The following is a guest put up from Shane Neagle, Editor In Chief from The Tokenist.

With US presidential elections concluded, Bitcoin has been hitting new all-time highs practically on a weekly foundation in some unspecified time in the future of November. Having reached almost $100,000 threshold on November Twenty 2nd, Bitcoin reinvigorated the altcoin market, now keeping a $1.49 trillion market cap.

The frequent wisdom would counsel that altcoins will apply Bitcoin’s lead, as prior traits earn shown. Nonetheless what styles of altcoins ought to heed distinguished efficiency? Extra importantly, are there new fundamentals in play to take into legend this time?

First, let’s revisit the connection between Bitcoin and altcoins. It’s a long way more predominant than one would think.

Why Does Bitcoin Lead the Crypto Market?

From the launch of Bitcoin mainnet in January 2009, to Bitcoin label breaching $10k threshold in November 2017, it took practically 9 years. Though Bitcoin step by step changed into a family title, it unexcited retained the gap of a recent, highly speculative asset. Here’s understandable in a central banking system, the keep apart money is synonymous with govt edicts – fiat (by decree) money.

Attributable to this truth, perception in govt edicts, and govt’s application of pressure, is what affords money its label. This has been the habituated frequent wisdom for generations. Furthermore, there is the search files from of medium. If Bitcoin is no longer a physical paper token issued by a central monetary institution, nonetheless digital, how can it be relied on?

Blockchain enthusiasts already know the respond. The central monetary institution, the Federal Reserve, also relies on an electronic ledger, which would possibly manifest its accounting as physical tokens (paper money) nonetheless no longer necessarily. In incompatibility, the total point of Bitcoin’s ledger is that its accounting is fortified towards arbitrary dilution.

That makes Bitcoin pseudo-digital. Its accounting is enforced by computing vitality by means of its proof-of-work algorithm, which erects a bridge between the digital and physical. The physical being the vitality and hardware sources wished for computing vitality. As a result, Bitcoin devices the altcoin market:

- Because the well-known cryptocurrency, Bitcoin’s sound money factor is easy to treasure.

- Because the Bitcoin community’s computing vitality grows, holders are more confident in the inviolability of Bitcoin’s accounting (disbursed ledger).

- As new altcoins appear, they are traded towards Bitcoin, it being the market benchmark tethered to physicality of vitality and hardware.

- In times of uncertainty of altcoins’ valuations, holders revert to Bitcoin as a safer asset.

- Likewise, in times of rising Bitcoin label, holders spill over to little cap altcoins for the reason that profit doable is increased. On the least, it is more complicated to gallop a large market weight that Bitcoin holds.

Inversely, the large Bitcoin market cap serves as a psychological cushion, repeatedly ready to absorb fleeing altcoin capital in times of distress. Nonetheless in a highly demanding landscape, that capital would possibly flit Bitcoin itself.

The difficulty is, if ample altcoin capital spills over, the total crypto market goes down on legend of many watch Bitcoin as appropriate one other cryptocurrency, albeit one which has the well-known mover inspire.

Altcoin-Bitcoin Pullback

The connection between the Federal Reserve and the crypto market is intrinsic. When the central monetary institution increased its balance sheet in plot over $6 trillion, between 2020 and 2022, the bloated liquidity spilled over into crypto sources, prompting traders to explore long-established trading methods to maximize alternatives.

Previously, crypto liquidity ballooned in some unspecified time in the future of the Initial Coin Providing (ICO) era, having peaked between 2017 and 2018. This era birthed top altcoins on the time; Ethereum (ETH), Cardano (ADA), EOS (EOS), Tezos (XTZ), Stellar (XLM), Algorand (ALGO), NEO (NEO), Filecoin (FIL), Tron (TRX), Chainlink (LINK), and plenty others.

Then another time, all liquidity is particular. The expansion of the altcoin market ate away Bitcoin’s market cap dominance. Traders often flip to trading rooms in some unspecified time in the future of such pivotal shifts to portion methods and insights into navigating market adjustments effectively.

