This day, revel in the On the Margin e-newsletter on Blockworks.co. The following day, web the knowledge delivered in an instant to your inbox. Subscribe to the On the Margin e-newsletter.

This day’s On the Margin Newsletter is brought to you by the Canadian engaged on this holiday, Felix Jauvin. Blissful Fourth of July!

This day’s shortened edition will dive into the predominant takeaways from the Federal Launch Market Committee’s minutes launched the day gone by.

June’s FOMC scoop

As usual, the free up of final month’s FOMC meeting minutes on Wednesday provided a veteran see at how committee contributors came to the selections they made in June.

Whenever you rewind the clock, it is seemingly you’ll possibly well very wisely be conscious that the final FOMC day used to be a weird one as we obtained the most up-to-date CPI readings most efficient just a few hours sooner than the true meeting final consequence used to be launched.

Inflation came in soft and led many to make investments how noteworthy of that print used to be baked into their resolution-making direction of.

So, I dug into the trivialities of the minutes. Here’s some critical things I figured out fascinating:

Conflicting inflation prints

Some participants principal that no matter a major decline in inflation in some unspecified time in the future of the second half of 2023, there had been less progress than in early 2024. The Might well also CPI reading provided some evidence of (modest) additional progress, with month-to-month adjustments indicating enchancment across varied imprint classes, including market-primarily based entirely entirely products and companies.

AI productivity gains

For the first time, the FOMC acknowledged the aptitude for AI to be a boon to productivity and work as a deflationary power:

“Contributors highlighted a quantity of components that had been prone to assist make contributions to continued disinflation in the length ahead… or the prospect of additional present-aspect improvements. The latter prospect included the probability of a enhance to productivity connected with companies’ deployment of artificial intelligence–connected technology.”

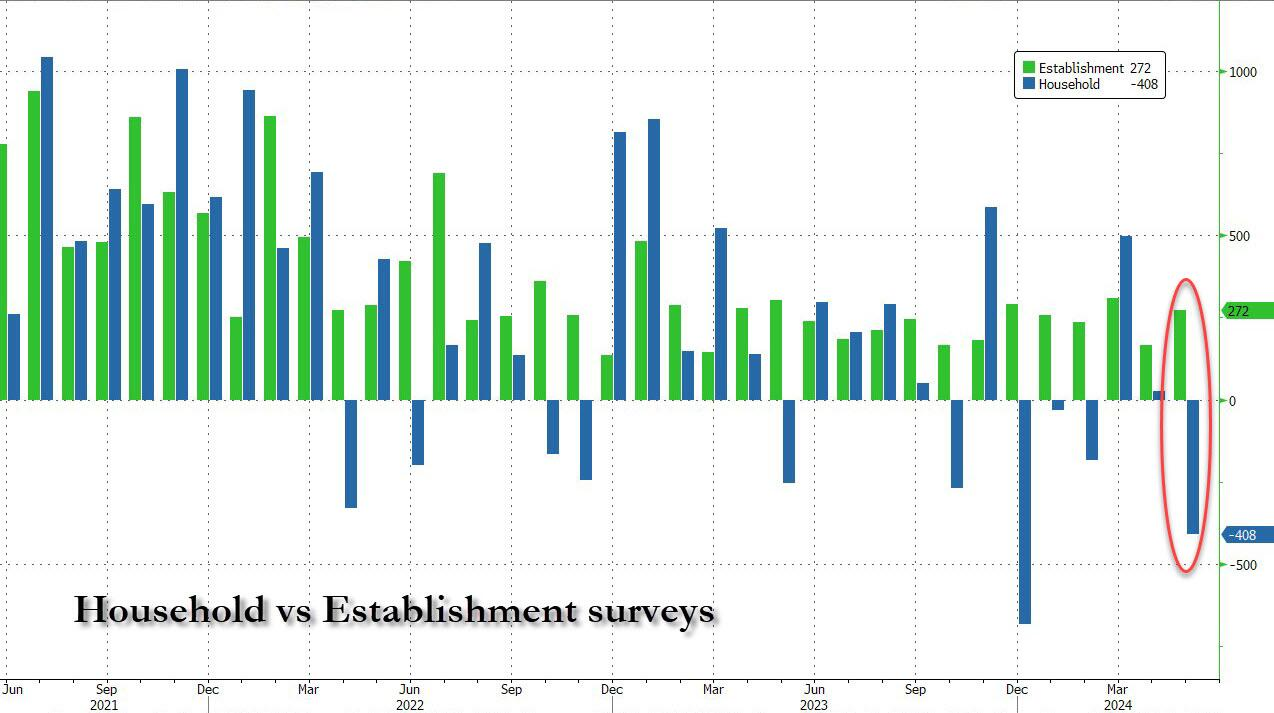

Broken labor surveys

There’s been a good deal of discuss how the institution peep has been overstating jobs gains compared to the family peep. Historically, the two are a ways more in line than they had been since 2022:

Interestingly, FOMC contributors are starting up assign to acknowledge that jobs gains could possibly well be overstated: “Several participants additionally instructed that the institution peep could possibly well contain overstated true job gains.”

Here’s fascinating. It’s very uncommon to be conscious FOMC contributors acknowledge that they’ve been attempting at knowledge that will possibly well be inaccurate. Extra, it will mean that they’ve been more hawkish on the labor market than they will aloof had been. This, paired with the dynamic that most job gains had been within piece-time jobs even as the economy retains losing plump-time jobs, could possibly well mean that the labor market is loads chillier than they thought.

Total, these FOMC meeting minutes instruct an old-usual standpoint on the economy that will not be any longer as connected. Significantly correct now when it feels admire we’re present process a bit of of a regime shift in the economy. That acknowledged, I aloof figured out it in total dovish via what they had been attempting at and discussing, in particular in light of the entire soft financial knowledge we’ve obtained since.

Have a large lengthy weekend all! We’ll talk on Monday.

— Felix Jauvin