This may perhaps be a box pronounce of enterprise halving for exchanges and ETFs — but a depressed moment for miners and rival cryptocurrencies.

The Bitcoin halving is rapid drawing shut, but whereas early traders will most seemingly be popping initiating champagne following the cryptocurrency’s recent rally, the 50% cut to block rewards isn’t colossal news for all americans.

So, who’re the winners and losers following this uncommon occasion, and the procedure may perhaps this delight in an impact on the markets going forward?

Learn extra: What’s going to future Bitcoin halvings detect admire?

The winners

“OGs” who delight in had exposure to Bitcoin for years high the checklist of beneficiaries. The halving skill comely 450 unique BTC a day are going to enter circulation, but this received’t topic mighty to those that started stacking sats a truly lengthy time ago.

Any individual who has held on to their Bitcoin since the first halving in November 2012 will delight in considered their investment surge by a jaw-shedding 502,693%. The arena’s greatest cryptocurrency has liked by 9,578% since the 2d halving eight years ago and by 607% following the final halving one day of the coronavirus pandemic in Would possibly perhaps well furthermore impartial 2020.

Exchanges

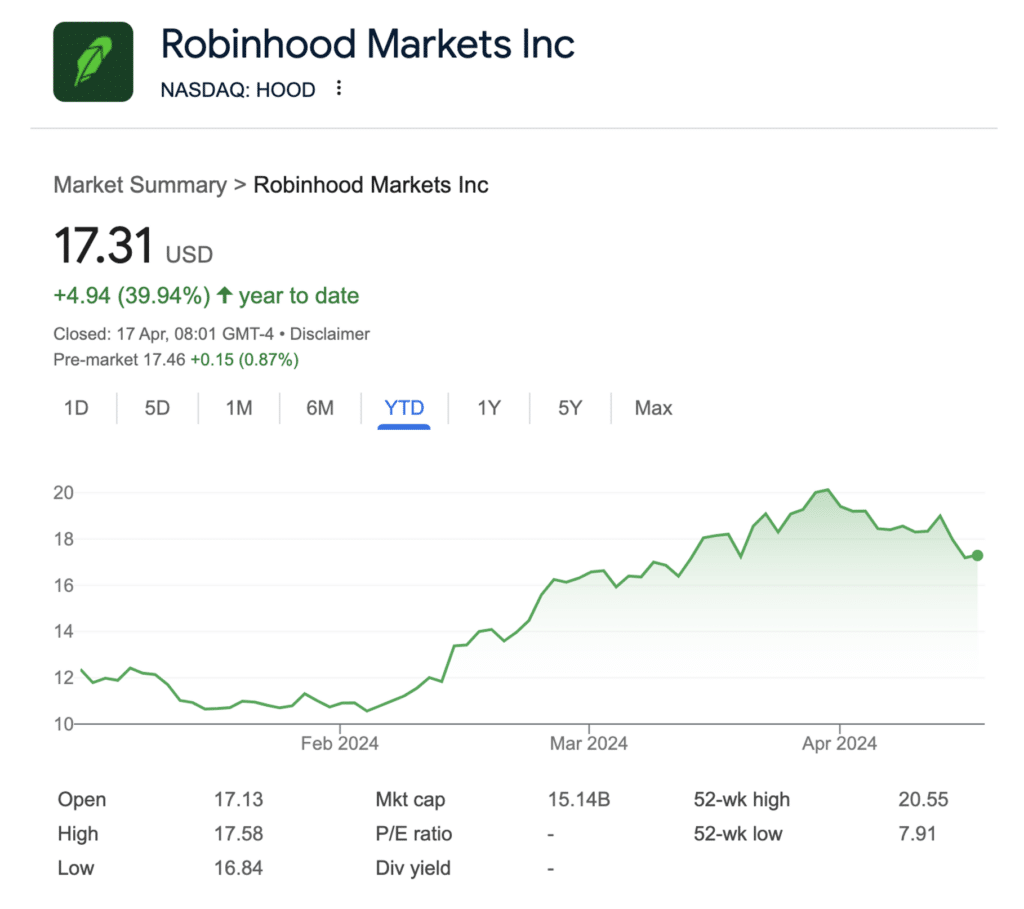

Platforms admire Robinhood and Coinbase will furthermore be rubbing their palms with glee because the halving kicks in, and outlandish shoppers initiating accounts to search out what the fuss is all about. Increased volumes among established traders will furthermore screech in bumper fees.

Both firms are essentially listed on the stock market and delight in considered their portion costs surge since the initiating of the year.

