This day, skills the On the Margin newsletter on Blockworks.co. The following day, fetch the news delivered immediately to your inbox. Subscribe to the On the Margin newsletter.

Welcome to the On the Margin Newsletter, delivered to you by Ben Strack, Casey Wagner and Felix Jauvin. Here’s what you’ll rating in on the present time’s edition:

- Every person says they need rate cuts, nevertheless what would possibly well even they imply for shares?

- Crypto ETF “price wars” establish headlines, though the jury is out on how powerful investors if reality be told care.

- Fed Chair Jerome Powell began his Congressional rounds this morning. Here’s how markets reacted.

Are rate cuts bearish?

A week never passes without seeing any individual philosophize with absolute certain bet that the FOMC slicing the Federal Funds Payment (FFR) is bearish for difficulty sources.

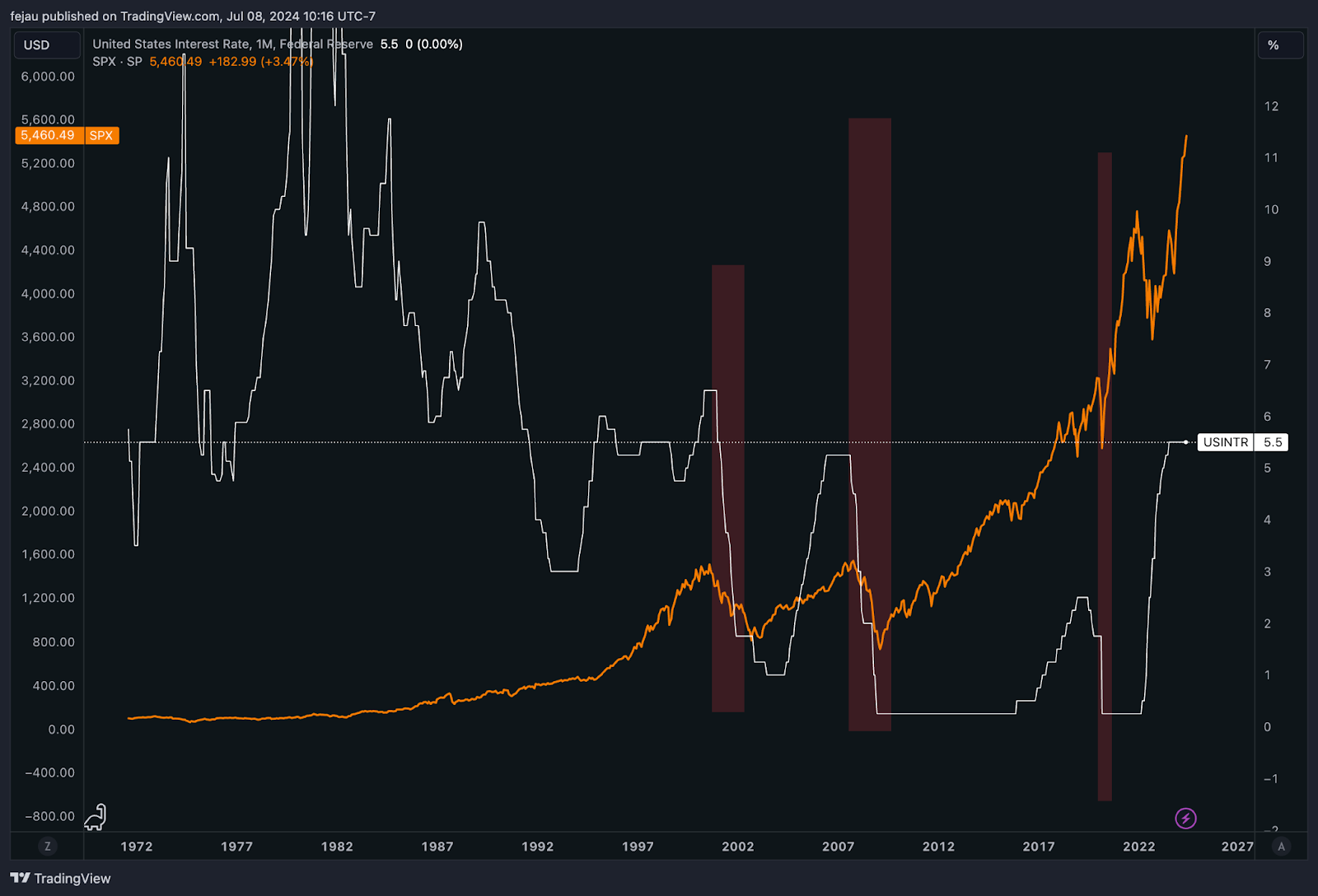

Riding that analysis is a simplistic study evaluating the associated price action of equities around the time the Fed starts slicing rates:

On the surface, it seems obvious! Clearly at any time when the Fed starts a predominant slicing cycle, equities tumble. Factual look on the obvious dot com smash, 2008 monetary disaster or the COVID smash as proof aspects, they are saying!

The validity of this solution is rather more nuanced than what a transient flee of a chart would possibly well even infer. At the core of figuring out whether rate cuts are bearish for equities or now now not is the requirement to discern the two kinds of rate cuts that exist: the normalization minimize versus the horror/recessionary minimize.