Though the ICO divulge spawned dozens of altcoins, it is also the case that most earn been false or boring in the water. As a result, Bitcoin regained some lost floor unless the Fed’s remarkable monetary intervention in some unspecified time in the future of the pandemic fable.

After the Fed’s money printing spree, Bitcoin dominance shrank further. Following the over-leveraged Terra (LUNA) collapse, tied to algorithmic stablecoin TerraUSD, the altcoin market suffered an estimated $60 billion loss.

Nonetheless on legend of top altcoins already performed higher than Bitcoin, as a result of their lower market caps and increased profit doable, the speculative pressure remained. This reduced Bitcoin’s dominance further, nonetheless finest in short.

In a normal domino toppling scenario, by the tip of 2022, the Fed-pulled liquidity rug ended up triggering the collapse of the over-leveraged FTX alternate, exquisite the total crypto market. Bitcoin modified into engulfed in the selloff fear, having dropped to its pre-2020 label level of $16.5k.

Then another time, as the tall search files from heed loomed over the total crypto market, Bitcoin started to acquire higher. The US regional banking crisis, in the spring of 2023, helped the case for Bitcoin’s fundamentals. The approval of Bitcoin ETFs in early 2024 and the 4th halving, further laid the groundwork for recent new all-time highs.

Nonetheless how has the altcoin market evolved alongside Bitcoin?

Memecoin Dominance Is Telling

Loads of the “veteran-guard” altcoins taking into consideration blockchain infrastructure, decentralized finance (DeFi), and numerous efforts to tokenize human activity by means of tidy contracts. Then another time, the crypto wipeout in some unspecified time in the future of 2022 looks to earn left psychological scarring.

