Over-the-counter (OTC) desks played a crucial feature in stabilizing procuring and selling for the length of the fresh crypto market rupture by acting as shock absorbers that contained volatility and restricted broader systemic dangers, in maintaining with a tag from Finery Markets, a leading crypto ECN and procuring and selling SaaS provider ranked among the pinnacle 30 digital asset corporations globally.

On Friday, bitcoin BTC$112,461.31, the leading cryptocurrency by market price, plunged from round $122,000 to $103,000, with a lot of the losses going on within the gradual hours. The broader market wilted, marked huge losses in replace cryptocurrencies and volatility in in every other case steady cryptocurrencies fair like Ethena’s artificial buck USDe, Wrapped Beacon Ether (wBETH) and Binance Staked SOL (BNSOL).

USDe rapidly crashed as little as 65 cents on Binance, largely due to the replace’s contain inefficiencies, while it held steady on varied, more liquid avenues relish Curve, Fluid, and Bybit.

Primarily essentially based totally on Finery Markets, the localized crisis would possibly perchance have spread had it no longer been for OTC desks acting as shock absorbers.

“The crisis underscored the cost of secondary procuring and selling conducted through OTC non-public rooms. This infrastructure acts as a firewall in opposition to systemic contagion due to the elementary disagreement in notify e book structure,” the agency said in a document shared with CoinDesk.

The agency explained that, now not like centralized avenues relish Binance, which depend upon central, visible liquidity, OTC desks offer a varied non-public atmosphere with off-conceal conceal liquidity tailored to every participant.

“[This] darkish liquidity deal reduces the spread of systemic likelihood,” the agency said, adding that non-public rooms can support assist some distance from monetary institution-whisk-relish dynamics precipitated by visible apprehension in public notify books.

OTC desks and centralized exchanges differ in how they offer liquidity and enact trades. On OTC desks, procuring and selling happens privately between merchants and sellers or through non-public liquidity swimming pools. Establishments and neat merchants usually transact over OTC desks to assist some distance from impacting the going market price of the asset.

Centralized exchanges operate with clear notify books the set up all people can peep on hand aquire and promote orders, developing visible liquidity but additionally exposing the market to immediate, apprehension-driven volatility.

Volume Surge on Finery

The institutional flight to stability for the length of the foremost liquidation match from October 10-12 is evident within the surge of procuring and selling volume inside of Finery Markets’ non-public procuring and selling rooms.

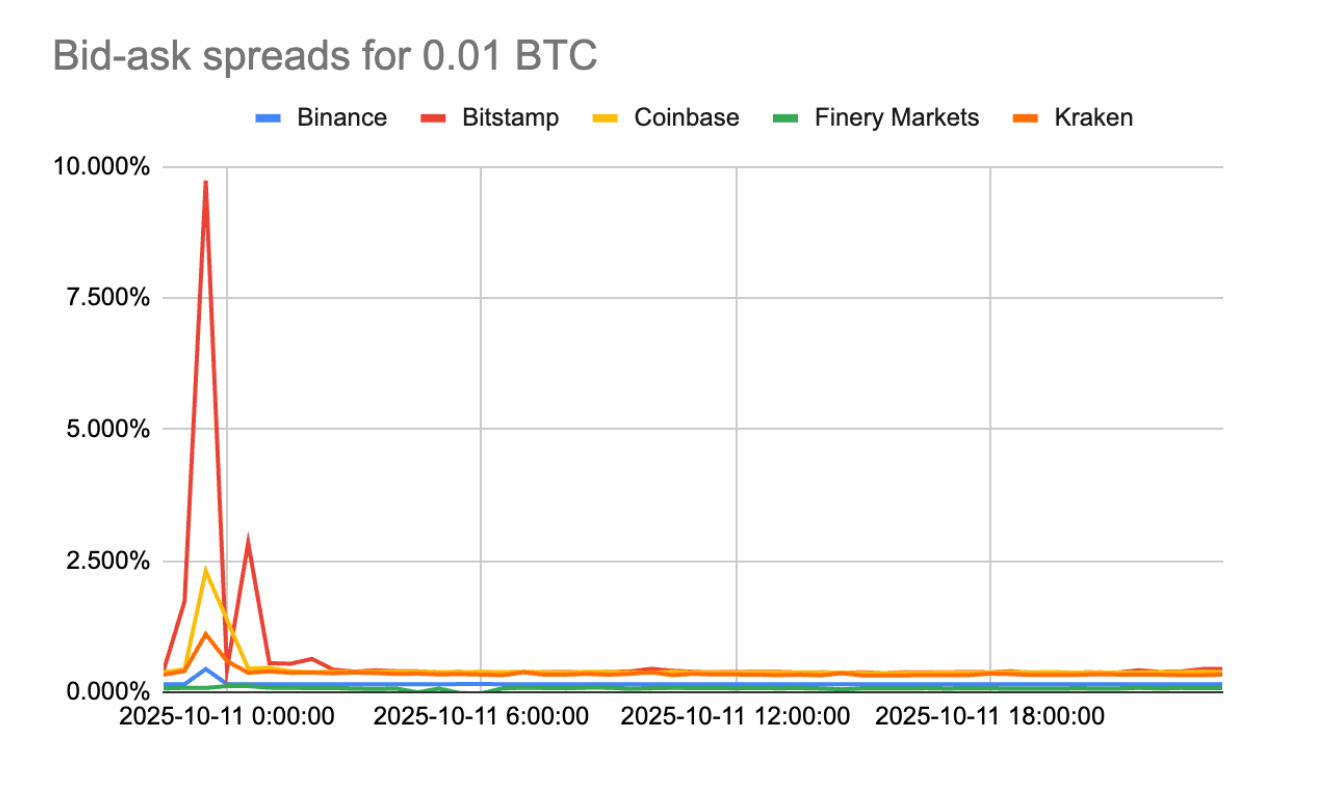

Week-on-week, volume in BTC/USDT and ETH/USDT pairs on these non-public rooms increased by 107%, deal outpacing the 48% progress considered on centralized platforms. Simultaneously, notify-quiz spreads, a key indicator of liquidity, narrowed sharply on Finery’s OTC venues, reflecting improved market depth and stability.

The chart exhibits that notify-quiz spreads for 0.01 BTC on Finery had been deal narrower than these on foremost centralized exchanges relish Coinbase, Bitstamp, Kraken, and Binance.

In varied phrases, executing neat trades became simpler on Finery than on varied avenues.