Welcome to the On the Margin Publication, brought to you by Ben Stack, Casey Wagner and Fexlix Jauvin. Right here’s what we unpack in our inaugural model:

- The European Central Financial institution has led the fee-cutting payment, at the same time as the inflation fee in all places in the pond stays high. Will the Fed hold a page from its e book day after as of late?

- Discover why more companies are procuring for bitcoin for their treasuries (hint: everyone needs an inflation-proof asset).

- Wednesday is a pleasant day with CPI figures losing in the morning and the FOMC wrapping in the afternoon. Care for studying to know what analysts are announcing and what are trying to be anticipating.

World fee-cutting season

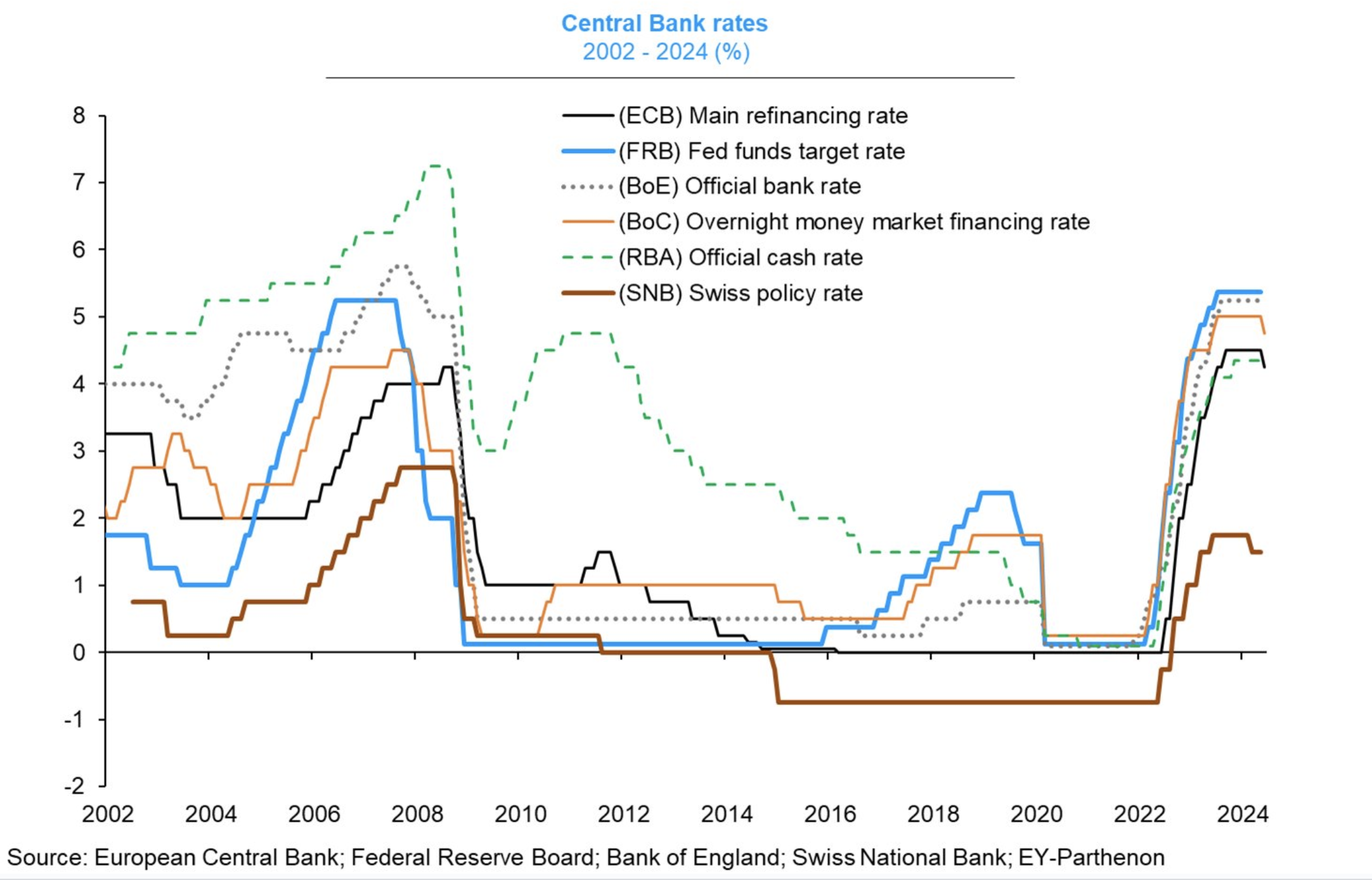

This week marked the initiate of the world fee-cutting cycle, with the Financial institution of Canada and the European Central Financial institution leading the payment.

The Financial institution of Canada kicked issues off final Wednesday, slashing the overnight fee by 25 basis capabilities and suggesting that as lengthy as inflation continues to tumble, more cuts would possibly per chance presumably apply. The very subsequent day, the ECB followed swimsuit, also cutting charges by 25 bps.

On the opposite hand, the ECB took a more hawkish stance on future cuts, citing power high inflation and ruling out extra cuts in the strategy-time length. Simultaneously, the ECB raised its inflation forecast by 0.2% for 2024 and 2025.

The timing is extremely though-provoking. In total, higher inflation forecasts would lead to more hawkish insurance policies. Some argue that the ECB, having painted itself into a corner, felt compelled to slice aid charges to quit accurate to its forward guidance despite rising inflation. This transfer, they argue, presentations the ECB’s accurate concerns.

On the diverse hand, there’s a compelling argument that the ECB has overtly acknowledged a valuable bother. In a world pressured with high debt-to-GDP ratios, high pastime charges develop monetary machine fragility by channeling an even bigger half of incomes toward debt servicing. This complicates monetary protection, as letting charges upward thrust naturally would possibly per chance presumably inflict severe economic bother.

