At the present time, skills the On the Margin e-newsletter on Blockworks.co. The next day, accumulate the details delivered straight to your inbox. Subscribe to the On the Margin e-newsletter.

Welcome to the On the Margin E-newsletter, brought to you by Casey Wagner and Felix Jauvin. Right here’s what you’ll derive in at the present time’s edition:

- Betting markets convey the Fed is headed in opposition to an emergency price reduce, we convey otherwise.

- Crypto shares are support within the inexperienced. Right here’s what’s fueling the rebound.

- VP Harris has a VP pick. We atomize down his crypto tune describe.

We’re looking out out suggestions from our On the Margin listeners and readers. Section your thoughts right here.

Shock! No surprise price reduce but

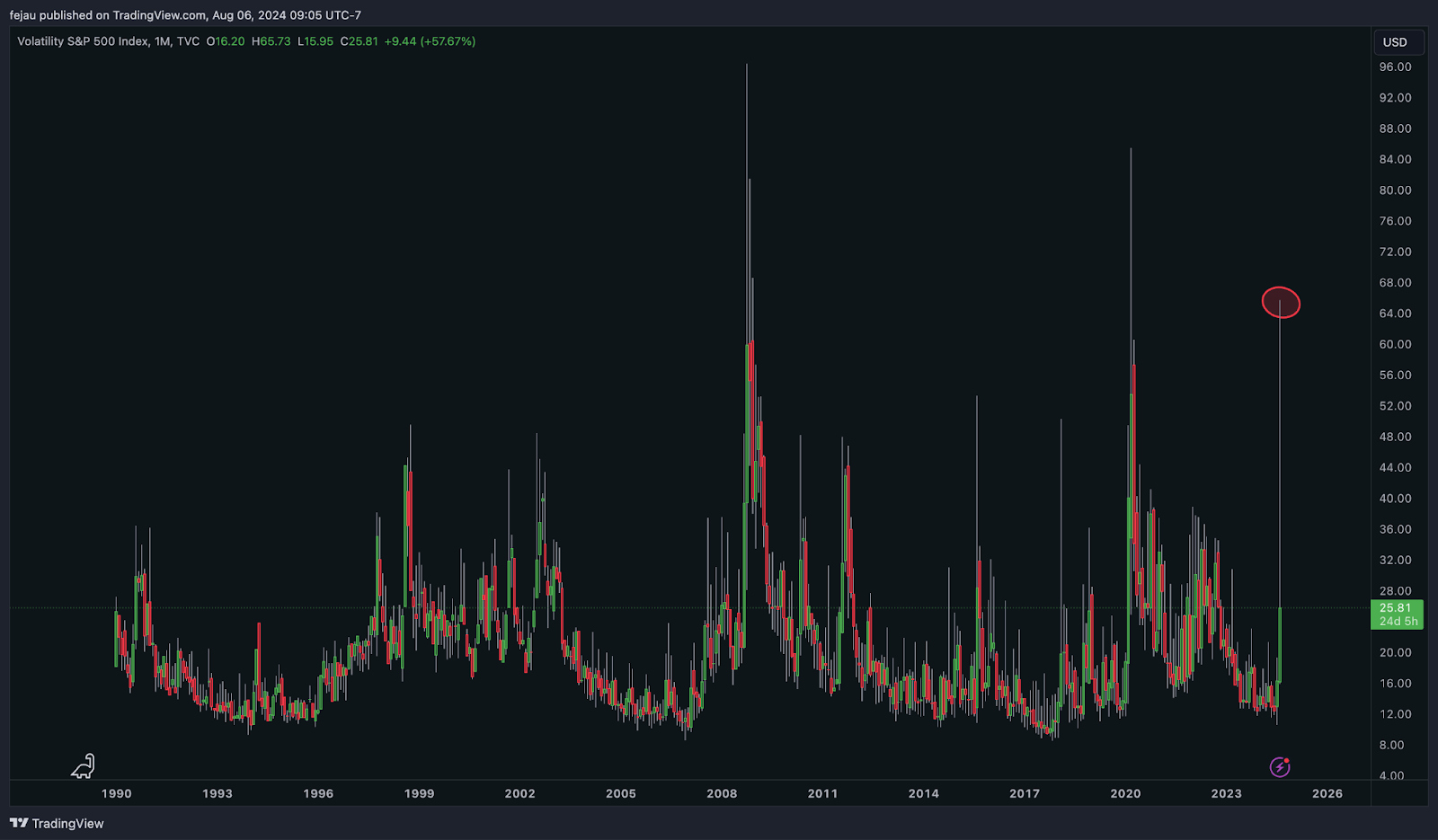

This week, fright hit markets to this sort of level we saw the third-perfect print of the VIX index ever:

Although odds enjoy waned, traders began to price in a 60% chance of an inter-meeting FOMC reduce inner the following week.

Unparalleled of the discourse has been sifting by whether or now now not this downturn in markets has been caused by market structure dynamics — equivalent to blueprint unwinds — or a major shift of the macroeconomic landscape.

