The next is a visitor put up from Shane Neagle, Editor In Chief fromThe Tokenist.

If the rest would possibly even be realized from the crypto market is that if a shortcut exists, that is also taken. When digital collectibles in the create of NFTs emerged, the market used to be snappy saturated. In flip, speculative NFT buys on their resell seemingly shifted actual into a market rout.

Equally with memecoins, whatever the rug pulls and pump and dumps, the appeal to of a instant buck on the race up demonstrated the ruinous mixture of low barrier to entry plus excessive hype seemingly.

But what in regards to the altcoin market itself, exterior of memecoins and NFTs? Is there a broader lesson, or even a chance, now that AI is an inextricable portion of lifestyles? First, let’s survey what happens with NFTs as an enlightening parallel.

Oversaturation and Speculation Fatigue

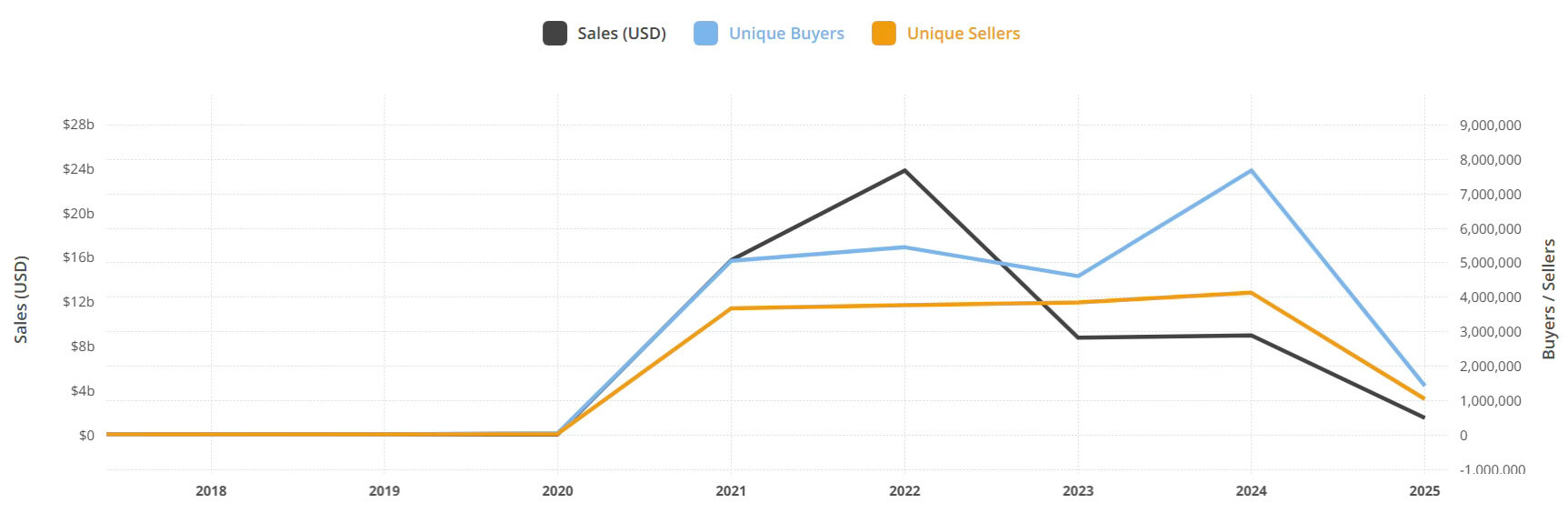

Honest before Terra (LUNA) collapse in Would possibly possibly perhaps 2022, world NFT sales reached on the topic of $24 billion. The optimism used to be so excessive that JP Morgan projected $1 trillion in annual metaverse income within a decade. That forecast now looks fully out of save.

Even supposing the cascade of bankruptcies, from Celsius to BlockFi and FTX, acted as a trigger for NFT market collapse, the writing used to be already on the wall. AI-powered image turbines such as Stable Diffusion and DALL-E maintain tremendously reduced the barrier to entry, opening the floodgates for spinoff low-effort NFT collections.

Such AI-powered saturation tremendously eroded the shortage of collectibles, which in the smash drove down speculative PFP (profile image) initiatives in settle on of utility-pushed NFTs and tokenized staunch-world resources (RWAs).

Altogether, the AI availability vastly exacerbated the underlying weak point of the NFT market – oversupply. This topic is now easy to seem at, as Ghibli mania is sweeping the social media plot, generated by both ChatGPT and Grok.

In flip, the collapsing profit-making from NFTs induced speculation fatigue. Memecoins maintain mirrored this dynamic pretty carefully, with the abet of further AI-powered layers:

- AI bots, such as Truth Terminal, swarming social media posts with AI-generated memes and narratives to promote tokens.

- Sniper bots, such as Banana Gun, executing millisecond trades, further abusing the memecoin market by sending unsuitable query signals.

The final results of AI amplification is the creation of a market that’s extremely inclined to bubble bursts. Consequently, repeated bursts trigger exhaustion and ever-reducing retail engagement — especially when members are lured by hype pretty than guided by sound concern administration. But the rely on is, would possibly this form of crypto exhaustion infect the altcoin market exterior NFTs and memecoins, on a deeper stage?

