Issues about stablecoin issuer Tether’s monetary balance resurfaced this week after BitMEX founder Arthur Hayes warned the firm could presumably well presumably face severe be troubled if the tag of its reserve assets were to drop. But CoinShares’ head of compare, James Butterfill, pushed support on those claims.

In a Dec. 5 market replace, Butterfill acknowledged fears over Tether’s solvency “be conscious misplaced.”

He pointed to Tether’s most in model attestation, which stories $181 billion in reserves against roughly $174.Forty five billion in liabilities, leaving a surplus of virtually $6.8 billion.

“Even supposing stablecoin dangers must nonetheless by no formula be pushed apart outright, the recent data attain no longer repeat systemic vulnerability,” Butterfill wrote.

Tether remains one of possibly the most a success companies in the sector, producing $10 billion in the first three quarters of the year — an surprisingly excessive figure on a per-employee foundation.

Connected: Arthur Hayes tells Zcash holders to withdraw from CEXs and ‘protect’ assets

The most in model supply of Tether fear

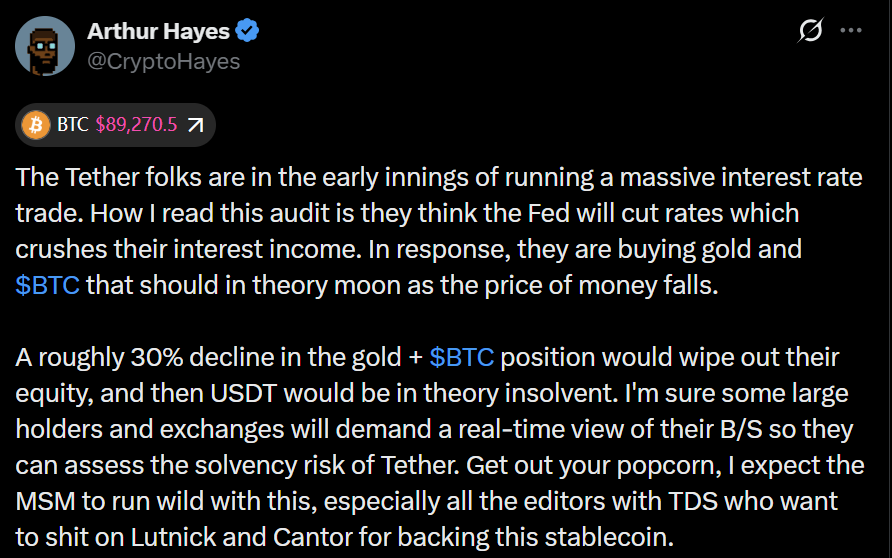

While hypothesis about Tether’s monetary health is infrequently new — media stores bear probed its reserves and asset backing for years — possibly the most in model round of solvency worries appears to be to stem from Arthur Hayes.

The BitMEX co-founder acknowledged final week that Tether changed into “in the early innings of working a huge interest-price alternate,” arguing that a 30% drop in its Bitcoin (BTC) and gold holdings would “wipe out their equity” and depart away its USDt (USDT) stablecoin technically “insolvent.”

Both assets perform up a appreciable share of Tether’s reserves, with the firm rising its gold publicity in most in model years.

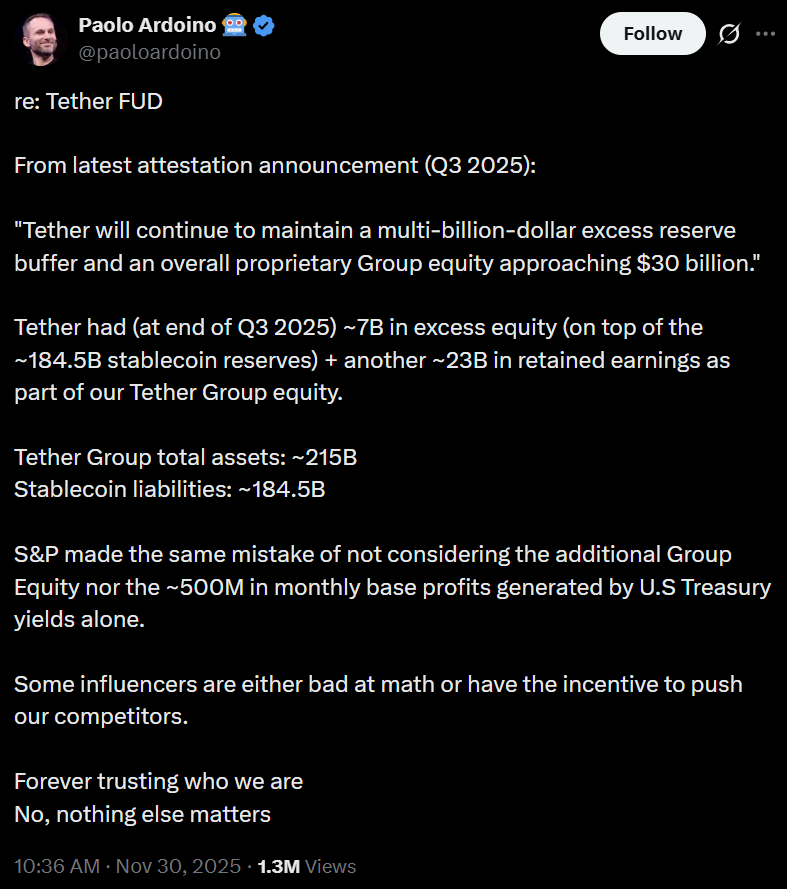

Tether is going thru criticism from extra than suitable Hayes. CEO Paolo Ardoino just just as of late pushed support on S&P Global’s downgrade of USDt’s capacity to defend its US dollar peg, dismissing the switch as “Tether FUD” — shorthand for terror, uncertainty, and doubt — and citing the firm’s third-quarter attestation document in its defense.

S&P Global downgraded the stablecoin over balance concerns, citing its publicity to “higher-threat” assets akin to gold, loans and Bitcoin.

Tether’s USDt remains the largest stablecoin in the cryptocurrency market, with $185.5 billion in circulation and a market fragment of virtually 59%, in accordance to CoinMarketCap.

Magazine: China formally hates stablecoins, DBS trades Bitcoin strategies: Asia Categorical