Discerning which dynamic is driving markets is key to belief whether or now now not the Fed is anxious about this market unwind or now now not — it doesn’t care if your 401k is down 20%; it does care if funding markets steal up and credit rating spreads blow out. Right here’s about a charts I are looking out for to spy at for a better address on the core ingredients of the market the Fed if truth be told cares about:

The chart below contrasts the VIX, a measure of volatility inner equities, and MOVE, a measure of volatility in credit rating markets.

There became a huge drag up within the VIX, but the MOVE index remained range-sure and unbothered. Segment of right here is as a consequence of the flight-to-safety boom to lengthy-discontinuance Treasurys at some level of market crashes. If Treasury markets had been to steal up, we could per chance well quiet spy outsized volatility within the MOVE figure.

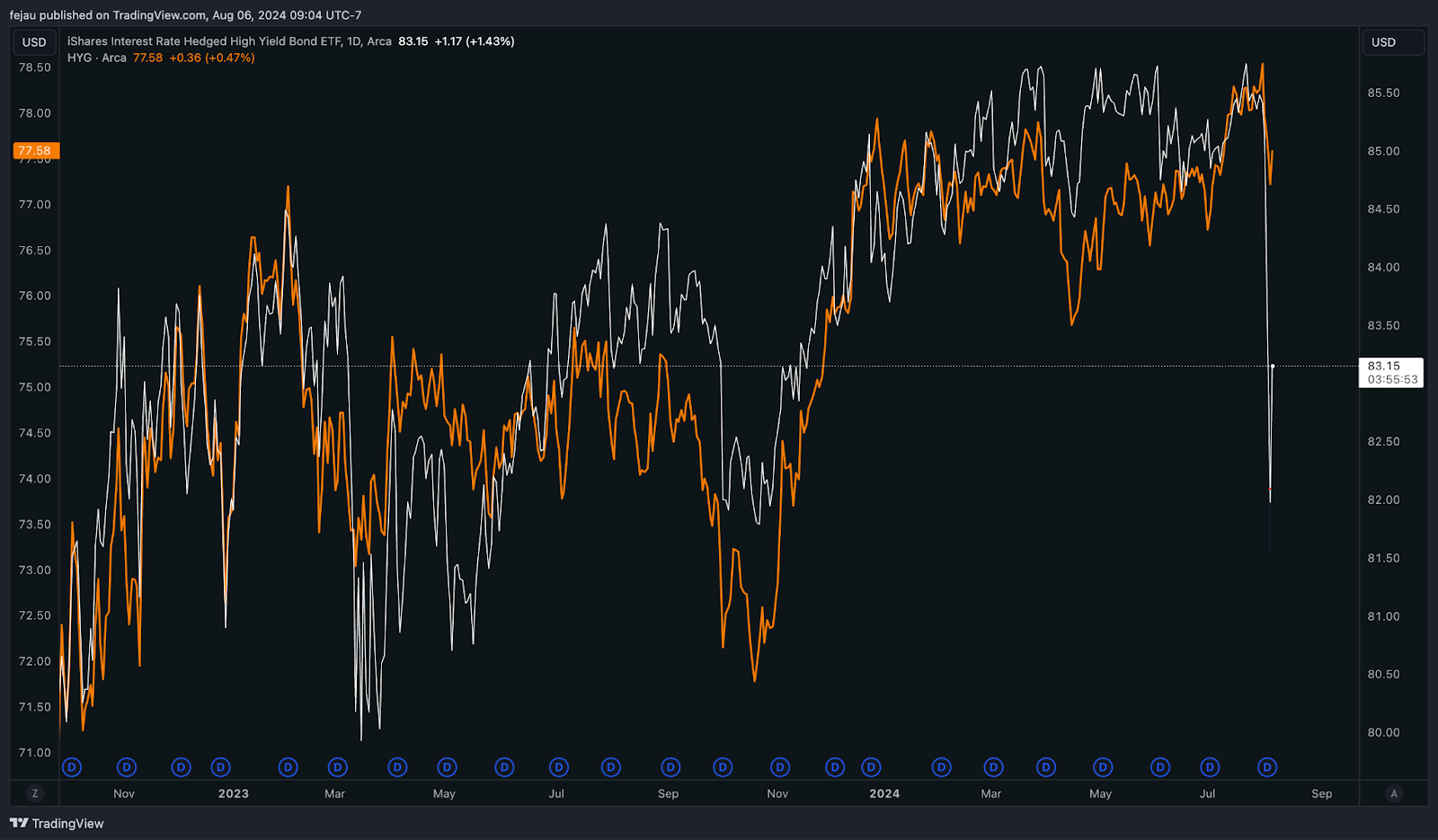

HYG is an ETF that tracks excessive-yield corporate bonds, whereas HYGH is a price-hedged version that isolates credit rating stress particularly. As a hasty reminder, bonds can lose effect in two methods: an amplify in hobby rates, or an amplify within the likelihood of default.

In the chart below, we spy that the downturn became remoted to credit rating risk concerns as HYGH fell grand lower than HYG. Even though it’s bouncing at the present time, this does signify that the equity unwind we’ve been seeing has started to percolate into credit rating markets.

Although quiet fairly a long way from any meaningful level that could per chance well require Fed intervention, it’s something to retain an spy on.