Normalization minimize

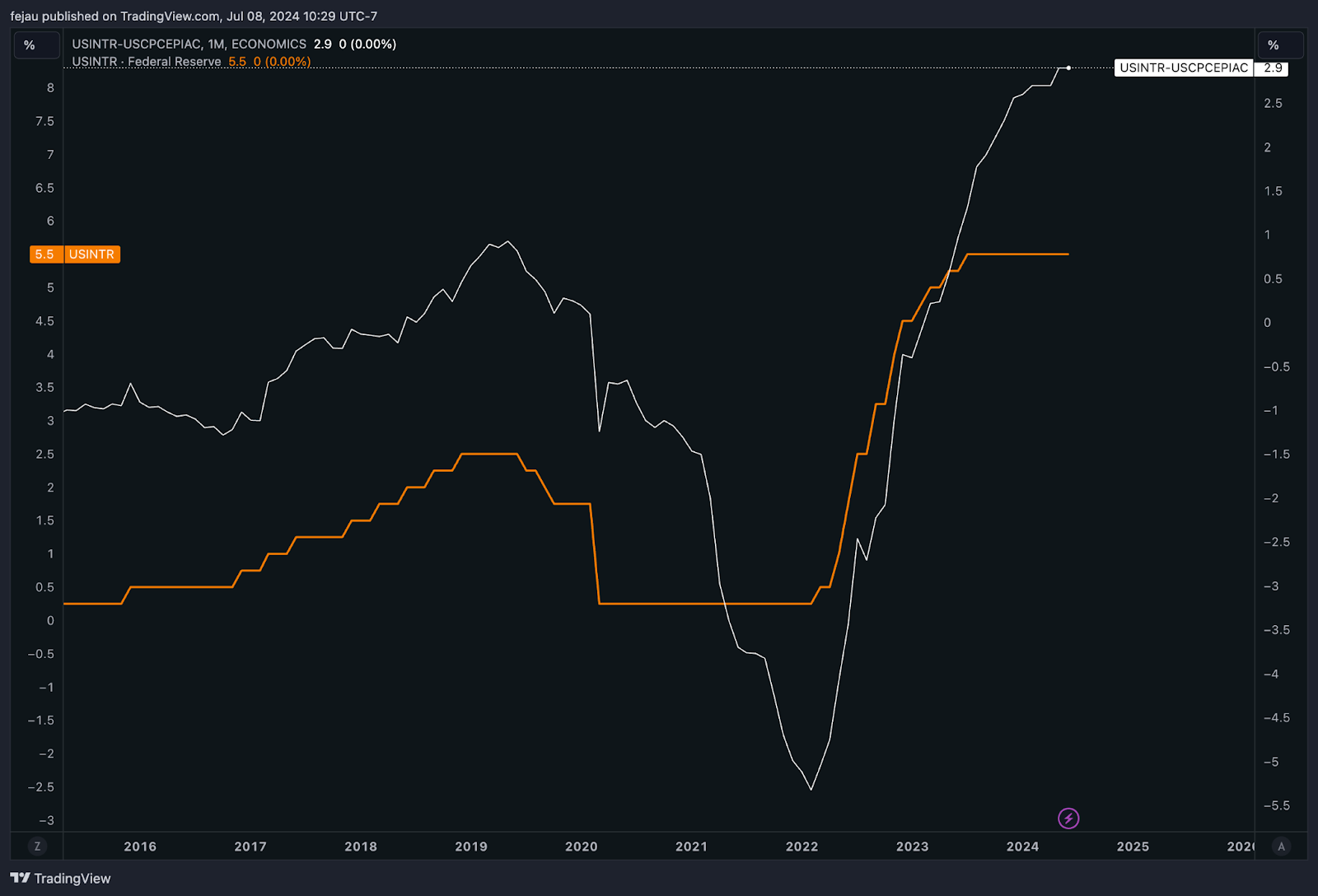

To perceive what drives a “normalization” minimize, or now now not it’s important to delight in actual rates. Precise Federal FFR is the nominal FFR minus inflation. For the reason that Fed makes a speciality of Core PCE, let’s exhaust that as our inflation metric.

If we study this chart, we explore that despite FFR (orange) having been held flat for a 365 days now, actual FFR (white) has if reality be told persisted to raise, which is organising more tightening on the economic system on a actual foundation. What provides?

Successfully, inflation has been on a accurate decline for a whereas now. And since inflation is subtracted from nominal FFR to fetch actual FFR, as inflation has declined, actual rates have faith increased.

This dynamic manner that for the Fed to put the same stage of restrictiveness as a 365 days within the past, central bankers must minimize rates to remain in line. Here is a normalization minimize and has nothing to again out with slicing rates to ease monetary stipulations and stimulating the economic system correct through a recession. The final time this took place became in 2019 sooner than COVID, when Chair Powell launched a “mid-cycle adjustment” rate minimize.

Recessionary minimize

Here is the more neatly-understood and established create of rate minimize where the FOMC like a flash and aggressively cuts rates because of the concerns about a recession or monetary disaster. The 2008 gigantic monetary disaster and the 2020 COVID smash are particular examples of this.

Merely put, the Fed is making an strive to stimulate the economic system to diminish the pains incurred from a recession. These fashion of cuts are frequently reactions to a smash that’s already going on and subsequently usually coincidentally bearish.

Difficulty minimize

At final, there are the horror cuts. These occur when an idiosyncratic event (usually of a geopolitical or monetary balance nature) triggers the Fed to ease. All over these cases, the economic system is now now not basically contracting. Normally, a catalyst happens that would possibly well even pose recessionary and monetary balance dangers, which makes the Fed like a flash and like a flash minimize rates.