And whereas we’re nowhere reach the market mania considered one day of the final bull speed, when adverts for crypto exchanges dominated the Fine Bowl, firms are initiating to notch up their advertising and marketing utilize as soon as extra. Grayscale has launched a unique industrial in recent days, with Coinbase hunting down TV spots one day of excessive-profile basketball video games. In a nod to Bitcoin Pizza Day, it’s merely explained this cryptocurrency’s staying energy with a becoming food analogy.

ETFs

Alternate-traded funds based fully on Bitcoin’s plight label had been permitted in the U.S. in January — and delight in helped propel BTC to a unique all-time excessive even sooner than the halving’s taken pronounce.

BlackRock’s iShares Bitcoin Belief has like a flash established itself as a main on this congested market. With $17.1 billion in property below management, it is also a key beneficiary if the halving sparks a renewed flee of inflows from retail and institutional traders.

Michael Saylor

Any individual else who comes out of the halving smelling of roses is Michael Saylor.

The founding father of MicroStrategy turned heads when he started aggressively buying Bitcoin to retain on its steadiness sheet in August 2020.

Rapid forward to now, and MicroStrategy has now accumulated a conflict chest of 214,000 BTC, with every costing comely $33,706 on moderate. That officially skill that comely one company owns 1% of the total BTC that may perhaps ever exist, and is currently sitting on paper earnings of about $6.5 billion.

It wasn’t constantly easy. When BTC plunged to lows of $16,000 one day of a punishing endure market in 2022, Saylor’s worthy wager develop into vastly in the pink — and funded by spy-watering ranges of debt.

Saylor has now taken a step aid as CEO and is now MicroStrategy’s government chairman, giving him extra time to advocate for Bitcoin. He does reasonably a couple of that on X.

Elevate your thinking. #Bitcoin pic.twitter.com/UVOOIJxUJz

— Michael Saylor⚡️ (@saylor) April 17, 2024

Journalists

Any checklist of winners from Bitcoin’s halving would be incomplete without crypto reporters. Hiya, it retains us busy! We’ll be preserving every twist and switch on crypto.news.

The losers

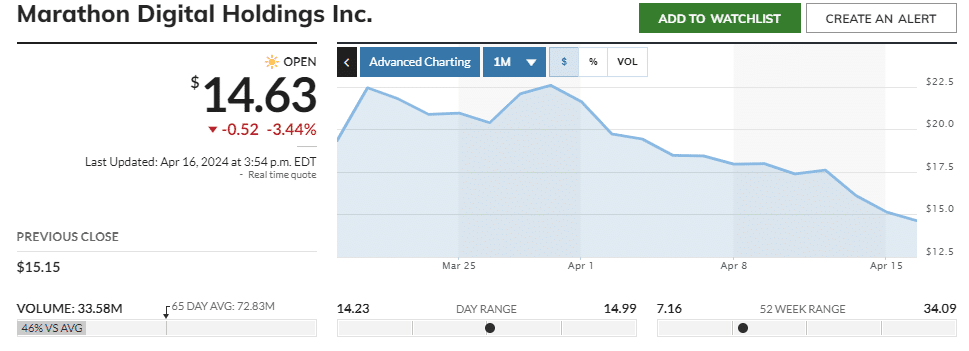

You’ll be unsurprised to bear in mind that miners are going to be hit not easy by the halving. In the self-discipline of one block, the rewards they receive for preserving the network accumulate will topple from 6.25 to three.125 BTC — that’s a fall of about $197,000 in money phrases.

Miners in areas with larger energy costs, and those with older gear, may perhaps well accumulate it’s no longer financially viable to continue. Even publicly listed mining giants delight in considered their stock label battered amid concerns over what the halving will indicate for their base line. Shares in every Marathon Digital Holdings and Rebel Platforms delight in slumped by 35% over the final month.

