Key takeaways:

- Tezos label prediction suggests a restoration to $1.25 by the tip of 2025.

- XTZ would perchance reach a maximum label of $2.87 by the tip of 2028.

- By 2031, XTZ’s label would perchance fair surge to $8.

Tezos began sturdy as a platform for perfect contracts and decentralized apps. After being released in 2018, its label touched an all-time high of $9.12 in 2021. On the opposite hand, all over this time, it faced points like complaints and energy struggles, inflicting a lack of investor trust.

Lastly, the overall market’s effects plummeted the coin’s label, and it has failed to enhance to the same designate since then. On the opposite hand, collaborations and innovations are rising on the Tezos network, bringing it into shut competition with other perfect contract platforms like Ethereum and Solana.

Many crypto lovers quiz questions like, “Can the Tezos coin hit $50 in the long bustle?” or on the very least, “Will Tezos continue to exist?”

Let’s fetch into Tezos label prediction and technical prognosis.

Overview

| Cryptocurrency | Tezos |

| Ticker | XTZ |

| Latest label | $0.5166 |

| Market cap | $541.47M |

| Trading quantity (24-hour) | $16.88M |

| Circulating supply | 1.04B XTZ |

| All-time high | $9.18 on October 04, 2021 |

| All-time low | $0.3146 on December 7, 2018 |

| 24-hour high | $0.5384 |