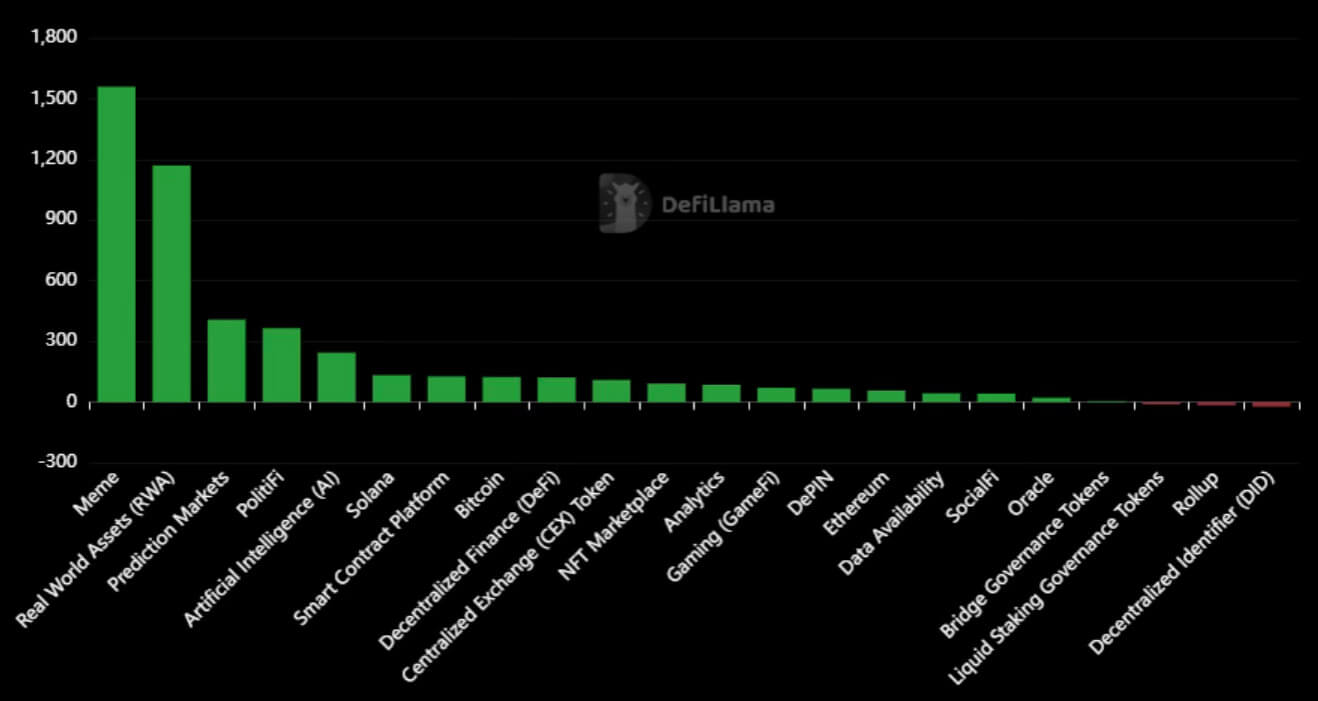

The lofty narratives of the outdated cycle earn been largely old-new by hype-gambling thru memecoins. Artemis files displays that memecoins earn dominated the crypto market, with finest AI tokens surpassing their efficiency in early 2024.

By mid-November, memecoins returned 6x the value than the crypto market common.

This coincides with Donald Trump securing his 2nd term in the Oval Scheme of job. In flip, this factors to crypto holders getting accustomed to social media-pushed hype cycles around communities in desire to altcoin fundamentals.

Likewise, the AI revolution is unexcited going stable. As opposed to numerous “ChatGPT with make-up” gadget and services offering hosted GPU servers, AI cryptos are also a hot subject, with the mighty-awaited liberate of AI agents anticipated to spurn one other bullish duration.

Kaito AI, market insights platform, sure that one in four crypto investors prioritize memecoin discourse. In numerous phrases, point of interest is more on short-term earnings in desire to long-term return of label. This fits more dynamic traders who glance up crypto traits on a each day foundation.

Narrative-sparkling, the next altcoin categories performed before Bitcoin 365 days-to-date: meme, staunch world sources (RWA), prediction markets, PolitiFi, AI, Solana and tidy contract platforms.

In total, there are 15,713 cryptocurrencies in circulation, tracked all over 1,178 exchanges and 494 categories. Such an infinite quantity of digital sources, all over so many categories, creates a horrifying psychological load to filter the wheat from the chaff.

Conversely, the recognition of memecoins is one manifestation of facing that psychological load. On the least, their simplicity and virality is itself a filtering mechanism. Nonetheless one other coping manifestation is the reversion to the “veteran guard” altcoins.

Older Altcoins Return to a Friendlier Scene

The 2022 collapse of crypto prices modified into so extreme that it changed into pointless to promote altcoins at such toppled prices. As a result, it is magnificent to suppose that many losses earn been unrealized, anticipating the brand new bullrun.

