Per the 2024 document by ChainPlay, an organization specialized within the prognosis and evaluate of blockchain projects, the GameFi sector is speculated to be in huge anguish.

Per the findings, 93% of the projects on this niche possess failed, with a median decline of 95% from their all-time highs. A crammed with 3,200 case be taught were analyzed.

Even investments within the sphere possess no longer been notably winning, inserting buyers on alert about its future within the GameFi panorama.

The final small print below.

Abstract

ChainPlay be taught 3,279 projects within the GameFi sector

ChainPlay, a correctly-identified company within the crypto world, has fair as of late publicly released its document on the fresh say of the GameFi substitute in 2024.

This sector, because of a hybrid between the sphere of gaming and that of decentralized finance, appears to be like to be going through a section of large disaster.

After main the upward thrust of cryptocurrencies in the end of the undergo market of 2022, attracting billions of greenbacks in investment, the GameFi panorama now appears to be like deal worsened.

Earlier than delving into the center of the topic, we demonstrate the methodology undertaken by ChainPlay in its be taught work.

A crammed with 3,279 plenty of blockchain recreation projects had been analyzed, thanks also to the collaboration of the associate company Storible.

The guidelines on the worth of the respective mission tokens comes from Dune Analytics, whereas the user recordsdata is obtained from DappRadar.

A mission is defined as “ineffective” if the worth of the respective token has fallen by bigger than 90% from its all-time high and/or has fewer than 100 active users per day.

The advent date of a mission’s token and the date on which it began to meet the aforementioned criteria determine its duration.

The guidelines regarding to the return on investment for venture capital and the annual fundraising recordsdata come from an inner database with a couple of recordsdata sources.

All recordsdata were unruffled in November 2024.

Tough existence for fresh GameFi projects: 93% fail in a temporary whereas

As talked about within the introduction, the document by ChainPlay highlights the failing nature of the majority of GameFi projects.

