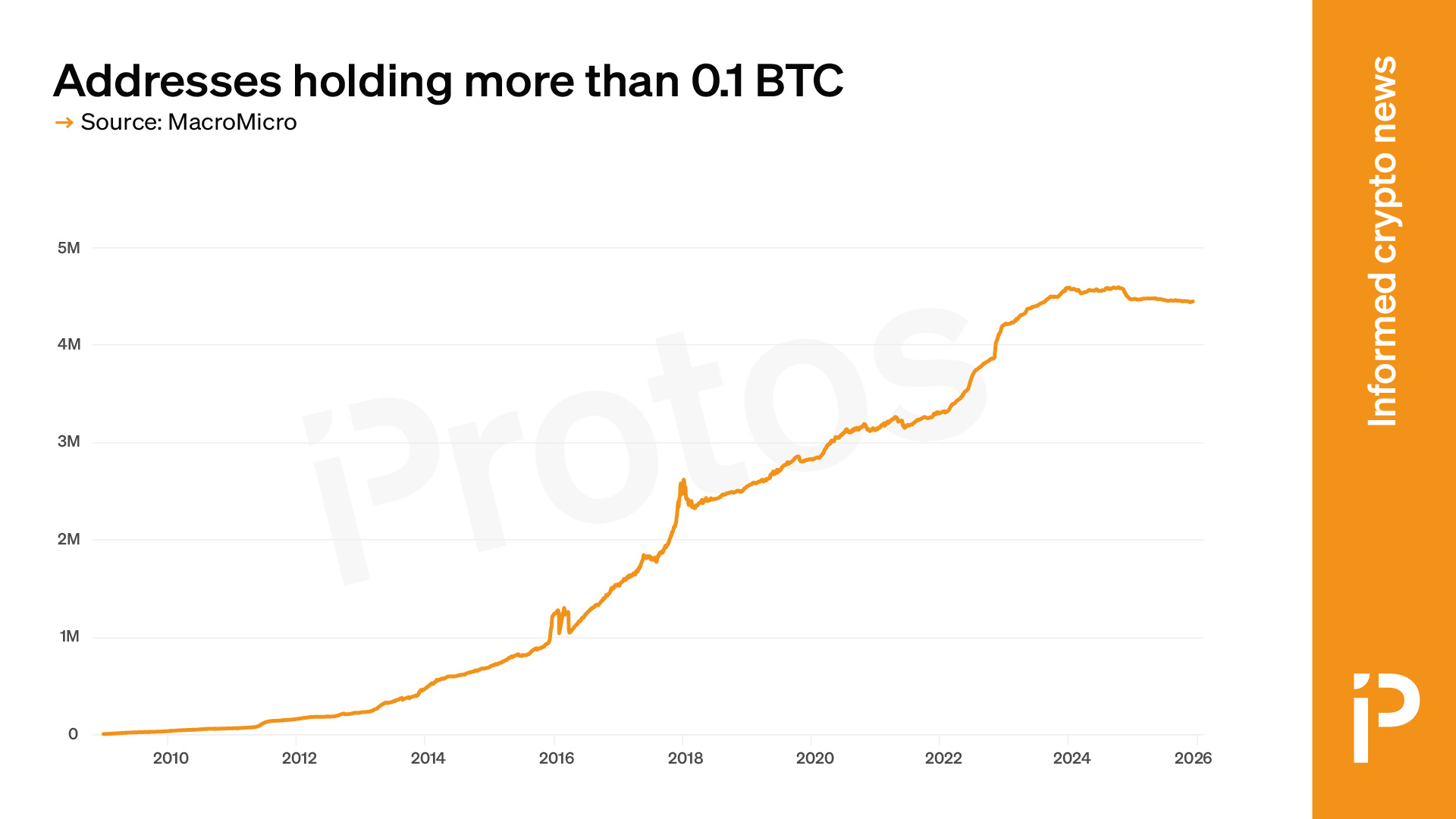

Since the Bitcoin community’s start in 2009, the need of exceptional bitcoin (BTC) addresses maintaining a steadiness increased than 0.1 BTC increased each and each year through 2023.

On the opposite hand, all over the final 24 months, that cohort has been jumpy.

Indeed, since December 8, 2023, the number has declined from 4,548,107 to 4,443,541.

When we chart this metric, we seek that the need of exceptional addresses has risen progressively (regardless of some transient blips lasting a few months), peaking in December 2023.

It plateaued through most of 2024, and then began to stir into this day’s severely ancient, two-year low.

That 2.3% decline is substantially worse than the 0.7% decline in addresses maintaining one-tenth much less (0.01 BTC), indicating much less willingness by patrons to withhold higher balances within single wallets all over the final two years.

There has never been a two-year length throughout which this metric declined previous to this month.

Are there fewer patrons with higher than 0.1 BTC?

On its face, the metric seems to tag a dwindling need of BTC patrons maintaining a few thousand greenbacks value of BTC in a Ledger, Trezor, Coldcard, or linked pockets.

Of course, it’s impossible to resolve whether the voice need of oldsters maintaining decrease than 0.1 BTC has declined or now not.

In this time limit, in stark contrast with the early days of the Bitcoin community, there are thousands of centralized exchanges, ETFs, derivatives, treasury companies, and other financial proxies that grant exposure to the value of BTC.

It’s impossible to disaggregate this commingled BTC on-chain to resolve the amount of holdings per person.

Learn extra: 95% of all bitcoin is now mined and circulating

Unique applied sciences to distribute BTC across addresses

A hardware pockets is the oldest and most stable skill to withhold BTC, nonetheless picks are broadly available. Many patrons, as an instance, utilize ETFs and other trade-traded merchandise that satisfy retirement memoir requirements, now not like pickle BTC.

To boot to the proliferation of BTC proxies, patrons enjoy also got figuring out to the safety practices of unspent transaction output consolidation. They’re the utilize of prolonged public key to distribute holdings into multiple wallets managed by one non-public key, Matryoshka doll-like embedded wallets with decoys for safekeeping, or cryptography like XOR to mix seed phrases from diversified wallets.

All of those safety practices are turning into increasingly extra commonplace, that skill that maintaining a single address with higher than 0.1 BTC is popping into increasingly extra pointless, whatever the dimensions of 1’s funding.

Quiet, tracking this authorized norm over time provides a assorted insight into the behavior of Bitcoin community users.

While patrons needed to proceed to procure orderly balances in single addresses value thousands of dollars through 2023, that style has reversed all over the final two years.