The month of July is essentially centered on the capability launch of to find 22 situation Ethereum ETFs. On the opposite hand, Bitcoin and every other the biggest property beget one thing equally gargantuan earlier than them.

BeInCrypto has compiled what essential trends that it is doubtless you’ll well demand in the next month that would also influence the crypto market.

Bitcoin’s Impress Would possibly per chance well Understand a Multi-Month Low

Bitcoin’s mark, at $61,150 at the time of writing, is keeping itself above the $60,000 mark. Whereas many feared that the market’s uncertainty could per chance well also beget pulled it below this diploma, they missed the bigger characterize.

BTC on the weekly chart could per chance well even be viewed forming a double-high pattern. This macro bearish pattern alerts that the asset could per chance well well be situation for a downward trend. Bitcoin’s mark could per chance well even be viewed breaking below the neckline at $61,483.

This breakdown could per chance well procure some give a take cling of to at $58,874, however the pattern suggests an improbable better decline. The target mark is decided 17% below the neckline at $50,982, which would result in a four-month low for BTC.

The likelihood of this occurring is somewhat solid, pondering the “promote in Would possibly per chance well simply and tear away” opinion continues to impress to find 22 situation BTC ETF inflows. Combining this with the volatility of the crypto market, a drawdown is extremely that that it is doubtless you’ll well well be also believe.

On the opposite hand, Bitcoin’s mark could per chance well also bounce support from $60,000 or $58,847 to invalidate the bearish thesis. This could per chance well well be confirmed as soon as $62,000 is reclaimed as give a take cling of to.

Arbitrum Would possibly per chance well Understand a Original All-Time Low

Arbitrum’s mark decline is anticipated, however the threat of a glossy all-time low is alarming. ARB, the 2d-largest Layer-2 token at the support of Polygon (MATIC), has viewed its expect of dwindle tremendously in contemporary weeks, leading to a vast mark tumble. Since early March, it has fallen by over 60% to $0.799, forming a head and shoulders pattern.

A head-and-shoulders pattern is a bearish reversal chart pattern with three peaks — a better heart height (the pinnacle) flanked by two lower peaks (the shoulders). As soon as the neckline is broken, it indicates a capacity trend reversal from bullish to bearish.

In accordance with this pattern, Arbitrum’s target mark is projected at $0. On the opposite hand, that is absurd because ARB is a essentially solid asset. The most likely ‘s a glossy all-time low for ARB, as it is currently sits above the sizzling minimal of $0.739.

Intelligent market sentiment could per chance well also speed up this decline, and sooner than the close of July, ARB could per chance well also seek for a glossy ATL.

On the opposite hand, if Arbitrum’s mark manages to bounce support from $0.739, it’d also rob a shot at breaching $0.929. A succesful attempt could per chance well also send ARB above $1.00, invalidating the bearish thesis.

NFTs Are Death

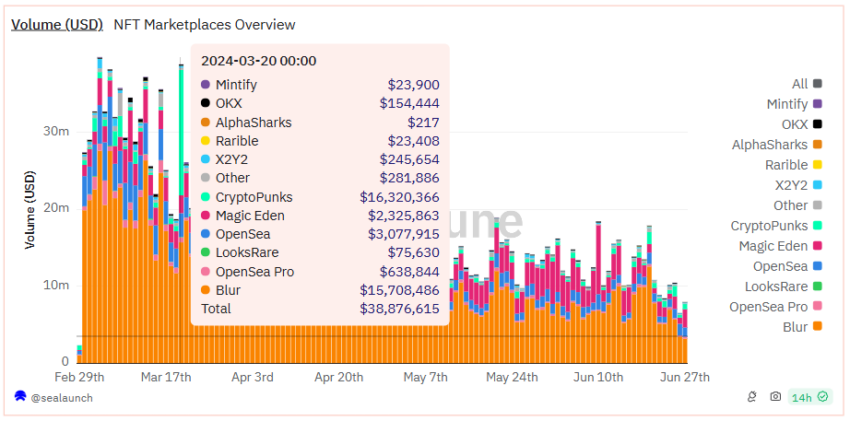

Non-fungible tokens (NFTs) received prominence in 2022, however their efficiency since then has been disappointing. Some resurgence in project and expect of took place in Q1 this one year.

On the opposite hand, this revival appears brief-lived. Over the last three months, total trading quantity has plummeted from $38.8 million to $7.9 million, marking an 81% decline.

The cause at the support of this tumble is twofold. First, the dearth of innovation offered on this home has left its expect of minimal. 2nd, there used to be a upward push in replacement investment alternatives and property corresponding to sincere-world property (RWA).

The upward push in Man made Intelligence (AI) tokens has also drawn merchants’ consideration. Given AI’s capacity for snarl, crypto merchants are leaning more toward deciding on them.

In consequence, the NFT trading quantity could per chance well also decline extra as bearish market stipulations and the aforementioned components way energy.