- Tether, the world’s largest stablecoin issuer, mints one more $1 billion value of USDT on the Tron blockchain on Friday.

- Gargantuan stablecoin inflows in the course of a market rally repeatedly mask fresh procuring strain.

- As traders brace for US and China inflation reports, tokens take care of BNB, BGB and TRX can maintain the earnings of the unstable market swings.

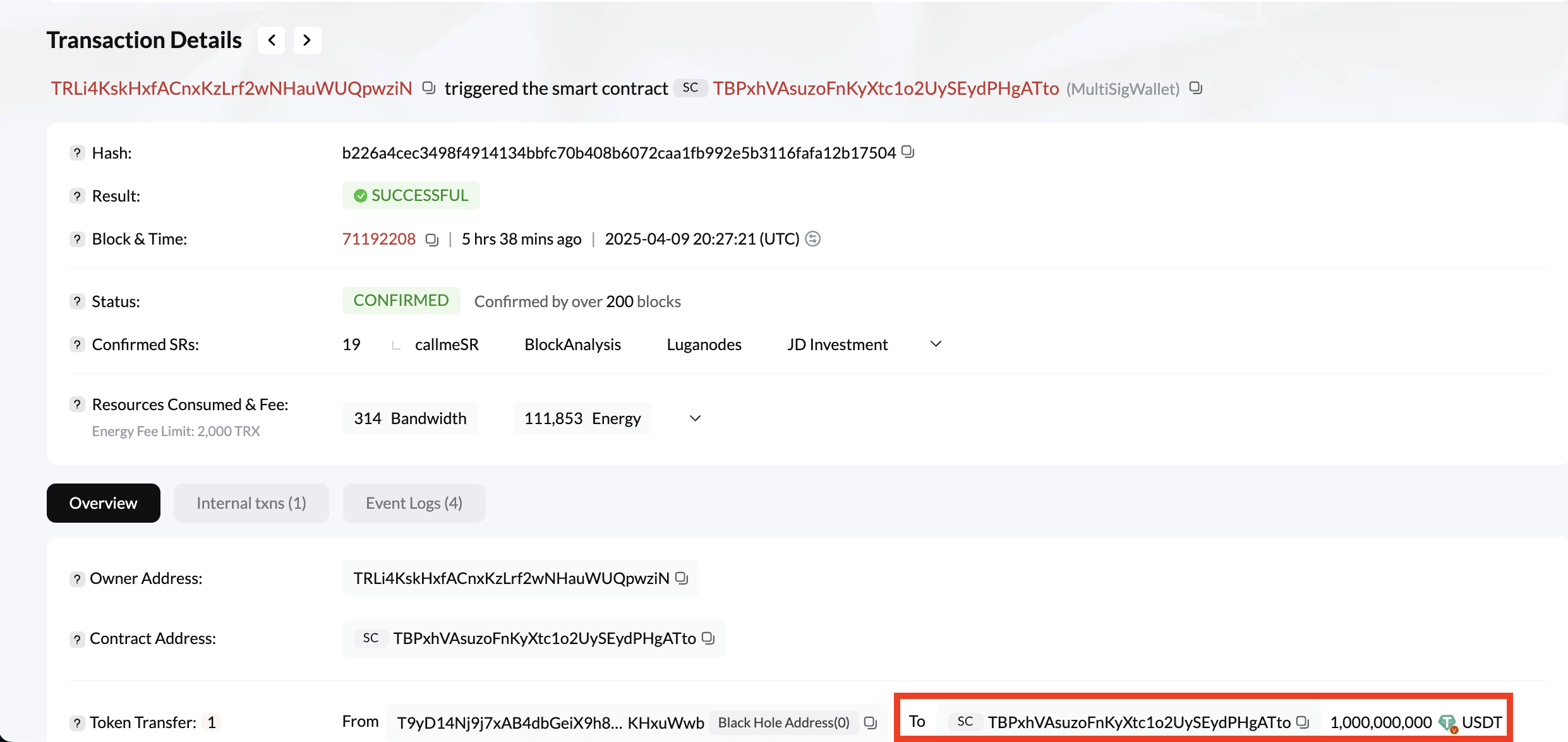

Unique $1B USDT Issuance signals liquidity surge on Tron network

Tether, the world’s largest stablecoin issuer, has minted one more $1 billion value of USDT on the Tron blockchain, in conserving with Whale Alert data printed Friday.