A technique to tackle this is by maintaining pastime charges low and allowing inflation to exceed targets for an prolonged length — a strategy identified as monetary repression. This strategy reduces debt-to-GDP ratios and lets in the economic system to deleverage with out the merciless effects of austerity. The downside is foreign money devaluation and diminished buying energy, notably for savers conserving sovereign debt with returns below inflation charges.

Financial repression works till inflation spirals out of adjust, forcing central banks to undertake aggressive tightening measures (as considered in 2021 when the Fed shifted from downplaying inflation to rapidly fee hikes), or till public discontent with inflation outcomes in societal pushback in opposition to the protection.

Occam’s razor suggests the ECB’s fee slice aid would possibly per chance furthermore merely be a one-off transfer, pushed by its old guidance. On the opposite hand, the speculation of enterprise repression shouldn’t be brushed aside as history presents rather a couple of examples, corresponding to put up-World Battle II economic insurance policies.

As we head into this week’s FOMC meeting and CPI unlock — each and every scheduled for the identical day — it’s worth alive to about.

— Felix Jauvin

19

The selection of buying and selling days in a row US space bitcoin ETFs collectively notched gain inflows — sooner than that file shuffle for the section ended Monday.

These products have now been reside for 5 months, to the day. The class saw gain cash stir in on 72 of those 104 days (a practically 70% clip).

The very most attention-grabbing bitcoin ETF, BlackRock’s iShares Bitcoin Belief (IBIT), has tallied gain inflows on 91 days — making it stir with the circulation-particular 88% of the time. IBIT changed into once managing $21.2 billion in resources as of Monday.

Whole gain inflows for the 10 space BTC funds tracked by Farside Traders stand at $15.6 billion. That comes even with the Grayscale Bitcoin Belief ETF (GBTC) seeing $18 billion worth of investor capital exit the fund.

BTC on more balance sheets

More companies are hoarding bitcoin for their treasuries — a tactic made famed by Michael Saylor-led MicroStrategy.