| 24-hour low | $0.5063 |

Tezos label prediction: Technical prognosis

| Metric | Fee |

| Volatility (30-day Variation) | 5.49% |

| 50-day SMA | $0.6074 |

| 14-Day RSI | 39.38 |

| Sentiment | Bearish |

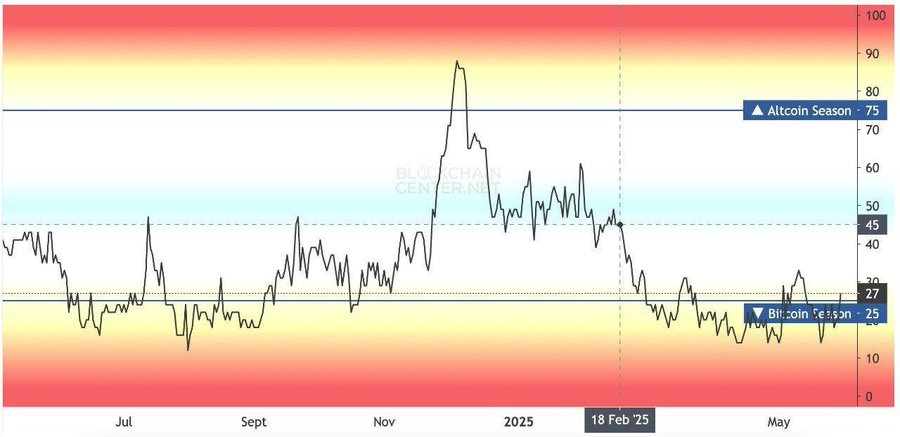

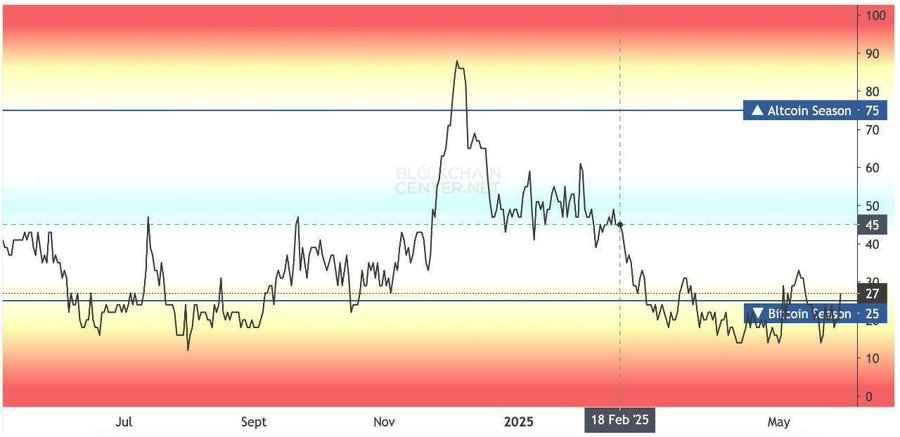

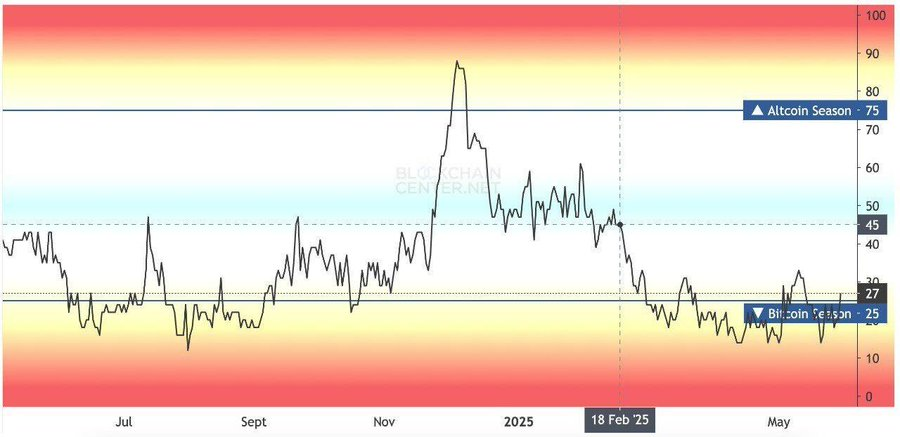

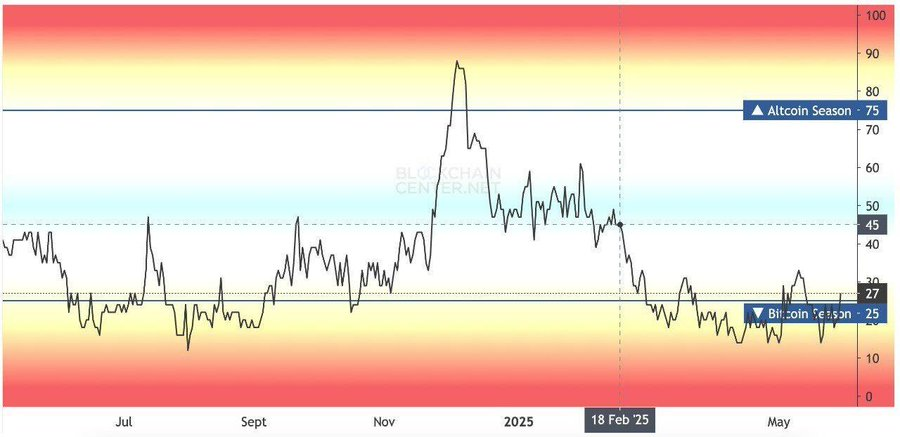

| Fright & Greed Index | 54 (Neutral) |

| Green days | 16/30 (fifty three%) |

| 200-day SMA | $0.6881 |

Tezos label prognosis

TL;DR Breakdown:

- XTZ is down 2.48% lately.

- The coin is making an strive out assist round $0.5160.

- XTZ is bearish in the short term.

Tezos label prognosis 1-day chart: XTZ has been gradually transferring down

The 1-day label circulate of Tezos (XTZ/USDT) on June 20 presentations that the coin has been gradually transferring down, currently hovering round $0.5177, showing a bearish vogue. The fee dipped below the center Bollinger Band (round $0.5675), and the MACD is in unfavorable territory, confirming downward momentum.

The On-Stability Quantity (OBV) presentations constant selling stress, reinforcing the bearish sentiment. This most contemporary label circulate suggests that if the XTZ continues below the $0.5160 stage, it would perchance fair additional fall to the following assist advance $0.5063 or even lower.