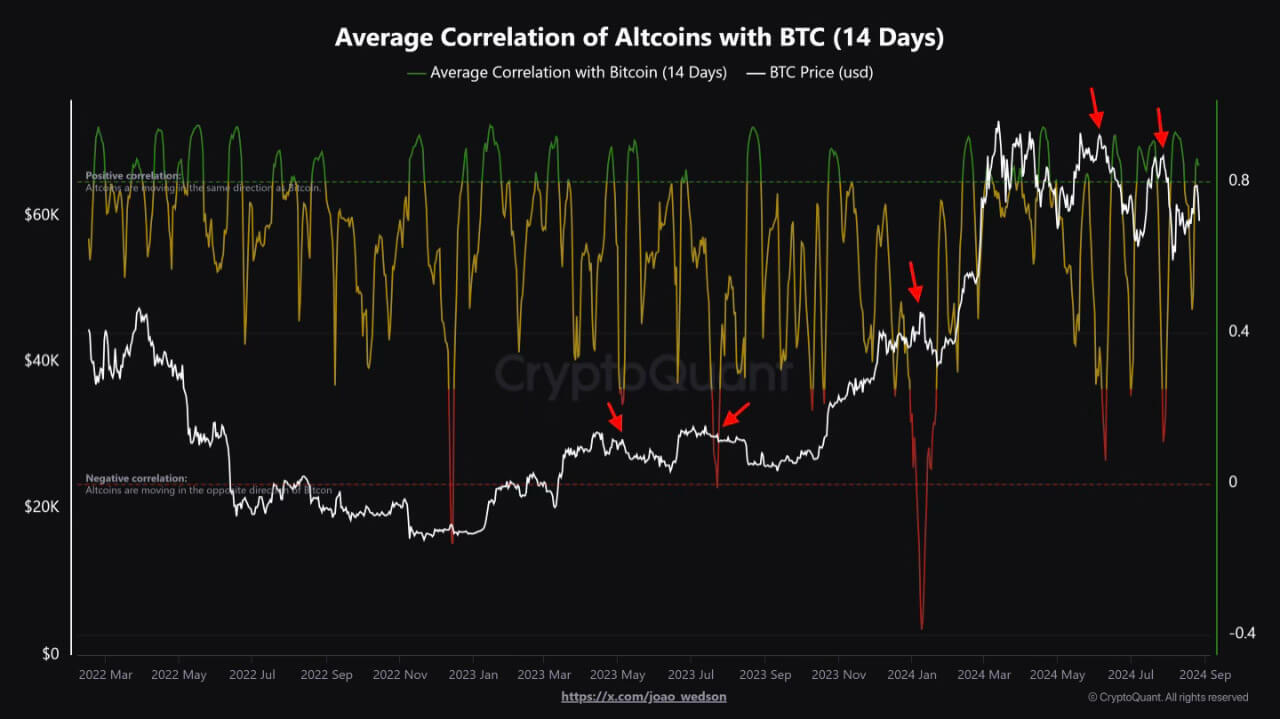

It looks that Bitcoin’s most modern bullrun is triggering that cycle. On the tip of August, Joao Wedson of CryptoQuant noticed that the altcoin market is all another time aligning with Bitcoin.

