BNB finds itself at a pivotal crossroads the establish conflicting indicators collide — a bearish breakdown fascinating key strengthen ranges, but a bullish flag sample hints at a capacity upward surge. This paradox leaves traders and patrons weighing which force will by hook or by crook dominate the market’s next transfer. As rigidity mounts from every aspects, working out the technical nuances on the support of this tug-of-war becomes needed to waiting for BNB’s trajectory within the shut to time duration.

BNB Faces Stress From Key Technical Stages

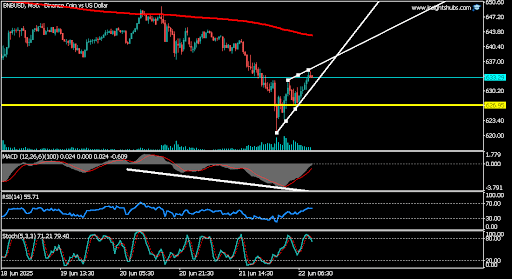

Analyzing the BNBUSD setup on the M30 timeframe, Thomas Anderson in an X submit highlighted that the price is currently sorting out the yellow strengthen line at $626.95, following a decisive tumble underneath the cyan mark line at $633.ninety nine. This breakdown has shifted short-time duration sentiment, suggesting that sellers are starting to exert stronger assign an eye on over the price lunge.

In accordance with Anderson, the 200 MA (red line), positioned between $642 and $645, is now acting as a dynamic resistance zone overhead. With mark trading underneath this transferring real looking, any attempts at recovery would possibly perchance well perchance simply face instantaneous rejection.

He also pointed out that the H1 chart confirms the continuing bearish momentum, with the price continuing to trade underneath every the cyan level and the 200 MA. This alignment between the M30 and H1 timeframes strengthens the case for extra downside lunge, especially if primarily the most recent strengthen at $626.95 fails to assign.

Till patrons role as a lot as reclaim key resistance ranges, the final outlook remains historical, and traders ought to assign an respect on how the price behaves across primarily the most recent strengthen to gauge the following seemingly transfer.

BNB’s Designate Outlook Bolstered By Bullish Continuation Signal

No matter the bearish outlook equipped by Thomas Anderson, eL Zippo expressed a more optimistic stance in his newest X tweet regarding BNB. He believes that BNB mute has the aptitude to upward push in payment, fascinating the existing negative sentiment round its newest mark lunge.

EL Zippo’s be aware is supported by the formation of a bullish flag sample on the chart. This sample is broadly most incessantly known as a continuation signal, indicating that the asset would possibly perchance well perchance simply resume its prior upward building after a duration of consolidation. For eL Zippo, the presence of this structure suggests that BNB would be developing for one other leg higher if market stipulations align.

At the time of writing, BNB modified into once trading across the $623 mark, reflecting standard mark lunge. The asset’s market capitalization stood at approximately $87.7 billion, signaling unprecedented investor interest.

Furthermore, BNB recorded a 24-hour trading quantity of roughly $1.8 billion, with mark and quantity exhibiting proportion beneficial properties of 2.11% and 13.22%, respectively—an illustration of renewed activity and particular sentiment available within the market.