Tezos label prognosis 4-hour chart: XTZ is additionally bearish in the short term

The 4-hour label of Tezos XTZ additionally signifies bearish stipulations. The fee is below the Alligator’s Jaw, with the golf green and blue transferring averages trending downward. The Chaikin Money Waft (CMF) is unfavorable at -0.07, and the Relative Strength Index (RSI) is at 37.24, signaling that the asset is nearing oversold stipulations. The fee is currently sitting round $0.517, with a anxiousness of additional blueprint back towards the $0.50 stage.

Tezos technical indicators: Ranges and circulate

Every single day straightforward transferring average (SMA)

| Interval | Fee | Motion |

|---|---|---|

| SMA 3 | $0.5646 | SELL |

| SMA 5 | $0.5829 | SELL |

| SMA 10 | $0.5823 | SELL |

| SMA 21 | $0.5839 | SELL |

| SMA 50 | $0.6074 | SELL |

| SMA 100 | $0.6195 | SELL |

| SMA 200 | $0.6881 | SELL |

Every single day exponential transferring average (EMA)

| Interval | Fee | Motion |

|---|---|---|

| EMA 3 | $0.5790 | SELL |

| EMA 5 | $0.5844 | SELL |

| EMA 10 | $0.5951 | SELL |

| EMA 21 | $0.6235 | SELL |

| EMA 50 | $0.7037 | SELL |

| EMA 100 | $0.8144 | SELL |

| EMA 200 | $0.8861 | SELL |

What to search data from from XTZ label prognosis subsequent?

Both label charts indicate that Tezos is currently in a bearish phase, with the possibility of additional downward circulate. On the opposite hand, it would perchance fair be nearing oversold stipulations, suggesting a doable short-term reversal if the assist ranges retain.

Is Tezos a long bustle investment?

Tezos would perchance be a fair investment as its label movements in the past and fresh times replicate alternatives for huge gains. Finally, there catch been vital occupy markets, but the associated fee recoveries that adopted establish cash in the pockets of merchants.

Moreover, the platform is rather developed and supports DeFi alternate choices, decentralized applications, and NFTs, so there are utilities that would perchance defend the coin’s label afloat and upward.

On the opposite hand, as the least bit times, it’s likely you’ll fair composed the least bit times halt your learn as a result of crypto would perchance be extraordinarily unstable.

Why is Tezos down?

Tezos (XTZ) has dropped by over 2% in the last 24 hours as a result of broader crypto selloffs, a shatter below severe ranges, and low altcoin momentum. XTZ has dropped below old assist at $0.533 and stays below the 50-day SMA.

Will Tezos increase?

Yes, Tezos is seemingly to enhance by the tip of this 365 days. Educated forecasts counsel that XTZ will draw $2 by then.

Will Tezos reach $10?

Yes, Tezos can reach $10. Its all-time high became $9.18; vital bullish momentum would perchance be required to recapture this stage.

Will Tezos reach $50?

In line with skilled prognosis, Tezos would perchance fair no longer reach $50 anytime soon. A plentiful market cap would perchance be required to reach that level. On the opposite hand, mass adoption and integration with original methods would perchance scheme this likely.

Does Tezos catch a fair long-term future?

Tezos appears to be like to catch a fair long-term future as a result of the platform in most cases brings updates, and vogue is ongoing. It additionally fits into the upper story of decentralized finance and decentralized applications.

Recent news/notion on Tezos

- Tezos activates its 18th protocol pork up, Rio, at block #8,767,488.

On Can also 1, 2025, Tezos activated its 18th protocol pork up, Rio—at block #8,767,488.

Rio brings:

⏱️ Versatile staking with 1-day cycles

🧩 Recent rewards model supporting DAL participation for better Layer 2 scalability

🔒 Enhanced network resilience with stricter baker express of being inactive… pic.twitter.com/rxVRNtQAkT— Tezos (@tezos) Can also 9, 2025

Tezos label prediction June 2025

If the bulls abet XTZ, the token would perchance fetch away, reaching a peak of $0.872 while asserting a median trading label of $0.613 in June 2025. Traders can search data from a minimum label of $0.504.