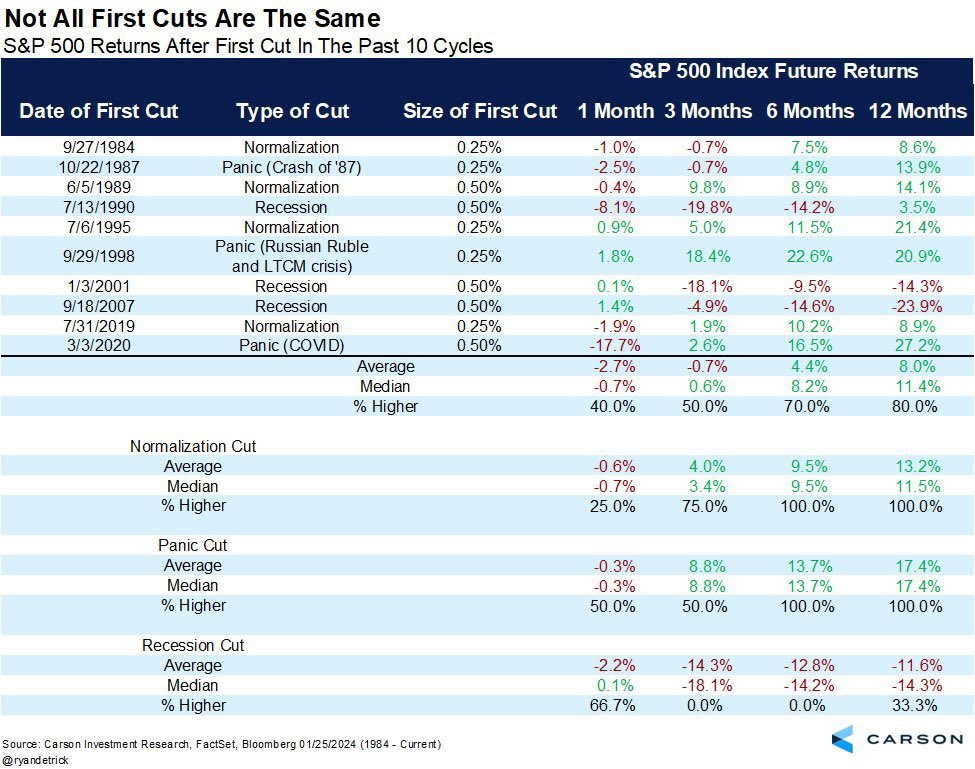

Empirical analysis of completely different kinds of cuts and their subsequent impact on equity indexes is shown below:

Clearly, normalization cuts (and even horror cuts) are now now not bearish catalysts. Rather the reverse. It’s easiest the recession cuts, where the Fed is making an strive to stave off a despair, that result in decrease equity costs.

As it stands on the present time, the economic system is slowing nevertheless restful rising, with the Atlanta Fed forecasting a 1.5% actual GDP boost rate for this quarter. Unemployment is growing bigger nevertheless is restful secularly low at 4.1%. We are restful far-off from any create of recessionary situation, which makes me deem that any doable upcoming rate minimize will seemingly be a normalization minimize, now now not a recessionary one.

— Felix Jauvin

233

The selection of crypto asset firms (of 344 full) which have faith withdrawn applications to arrangement within the UK since 2020, in conserving with records from the Monetary Conduct Authority. That’s in level of truth two-thirds of them.

Thru crypto legislation, the Crypto Council for Innovation estimates the UK is as a minimal 18 months within the again of the EU. As we wrote the day old to this, the UK’s most original overall election outcomes would possibly well even easiest extend extra growth as the Labour Celebration establishes its priorities.

Will ETH ETF charges even topic?

Many of the revised ether ETF S-1s came within the day old to this, as anticipated.

Contributors of the crypto/TradFi crowd on X (on the side of this reporter) had been on alert, ready to search if more issuers would fraction the planned designate aspects.

I reported in my posts that…neatly…there wasn’t powerful to file.

Easiest the planned product jointly filed by Invesco and Galaxy published a price we didn’t know about previously. The firms are region to cost a 0.25% sponsor price — a shrimp little bit of bigger than the 0.19% and nil.20% marks shared by Franklin Templeton and VanEck, respectively, in prior filings.

BlackRock, Constancy, Grayscale and others chose to now now not yet clarify their cards. These small print will seemingly come of their finalized S-1s, anticipated very soon.

We watched the “price warfare” carry form when US region bitcoin ETFs launched in January. Nonetheless now we ask how powerful the charges if reality be told topic.

ETF.com analyst Sumit Roy acknowledged distribution and tag establish will topic bigger than small price differences. A much bigger incompatibility — akin to 10 or 20 foundation aspects — would seemingly have faith more of an impact on investor alternative, he added.

“BlackRock and Constancy have faith unprecedented advantages, which they’ll exploit, nevertheless there is room for smaller issuers love Bitwise to form a foothold within the condominium as neatly with low charges and unfamiliar angles,” Roy told Blockworks.

The bottom US region bitcoin ETF price — with the exception of preliminary price waivers — became Franklin Templeton’s, at 0.19%. The agency undercut Bitwise’s 0.20% price a day after the funds launched.