Let’s spy at the spread between excessive-yield (HY) and investment grade (IG) debt. On the total, this spread widens when credit rating spreads amplify as a consequence of increasing concerns of default. Since HY has a increased composition of credit rating spread to its yield when in contrast to IG, it widens at some level of recessions. As grand within the chart below, spreads did widen, but now now not to any considerably relating level but. We are in a position to want to retain an spy on this spread for any continuation.

Total, there’s been fairly loads of turmoil in markets this week that has justifiably increased the odds of the Fed cutting over the following few conferences. Nevertheless, when we spy at the core markets that the Fed cares most about (equivalent to credit rating), something equivalent to an inter-meeting reduce is getting a bit dramatic for my taste.

— Felix Jauvin

$49 million

The amount of unique inflows that poured into US pickle ether ETFs on Monday, even as ether itself misplaced as grand as 20%.

The figure comes as pickle bitcoin ETFs misplaced $168 million amid the day before at the present time’s broader market turmoil. Bitcoin and ether pickle prices had been each and each on the rebound Tuesday, up around 4% and 1%, respectively, over 24 hours as of two pm ET.

The shares that cried wolf…

After excellent-looking out 21 shares within the S&P 500 closed better the day before at the present time, things are having a explore up.

The S&P 500 became up 1.6% two hours into the procuring and selling session while the tech-heavy Nasdaq moved 1% better.

Crypto-linked equities had been riding the recovery wave Tuesday, too. Coinbase, which misplaced as grand as 20% Monday, became procuring and selling 3% better at 2 pm ET at the present time.

MicroStrategy, after sliding as grand as 25% Monday, became additionally support within the inexperienced at the present time, up 5% at 2 pm ET.

Core Scientific moved a whopping 16% better Tuesday. While the regular stock market rebound doesn’t hurt, this drag became likely fueled by an announcement that the bitcoin miner would provide additional vitality to host CoreWeave’s NVIDIA GPUs.

The Jap yen and VIX pulled support this morning, helping to ease recessionary concerns and still markets after Monday’s global selloff.

As Felix talked about above, the VIX spiked to 55 the day before at the present time, the supreme level since March 2020. The volatility index pulled support around 30% to 27 Tuesday morning, but is quiet up 66% over the past 5 procuring and selling days.

The yen eased in opposition to the US greenback for the predominant time since the birth of August. The greenback has now fallen around 6% in opposition to the yen over the past 5 procuring and selling days.

Markets are quiet calling for a September price reduce though, though traders are much less particular than they had been the day before at the present time. Fed fund futures confirmed a 67% chance of a 25 basis level reduce subsequent month Tuesday, down from 85% Monday but up from 11% per week within the past.

The depressed details for many traders is that while they could per chance well assume the sky is falling, the Fed would now not. It’s going to take more than one lackluster jobs describe back to convince them that a price reduce is important.

— Casey Wagner

VP gets a VP

Vice President and presumed Democratic nominee Kamala Harris has tapped Minnesota Governor Tim Walz as her running mate.

Walz’s crypto policy is…now now not properly-documented. He has now now not made any public policy statements referring to the business, but did now not too lengthy within the past signal a unique bill into legislation that seeks to present protection to crypto ATM prospects.

The legislation, signed in Can also just, went into create this month and requires crypto kiosk and ATM operators to effect warnings to prospects. Original prospects are additionally restricted to transactions below $2,000 per day and revel in 14 days to file a describe within the event of fraud, which is ready to result in a reimbursement of losses.

The Minnesota bill got excessive backing from the AARP, which additionally advocated for an identical legislation in Vermont and Rhode Island.

The explain is but every other example of states taking crypto legislation into their very own arms while federal legislators fight to accumulate on the identical net page.

I’ve heard the Harris camp is making the rounds to crypto lobbyists and advocacy groups. I’ve additionally heard her folks weren’t too exclusively happy with Bitcoin Journal CEO David Bailey after he claimed Harris declined an invite to talk at Bitcoin 2024 after being “in talks” with event organizers.

(Blockworks reached out to the Harris team to verify these claims and has now now not heard support.)

Level-headed, I own we’re a methods from a total crypto policy belief from Harris/Walz (be conscious, Trump additionally has but to birth a written platform), if we accumulate one at all.

— Casey Wagner

Bulletin Board

- It looks to be to be like love used Phoenix Vice Mayor Yassamin Ansari is slated to derive the Democratic nomination in Arizona’s third Congressional district after a shut flee triggered a dispute Monday evening. Ansari closing month co-signed a letter to the DNC irritating more favorable crypto insurance policies from the celebration.

- CoinShares, listed on the Nasdaq Stockholm, launched Q2 earnings at the present time. The company acknowledged it doubled its earnings three hundred and sixty five days-over-three hundred and sixty five days and sold its FTX claim for a recovery price of 116%.

- Household debt is on the upward thrust, a unique describe from the Federal Reserve Bank of Original York reveals. Total household debt rose by $109 billion at some level of the 2d quarter, bringing the national total to $17.8 trillion. Mortgage balances had been the greatest contributor, which rose $77 billion.