and for their seemingly to force innovation and efficiency within the industry.

Ideal Altcoin Fundraises

Main the associated payment is Monad, which has raised $225 million. This new Layer-1 blockchain is designed for saunter and interconnectivity, boasting capabilities like 10,000 transactions per 2d, one-2d block cases, and single-slot finality.

Monad’s EVM compatibility additional improves its charm, positioning it as a significant participant in improving blockchain efficiency and scalability.

Berachain has additionally made a principal influence, elevating $169 million. Known for its unfamiliar Proof-of-Liquidity (PoL) consensus mechanism, this EVM-compatible blockchain integrates validators and initiatives by design of an financial model designed to enhance liquidity and governance.

Its technique to align network incentives has attracted significant investment. Subsequently, highlighting its seemingly to persuade the blockchain ecosystem.

Now not a long way within the support of, Farcaster has secured $150 million. This community-driven protocol objectives to enhance social networks by giving users protect watch over over their knowledge. It additionally enables developers to avoid wasting applications with out network permission. Farcaster’s user-centric attain has resonated with traders, reflecting the market’s search files from for decentralized social media solutions.

Study more: Which Are the Finest Altcoins To Make investments in June 2024?

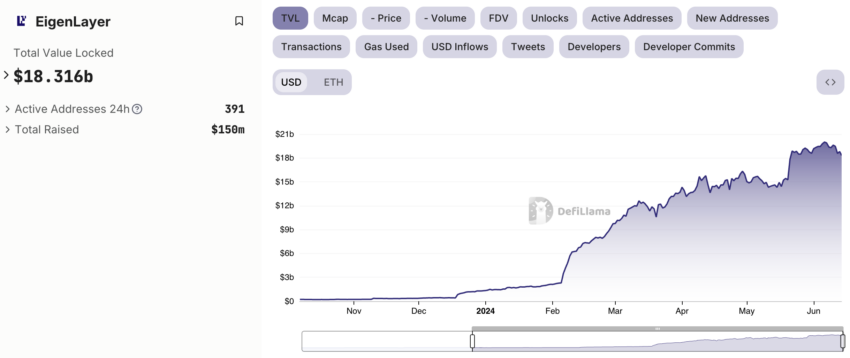

One other crucial venture is EigenLayer, which has secured $100 million in funding. Constructed on the Ethereum network, EigenLayer enables protocols to leverage Ethereum’s acquire trust network with out setting up its have validator build of living. By providing off-chain knowledge availability to Layer 2s, EigenLayer helps decrease costs and improve efficiency.

The EIGEN token is inclined for staking alongside ETH restaking. More importantly, the protocol has amazed over $18 billion in entire mark locked up to now.

Within the meantime, Babylon has raised $70 million, introducing Bitcoin as a staking asset. This attain enables Proof-of-Stake chains to tap into the plentiful reserves of BTC for funding. As a result of this truth, they bridge the gap between Bitcoin and Proof-of-Stake ecosystems and providing new avenues for monetary enhance and steadiness.

“The skill for holders to stake their Bitcoin while keeping their keys is a significant step forward. It’s a laborious topic that has been solved by Babylon with some cryptographic genius,” Alasdair Foster, CEO of Bullish Capital, mentioned.

Equally, Avail has garnered $70 million in funding. This Web3 infrastructure layer helps modular execution layers to scale and interoperate in a trust-minimized attain. Avail’s infrastructure caters to the growing search files from for scalable and interoperable blockchain solutions, supporting a super sequence of applications within the Web3 home.

Indirectly, Eclipse has raised $50 million by positioning itself as “Ethereum’s fastest Layer-2”. By operating the Solana Virtual Machine (SVM) as a rollup on Ethereum, Eclipse objectives to present scalable and worth-effective solutions. Indeed, these are constructed for developers and users interacting with Ethereum and Solana orderly contracts.

With significant capital backing, these altcoin initiatives might likely well force the subsequent wave of innovation within the crypto market.