Binance’s dilapidated CEO Changpeng Zhao acknowledged the USD1 stablecoin in an X put up on March 24. He clarified in but every other put up that the USD1 stablecoin it is not but tradable, cautioning the neighborhood against scams the utilization of the linked name.

The legit X page for WLFI has since quoted his tweet with an legit warning, which acknowledged that USD1 is no longer but tradable and that customers must beware of scams.

pic.twitter.com/zXXG3LCESB

— WLFI (@worldlibertyfi) March 24, 2025

CZ’s warning to his followers

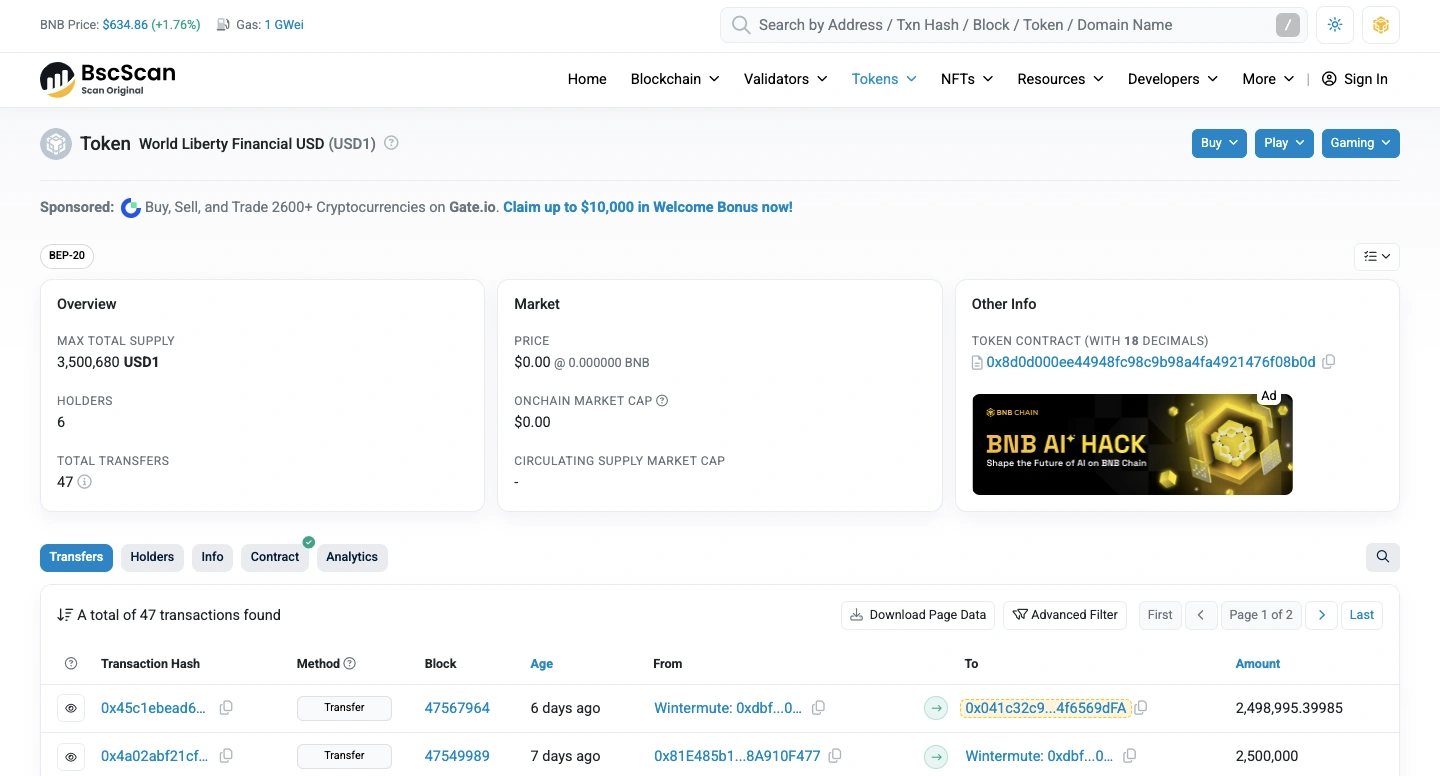

Hours sooner than CZ warned customers about doable scams linked to USD1, he printed in a put up that the aloof contract of the self-proclaimed “World Liberty Monetary USD” stablecoin has been deployed on BSC.