| Tezos label prediction | Minimum label ($) | Common label ($) | Maximum label ($) |

| XTZ label prediction June 2025 | 0.504 | 0.613 | 0.872 |

Tezos label prediction 2025

Specialists imagine the overall outlook for Tezos (XTZ) in 2025 is certain. Consumers can search data from a minimum market label of $0.4863, a median label of $0.6124, and a maximum label of $1.25.

| Tezos label prediction | Minimum label ($) | Common label ($) | Maximum label ($) |

| Tezos label prediction 2025 | 0.4863 | 0.6124 | 1.25 |

Tezos label prediction 2026-2031

| 365 days | Minimum Mark ($) | Common Mark ($) | Maximum Mark ($) |

| 2026 | 1.13 | 1.16 | 1.46 |

| 2027 | 1.44 | 1.68 | 1.92 |

| 2028 | 2.36 | 2.44 | 2.87 |

| 2029 | 3.42 | 3.52 | 4.12 |

| 2030 | 4.63 | 4.77 | 5.87 |

| 2031 | 7.02 | 7.21 | 8.00 |

Tezos label forecast for 2026

In line with the XTZ label forecast for 2026, Tezos is anticipated to commerce at a minimum label of $1.13, a maximum label of $1.46, with a median label of $1.16.

Tezos label prediction for 2027

The XTZ label prediction for 2027 signifies a persisted upward thrust, with minimum and maximum prices of $1.44 and $1.92, respectively, and a median label of $1.68.

Tezos label prediction for 2028

Tezos’s label is expected to reach on the very least $2.36 in 2028. The utmost expected XTZ label is $2.87, with a median label of $2.44.

Tezos label prediction for 2029

The XTZ label prediction for 2029 estimates a minimum label of $3.42, a maximum label of $4.12, and a median label of $3.52.

Tezos label prediction for 2030

The Tezos label prediction for 2030 suggests a minimum label of $4.63 and a median label of $4.77. The utmost Tezos label is determined at $5.87.

Tezos label prediction for 2031

The XTZ label prediction for 2031 anticipates a surge in label, ensuing in a maximum label of $8. In line with skilled prognosis, merchants can search data from a median label of $7.21 and on the very least $7.02.

Tezos market label prediction: Analysts’ XTZ label forecast

| Firm | 2025 | 2026 |

| Changelly | $0.952 | $1.36 |

| DigitalCoinPrice | $1.37 | $1.62 |

| CoinCodex | $0.675 | $0.547 |

Cryptopolitan’s Tezos (XTZ) label prediction

Per the Cryptopolitan team, Tezos is expected to reach $1.5 by the tip of 2025, and forecasts as much as 2031 give a certain outlook for XTZ to interrupt above the $8 designate. For that to happen, future label movements and an lengthen in Tezos’ adoption needs to be bullish.

Tezos historical label sentiment

- Tezos mainnet went dwell in September 2018 and straight won recognition for facing the environmental influence of blockchain technologies on the second with its PoS model.

- XTZ’s label peaked all around the bullish cycle of 2021, reaching above $9.0.

- After 4 April 2022, XTZ’s label plummeted below $4.0; by 9 Can also, it had sharply fallen below the $2 designate.

- XTZ surged to about $1 before every thing of December 2022, but the bears reclaimed the market by the tip of the month, ensuing in a fall to $0.73. The coin recovered in 2023, averaging a market label of $0.8.

- With out reference to the partnership milestones accomplished, Tezos (XTZ) had a largely bearish 2024. The coin reached a high of $1.4 in April but misplaced about 60% by August.

- The bulls soon entered the market, and XTZ noticed renewed buyer hobby, which resulted in a peak label of $0.7015 in September and $1.856 in November. The surge prolonged into December—Tezos XTZ recorded a maximum label of $1.909. Mark corrections adopted thereafter, and the coin closed the 365 days at $1.286.

- In January 2025, XTZ reached a maximum label of $1.49, but in February, it misplaced momentum, averaging $0.72 per unit. After a failed strive at breaking above $0.80 in early March, XTZ managed a high of $0.6186 in April and $0.70 in Can also.

- XTZ is currently trading between $0.5063 and $0.5384 in June.