Whether these companies look to emulate MSTR, use a gimmick to develop their half build or if truth be told factor in in BTC, the macro landscape makes the resolution less taboo than possibly it once changed into once.

Saylor’s alternate intelligence-slash-instrument firm started stashing bitcoin in 2020. Its pile grew to 214,400 BTC as of April 26 — worth $14.3 billion on Tuesday morning.

Tesla in 2021 bought $1.5 billion of bitcoin “to extra diversify and maximize returns on our cash,” it said in an SEC filing. The firm held $184 million of digital resources on its balance sheet as of March 31.

MicroStrategy stock is up 118% 300 and sixty five days thus a ways. This “wildly successful” proof of theory has shown others it will also be a prudent procedure to return worth to shareholders, great Swan Bitcoin evaluate analyst Sam Callahan.

Then there’s the unusual FASB accounting guidelines, which obtain it more uncomplicated for companies to hold bitcoin on their balance sheets.

And so we saw Jap investment agency Metaplanet look to become Asia’s MicroStrategy in April. Scientific tech firm Semler Scientific bought $40 million of BTC final month and DeFi Technologies moral this week published its aquire of 110 BTC.

“I inquire this model to become in vogue as inflation continues to erode the buying energy of cash and cash-like equivalents, leading companies to perceive doable decisions,” Callahan said.

ProChain Capital President David Tawil said he doesn’t think companies like Semler or DeFi Technologies are necessarily taking a look to be a “MicroStrategy junior” — noting there seemingly isn’t room in the marketplace for that. Rather, they’re the use of BTC for worth appreciation, notably on this macro surroundings.

Particular, the earlier adopters of this maneuver would be companies with less to lose. But bigger, more “severe” gamers tend to in the waste leap aboard, Tawil suggested Blockworks.

He added: “And then we’re off to the races.”

— Ben Strack

Overjoyed CPI Report AND Fed Day Eve!

The following day is a gigantic day. We obtain Might well unprejudiced’s CPI file in the morning sooner than the market opens; then the Fed will unlock its pastime fee resolution and projections prior to its discontinuance.

First, let’s hold a have a look at the historical affect on equity costs throughout an FOMC week. As DataTrek Be taught founder Nicholas Colas identified, there has been a shift recently.

From 1994 to 2011, the S&P 500’s entire yearly return came in the three days surrounding FOMC meetings. That model is, unnecessary to utter, lengthy unnecessary. In the previous 18 months (throughout which there were 12 FOMC meetings), the S&P 500 has most attention-grabbing gone up spherical half of the time between Monday and Thursday of Fed weeks.

But starting a Fed day with a CPI print provides a relaxing twist.

Analysts from JPMorgan are calling for Might well unprejudiced’s month-over-month settle to enlighten a roughly 0.3% develop in costs, which must have minimal affect on markets. UBS analysts are equally trying forward to the annual inflation settle to return in discontinuance to the final read of 3.4% recorded in April, which must peaceable be sufficient to persuade traders that costs are genuinely trending lower.

Either formulation, the affect of the CPI file will be quick-lived. No subject Jerome Powell says in the afternoon — and what the projections enlighten — will reply the main ask a CPI file continuously raises: what does this mean for pastime charges?

— Casey Wagner

Bulletin Board

- All’s successfully after Wells secret agent? No subject months of regulatory headwinds, crypto companies are remaining resilient, Consensys lawful chief Invoice Hughes said.

- Fidelity World joined JPMorgan’s Tokenized Collateral Network (TCN), the companies announced Monday. Fidelity World tokenized shares of its cash market fund by TCN, which is constructed on Onyx, JPMorgan’s inner most blockchain community.

- Lawful in time for Roaring Kitty’s most standard market-transferring comments, a brand unusual e book on the WallStreetBets subreddit is here. Read the Blockworks overview from concept editor Molly Jane Zuckerman here.