Other cryptocurrencies

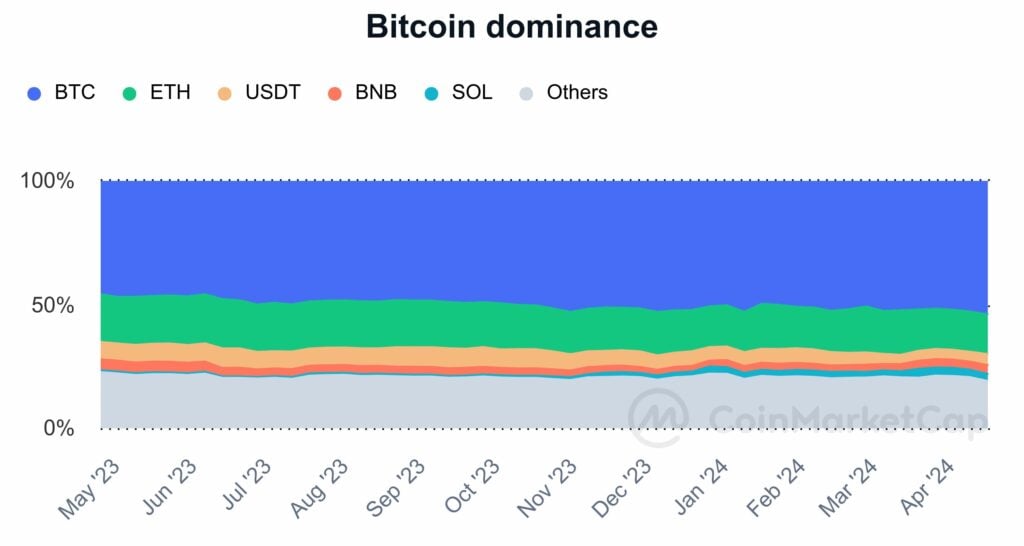

Bitcoin’s dominance now stands at 54.2%, in comparison with forty five.8% a year ago.

The lengthen in BTC’s market portion has been on the expense of Ether and smaller altcoins.

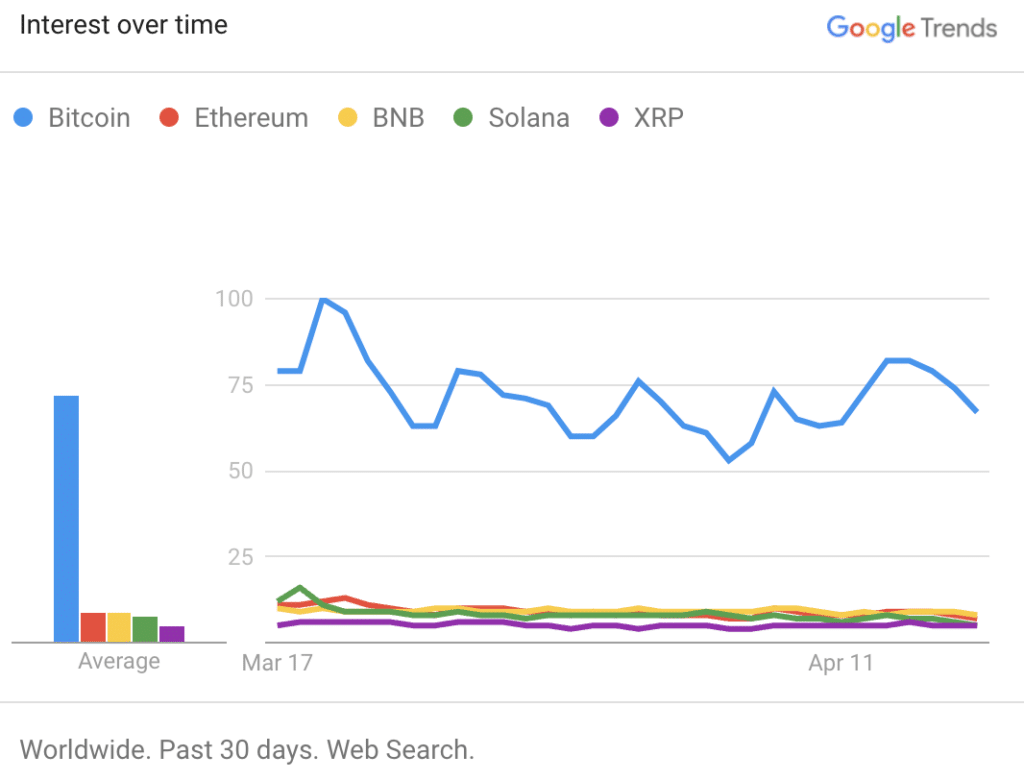

Traders aren’t comely vote casting with their wallets. Google Trends recordsdata exhibits that search passion in Bitcoin is mighty outpacing rival cryptocurrencies, that are struggling to fetch a spy in upright now.

Analysts

There’s no shortage of pundits sharp to step forward and beauty ambitious predictions about where Bitcoin costs will high-tail subsequent.

The likes of JPMorgan delight in steered that BTC will most seemingly be heading for a publish-halving skedaddle to $42,000, whereas Fundstrat World Advisors founder Tom Lee is adamant that a rally to current highs of $150,000 may perhaps well lie forward in the subsequent 12 months.

Not all americans is also upright — and by the tip of the year, some analysts who made pie-in-the-sky predictions will delight in egg on their faces.

Learn extra: 3 assorted cryptocurrencies which delight in halvings