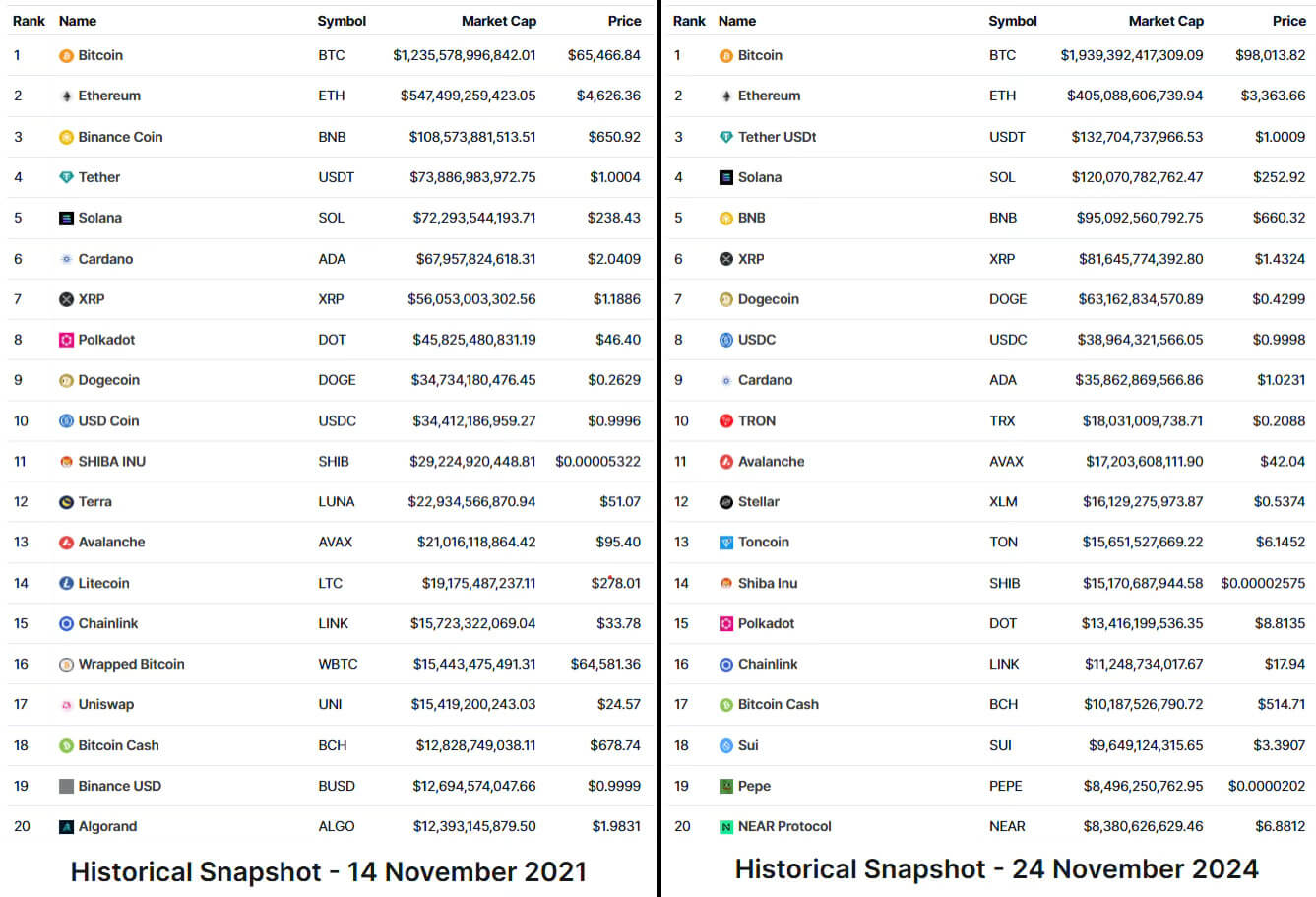

One day of the tip 20 altcoins (excluding for stablecoins) in the outdated cycle, in some unspecified time in the future of the height of the November 2021 bullrun, 11 earn remained. Though most of their prices are unexcited a long way away from the prior tops, they earn the aptitude to reclaim floor below the conclusion that here’s appropriate the launch of a brand new bullrun.

This often is the case if more alternate-traded funds (ETFs) are accredited, which spurred Bitcoin to rally and attain increased floor earlier in the 365 days. Case in point, NYSE Arca just currently filed for Bitwise 10 Crypto Index Fund, including the next coins:

| Portfolio Asset | Symbol | Weight |

|---|---|---|

| Bitcoin | BTC | 75.10% |

| Ethereum | ETH | 16.50% |

| Solana | SOL | 4.30% |

| XRP | XRP | 1.50% |

| Cardano | ADA | 0.70% |

| Avalanche | AVAX | 0.60% |

| Chainlink | LINK | 0.40% |

| Bitcoin Money | BCH | 0.40% |

| Polkadot | DOT | 0.30% |

| Uniswap | UNI | 0.30% |

Curiously, the burden of Bitcoin in the index is mighty increased than most modern Bitcoin dominance. Another time, this factors to the crypto dilution say. In spite of altcoins being more cost effective, there are so many of them that it is complicated to gauge their magnificent label long-term.

Likewise, their scarcity is no longer assured. As more centralized initiatives, their inflation fee would possibly additionally be a subject of switch. As an instance, Solana’s most modern inflation fee of SOL tokens is 4.886% while the long-term proposition is 1.5%.

Then another time, now that the anti-crypto SEC Chair is on the technique out, while the purportedly crypto-friendly Trump admin is incoming, the crypto market is more seemingly to deepen its liquidity pool. Additionally, the brand new verdict that sanction towards Twister Money modified into unlawful is more seemingly to earn large reaching implications.

The court docket effectively acknowledged that dApps are a brand new type of asset, lacking sanctionable ownership as a tidy contract code. To keep apart it in another case, the court docket reinstated frequent sense that open-provide can’t be property.

The Bottom Line

Even with ancient money present enhance, liquidity is finite. Bitcoin managed to seize most crypto liquidity, as it pushed an completely numerous technique of viewing money. This monetary doable spurred countless altcoins into existence, rising the utility of tidy contracts.

Nonetheless as an replace of expansion, the crypto market underwent constriction as a result of big fraud and over-leverage, flattening Bitcoin with it. In a cleaner market and more bullish regulatory landscape, Bitcoin is now poised to keep off a brand new altcoin bullrun.

Amid the daunting altcoin numerosity, 1st gen altcoins resurfaced, making an are attempting to anchor label to established familiarity.