AI In Blockchain Coding: Original Distortion Frontier

For years, it has been frequent to measure the underlying cost of a blockchain mission by developer involvement. This developer reveal then serves as a brand toward seemingly tokenholders. After all, if a mission has few core developers, there’s a ways better concern the mission will endure if they leave.

In flip, there would possibly be much less effort going into worm hunting, new capabilities, roadmap implementation and optimization. Right here is why many dedicated web sites exist to reveal this metric, tracking developer commits all the contrivance in which through completely different time courses.

Briefly, developer reveal measures blockchain’s effectively being web page. As developers peep incentives, it would possibly even stamp the blockchain’s adoption seemingly as their key prolonged-term cost driver.

But with AI in play, we are a distinguished distortion seemingly. Over the closing year, it has been widely accredited that AI objects, alongside image generation, are at their most efficient through coding. Particularly, Anthropic’s Claude 3.7 has been effectively got as a coding multiplier, in a position to replacing junior tool engineers.

This opens an entirely new landscape by which few senior developers can leverage their AI underlings to:

- Generate neat contracts, from ERC-20 to BEP-20.

- Craft tokenomics, whitepapers and even roadmaps.

- Clone existing initiatives which will more than seemingly be delivery-provide, implementing a pair of tweaks.

And staunch because it came about with NFTs and memecoins, the lower the barrier to entry, the simpler the oversupply seemingly. AI retains reducing that barrier to entry, with the ability for a tubby blockchain mission pipeline, from neat contract code to social media enhance.

It would possibly perhaps even be the case that AI would possibly maintain neat contract audits by generating unsuitable self belief. Thru developer reveal metric, AI instruments can without complications distort it with auto-generated commits and pull requests, or even unfounded GitHub accounts that generate minor and frequent updates.

Consequently, as new tokens will more than seemingly be found in in the highlight, that is also extra complicated to assess its honest cost and effectively being.

The Understanding Side of AI-Powered Token Technology

Even in the early stage, AI objects are turning into replace-worthy through coding. This opens the door for churning out tokens with minimal effort, once extra repeating the NFT-like cycle of flooding the market with low-utility tokens.

This would possibly increasingly inevitably trigger extra exhaustion and disillusionment with the crypto plot, as that is also extra complicated to filter AI noise. By the identical token, there would possibly be advantages:

- Bitcoin would possibly be further fortified as a uncommon cryptocurrency that depends on staunch world resources (vitality, hardware) by the utilization of proof-of-work algorithm. As such, Bitcoin can help because the anchor for the broader altcoin market.

- Initiatives relying on AI code generation will smash in extra forks and zombie chains, but this instant decay in reveal will enhance pre-AI legacy chains.

- Initiatives with staunch-world exhaust cases will proceed to manufacture traction.

Within the smash, AI can now not sustainably unfounded adoption. Rather, AI can help as a filtering mechanism to purge worn initiatives.

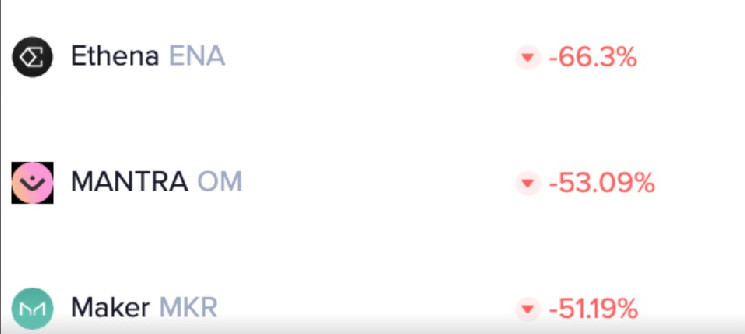

Sadly, memecoin reveal over the last few years clearly reveals that people peep out early opportunities in hopes of getting the coveted 10x profit lock-in. Right here is now not an investor mindset but a instant buck mindset. As a result of this truth, this driver will help incentives to exhaust AI for crypto mission generation for no completely different motive than to extract wealth.

But, in the reverse direction, blockchain initiatives will additionally provide solutions. Case in level, OriginTrail (TRAC) mission is leveraging Decentralized Records Graph (DKG) to form particular verifiability of info aged by AI.

“Even abusing social networks for political manipulations would possibly watch minuscule in contrast to an absence of have confidence in solutions to which we are “outsourcing” our cognition. Programs that we would possibly have confidence to course of remarkable amounts of info and provide us inputs for our actions or even form certain actions autonomously, maintain the absolute best seemingly requirements for transparency and verifiability.”

Hint Labs whitepaper Verifiable Net for Synthetic Intelligence: The Convergence of Crypto, Net and AI

Prolonged-term, it’d be prudent to query further erosion of have confidence in the altcoin market. After all, it is seemingly that heavily produced, unaudited contracts will lead to now not staunch rug pulls, but costly hacks. Onchain fame efforts from Karma3Labs would possibly abet, but it no doubt is unclear if such innovative solutions would possibly pass beyond niche adoption.