Nonetheless Franklin Templeton’s BTC fund has attracted upright $345 million of earn inflows after six months on the market. The Bitwise Bitcoin ETF (BITB) has brought in about $2.1 billion.

Funds by BlackRock and Constancy lead flows within the class, with $17.9 billion and $9.4 billion, respectively. Each cost a moderately bigger 0.25%.

Essentially the most pricey fund by far — the Grayscale Bitcoin Trust ETF (GBTC), at 1.5% — has endured nearly $18.6 billion of earn outflows.

Enterprise watchers proceed to show screen what Grayscale would possibly well even cost for the “Mini” versions of GBTC and its Ethereum Trust (ETHE).

The underside line: Sign isn’t the entirety. And yet, we are able to’t abet nevertheless want to know.

— Ben Strack

So, carry out banks retain a watch on themselves?

Federal Reserve Chair Jerome Powell looked sooner than the Senate Banking Committee Tuesday morning to kick off his two-day Capitol Hill tour.

The hearing went as anticipated for the principle 90 minutes or so, with lawmakers asking about growth on inflation and when central bankers would bring down interest rates. Powell, as in fashion, became vague about any timeline — reiterating that extra records can be wanted sooner than any policy adjustments.

“This day [I’m] now now not going to be sending any indicators regarding the timing of any future actions,” Powell acknowledged.

The dialog got a shrimp bit spicier when Sen. Elizabeth Warren opted to take a look at Powell within the brand new seat for her distributed five minutes.

Here’s a snippet of their alternate:

Warren: Chair Powell, within the six and a half of years attributable to you acknowledged, ‘Trust the banks to administer themselves,’ how most of the 10 greatest banks have faith put insurance policies in converse to extend annual bonuses for this broader group of serious workers whose difficulty-taking would possibly well even endanger the monetary institution?

Powell: I don’t know namely. My bet is all of them.

Warren: You suspect 10 out of 10? The answer is zero out of 10.

Powell: I doubt that.

Warren: Successfully, return and look, attributable to we’ve regarded at their statements on this.

The two then got into it over whether or now now not Powell if reality be told acknowledged, “Let the banks retain a watch on themselves.” (Spoiler: Powell thinks he became taken out of context.)

The Fed maintains that mountainous monetary institution capital reserve requirement tips must restful now now not raise powerful, Powell reiterated. The distinctive proposal issued final July suggested requirements raise to twenty% of invested sources.

Despite the fireworks, equities and cryptos alike regarded screech with the hearing overall — as a minimal before the entirety. Bitcoin and ether received as powerful as 5% every correct during the principle couple hours, whereas the S&P 500 and Nasdaq Composite indexes posted early beneficial properties of roughly 0.4%.

All the pieces slipped later within the session, even supposing bitcoin and ether had been ready to put some momentum. The crypto sources had been up 2.2% and a pair of.4%, respectively, at 2 pm ET (from 24 hours prior).

The S&P 500 and Nasdaq had been also up a shrimp little bit of — inching 0.1% and nil.08% bigger, respectively, for the time being.

— Casey Wagner

Bulletin Board

- Crypto got a degree out within the GOP’s 2024 platform documents launched Monday. “Republicans will stop Democrats’ unlawful and unAmerican Crypto crackdown and oppose the introduction of a [CBDC],” it states. Whereas crypto-connected legislation has received some bipartisan toughen unbiased now now not too prolonged within the past, more Republican Congress members have faith traditionally voiced toughen for the sector (as a minimal publicly.)

- Cboe on Monday filed what are identified as 19b-4 proposals for the solana ETFs previously planned by VanEck and 21Shares. This step prompts the SEC to acknowledge the filing by publishing it within the federal register, at which time a 240-day clock starts for the agency to rule on the merchandise. March 2025 drama, anyone?

- Used Valkyrie Investments CEO Leah Wald is now the president and chief govt of Toronto-basically based completely completely crypto investment agency Cypherpunk Holdings. She seeks to pressure innovation on the company by “expanding its investment portfolio,” she mighty in an announcement. Compare blockworks.co for a Q&A with Wald regarding the brand new role and the broader crypto condominium.