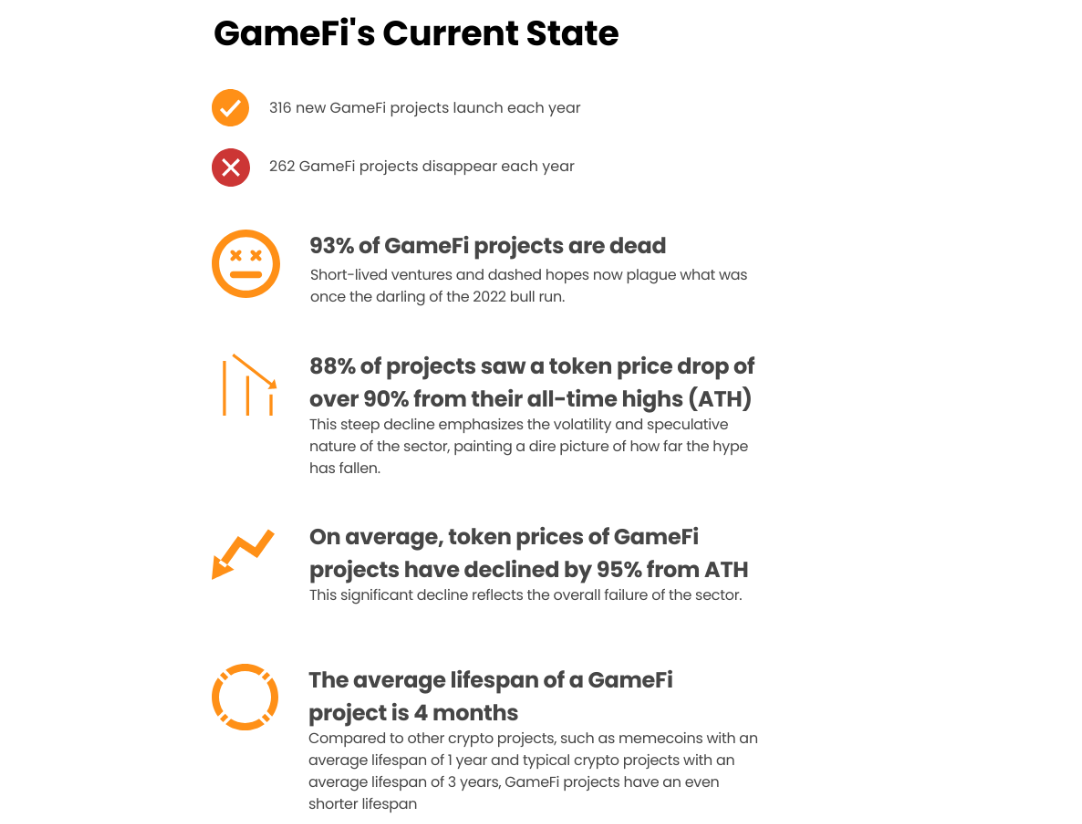

On moderate, 316 fresh projects are launched each One year, but 262 of these recede within just a few months and are regarded as “ineffective”.

While in 2022 the union of gaming with decentralized finance appears to be like like a pattern destined to develop, fine 2 years later a fully plenty of portray emerges.

88% of the full GameFi token substitute has considered a ticket drop of over 90% from their respective all-time highs. This converse highlights the melancholy utility of the digital assets in question, reflecting a mere speculative price tied to the momentary hype.

On moderate, the prices of these tokens possess lowered by 95% from their ATH, highlighting the huge disappointment of buyers who believed on this fable.

Maintain in suggestions that the moderate duration of a GameFi mission is most effective 4 months, deal decrease in contrast to plenty of sectors within the crypto and blockchain world.

This incredibly quick existence highlights the substantial difficulties in building sustainable gaming ecosystems over time, in a position to attracting net site traffic organically.

Contributing to this classic failure will likely be the rapid evolution of recreation logics and the ever-changing challenges of the gaming substitute, which constantly fluctuate over time.

All these statistics paint the GameFi world as a transitory set aside unable to provide prolonged-term experiences to avid gamers and buyers.

Retail and VC investments on this market niche: questionable performance

The macabre outlook of the GameFi substitute is confirmed by ChainPlay recordsdata on retail and VC investments, which suffer from unappealing performance.

On the change hand, though the high failure rate of GameFi is straightforward, the profitability parameters designate two definite realities for retail buyers and venture capitalists.

As for the first, the document highlights an moderate income of 15% for all those small operators who possess invested in decentralized preliminary choices (IDO).

We are speaking about numbers which will likely be no longer very most valuable which, despite the sure appreciation, must be linked to the stratospheric converse of the full crypto substitute since 2022.

Moreover, when retail buyers skill the IDOs of GameFi tokens, they incessantly must alter to unhealthy vesting constraints, with assets locked for so a lot of months.

Focused on the moderate drop of 95% talked about earlier, you understand correctly that a median income of 15% doesn’t elaborate the presence of such financial limits.

For plenty of retail buyers, the aspiration to make financial success with GameFi has became into a shocking truth of illiquid assets and falling prices.

For Mission Capitalists (VC) the returns seem more polarized, with one section emerging in income whereas the plenty of displays most valuable losses.

The frequent profits are equal to 66%, with 42% of the VCs recording performance between 0.05% and 1950%, whereas the final 58% incurs losses ranging from -2.5% to -98.8%.

The head venture capital buyers are Alameda Compare with an ROI of 713.15%, Soar Capital with an ROI of 519.11%, and Delphi Digital with an ROI of 490.50%.

Honorable point to also for Binance Labs which recordsdata moderate performances of 338.52% and 3Commas with a return of 267.20%.

On the plenty of hand, basically the most unproductive funds were Golden Shovel Capital, which misplaced 97.4% in GameFi, and Infinity Capital with a ROI of 97.1%.