“Welcome to @BNBChain!” His tweet read. “In step with BSCScan, the aloof contract changed into deployed 20 days within the past. Assemble!” He concluded with an applause emoji.

The put up triggered excitement from customers, with many claiming these are exact signs that BNB season is able to birth out up in paunchy swing. CZ’s clarification put up came hours later.

“I changed into suggested since this put up, quite quite a bit of scammers created cash with the linked name. The legit USD1 is no longer tradable but. Please stay no longer tumble for the scams,” it read.

It changed into an strive and set his followers, many of whom are vastly influenced by his tweets, safe attributable to although he referred to it as “the legit USD1,” CZ’s swear isn’t an steady indicator that there would possibly be an legit partnership between Binance and World Liberty Monetary.

Some customers replied to his warning by criticizing his “spontaneous” posting model, pointing out that the neighborhood would possibly perchance perchance take his posts completely out of context, which would possibly perchance perchance well bask in misunderstandings.

Talks of a WLFI-stablecoin began closing year, triggering moral concerns and problems

WLFI, the Trump family-linked crypto challenge, printed plans to bask in and discipline its bear stablecoin closing year October in accordance with sources quoted by Decrypt.

The stablecoin is designed to maintain a staunch payment that is pegged to the US greenback, nonetheless succor in October, when the info first broke, it changed into printed the World Liberty group changed into within the heart of of determining easy systems to provide the financial product safe sooner than bringing it to market.

The moves that adopted perceived to substantiate a doable stablecoin challenge, even including the appointment of Rich Teo, co-founder of stablecoin issuer Paxos, as World Liberty’s stablecoin and price lead.

It has been months since then, and it is now about to turn out to be a actuality whatever the worries.

World Liberty is already a in point of truth controversial enterprise entity attributable to of its links to the dilapidated—and now model—president of the US. Alternatively, the notion of Trump and his enterprise partners issuing their bear stablecoin is even extra controversial because it poses regulatory hurdles spanning securities classification, financial licensing, AML/KYC compliance, reserve transparency, and political sensitivities.

For stablecoins to maintain their stability, they ought to be heavily collateralized. Steal neatly-liked stablecoin issuer Circle to illustrate; it reportedly holds billions price of greenback-denominated sources at regulated American financial institutions to succor its billions price of stablecoin, USDC, for the time being in circulation.

Some initiatives, like Terra, have tried to circumvent this intention of fiat collateralization, most frequently by the utilization of crypto as a backing, nonetheless they’ve failed. Terra’s intention changed into successful for over a year till UST’s tag collapsed to zero in Would possibly perchance 2022, wiping out about $60 billion in payment and triggering a bloody response from the broader crypto market.

More questions about how the USD1 will most certainly be promoted to market

How WLFI will address the anxiousness of reserve transparency stays to be seen. Alternatively, the onboarding of skilled figures within the stablecoin enterprise like Rich Teo suggests WLFI is responsive to the aptitude challenges.

No subject the aptitude upright and regulatory strife, having its bear USD1 stablecoin would possibly perchance perchance supply the World Liberty group big earnings. Take care of banks, stablecoin issuers rake in cash by reinvesting buyer deposits in yield-bearing merchandise like US Treasury funds.

Tether, the company within the succor of USDT, reported a legend $5.2 billion profit within the indispensable half of 2024 alone. Revenue generated from having its bear USD1 stablecoin would possibly perchance perchance enhance World Liberty’s future plans, nonetheless issuing a current stablecoin in an already saturated discipline shouldn’t be any easy job.

It would require deals with high crypto exchanges, equivalent to Coinbase and Binance, to provide the asset available to a aloof swath of customers. Alternatively Binance for the time being has a “strategic business partnership” with First Digital Labs, issuer of the fifth-excellent stablecoin by market capitalization, FDUSD while Coinbase co-problems USDC, the second excellent, alongside with Circle.

Significantly, but every other Trump challenge, the Trump Media and Technology Neighborhood (TMTG) reached a nonbinding settlement with Crypto.com on launching a collection of alternate-traded funds and alternate-traded merchandise (ETFs) on Monday. Alternatively, there changed into no demonstrate of any doable collaboration between the initiatives on any impending stablecoin initiatives.

The importance of stablecoins to the ecosystem has turn out to be apparent within the previous couple of years. They’ve turn out to be the shuffle-to sources for merchants who must retain their funds even while the market fluctuates. They are going to even be used as greenback equivalents in markets where dollars are restricted or inaccessible, making them indispensable bridges between crypto and dilapidated financial markets.