Quick Seize

The inflationary misfortune the economic system has been grappling with since 2021 has induced a novel peep at Bitcoin’s performance.

Central banks get leveraged the User Value Index (CPI) methodology to condominium their 2% inflation mandate, a mannequin that has its critics resulting from the representation of the ‘basket’ of goods, offered that varied other folks get varied day-to-day consumption patterns.

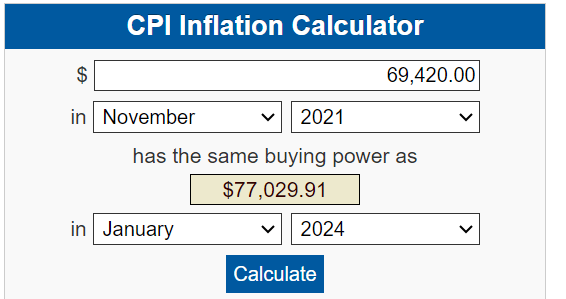

The greatest gravity of inflation’s affect on the digital asset market would per chance even additionally be considered when adjusting Bitcoin’s all-time high of roughly $69,420 in November 2021 to a CPI inflation-adjusted resolve. The calculation, in conserving with CPI metrics, reveals a placing actuality: for Bitcoin to in actuality reclaim its zenith, it would must set up closer to a worth of $77,000, in accordance with recordsdata offered by the US Bureau of Labour Statistics.

Whether Bitcoin serves as a hedge against inflation or a instrument for forex debasement stays a contentious subject. Nonetheless, its long-timeframe returns continue to gasoline these discussions, emphasizing its capability characteristic in either an inflationary or stagflationary environment.