This issuance pushes Tether’s total USDT present on Tron past $50 billion, reinforcing its dominance within the stablecoin sector.

On the other hand, timing of Tether’s newest mints—fair correct sooner than wanted macroeconomic reports from each and each the U.S. and China—counsel it may per chance presumably also very smartly be linked to traders having a take into consideration to enter crypto positions to capitalize on capacity non everlasting gains.

On the flip aspect, the $1 billion inflow may per chance well per chance furthermore present firepower to scoop the dip if hawkish inflation indicators emerge from any or each and each of the world’s two largest economies on Thursday.

Particularly the inflows coincided with Bitcoin imprint which temporarily surpassed $83,600 after mature U.S. President Donald Trump launched a rollback of the world tariffs. With CPI and PPI data looming, Tether’s $1 billion liquidity injection may per chance well per chance present directional momentum, relying on the result of every.

Tron On-chain metrics heat up as Tether mints one more $1B in USDT

Tron’s blockchain fundamentals are flashing bullish signals, supported by a raft of intense on-chain exercise amid the market turbulence.

On Wednesday, on-chain data from Tronscan reveals that Tether’s the world’s largest stablecoin issuer done one more $1 billion USDT issuance on the network.

This aligns with the dominant account that traders starting up to re-allocate capital in direction of crypto probability sources.

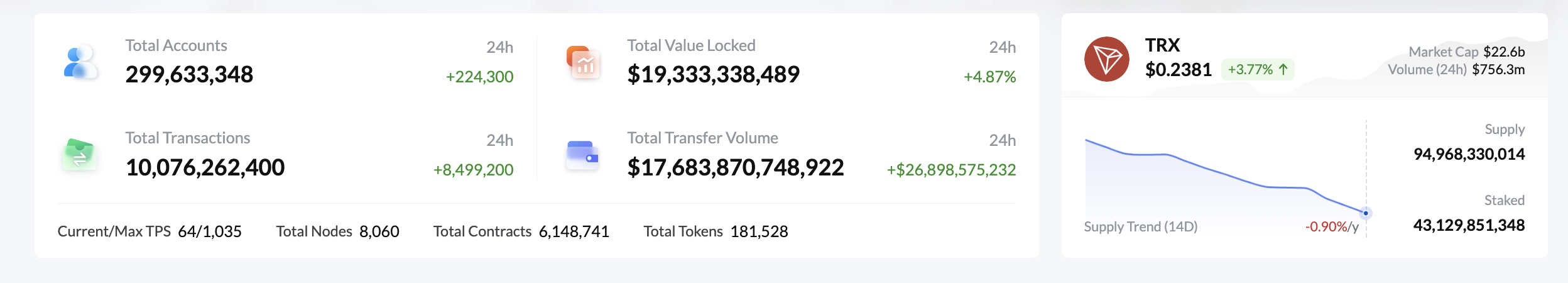

Validating this stance, Justin Sun’s Tron network expansion has accelerated vastly. In line with valid-time data from Tronscan, new TRX accounts surged by 224,300 in fair 24 hours, bringing the cumulative depend to 299.63 million. This uptick emphasizes rising user adoption and elevated stablecoin exercise as market turbulence heightens.

More importantly, Tron’s everyday transaction depend elevated by 8.5 million, pushing the total possibility of all-time transactions past 10.07 billion. Concurrently, the Total Tag Locked (TVL) climbed 4.8% to $19.33 billion, reflecting a meaningful injection of new capital into the Tron DeFi ecosystem.

These headline metrics are extra supported by deeper liquidity indicators. Over a 24-hour interval, Tron’s transfer volume surged by $26.89 billion, lifting cumulative transfer volume to a heroic $17.68 trillion. This suggests capital is actively keen within the ecosystem—no longer fair correct parked—which in most cases precedes quiz strain for TRX.

In essence, TRX present-aspect dynamics paint a image of tightening present and enhanced investor sentiment after Trump’s possibility to conclude tariffs imposed on all US’ change companions, except China.

TRX imprint primed for breakout amid liquidity wave

Traditionally, fresh stablecoin issuance—especially on Tron—has preceded surges in TRX and other associated tokens. Vital of the newly minted USDT fuels contaminated-border transfers, OTC desk settlements, and DeFi lending, all of which incur TRX gasoline charges.

Hence, intervals of intense market volatility with traders rotating out and in of stablecoins repeatedly generate well-known traction for the TRX token holder incentives, ensuing in chronic aquire strain.

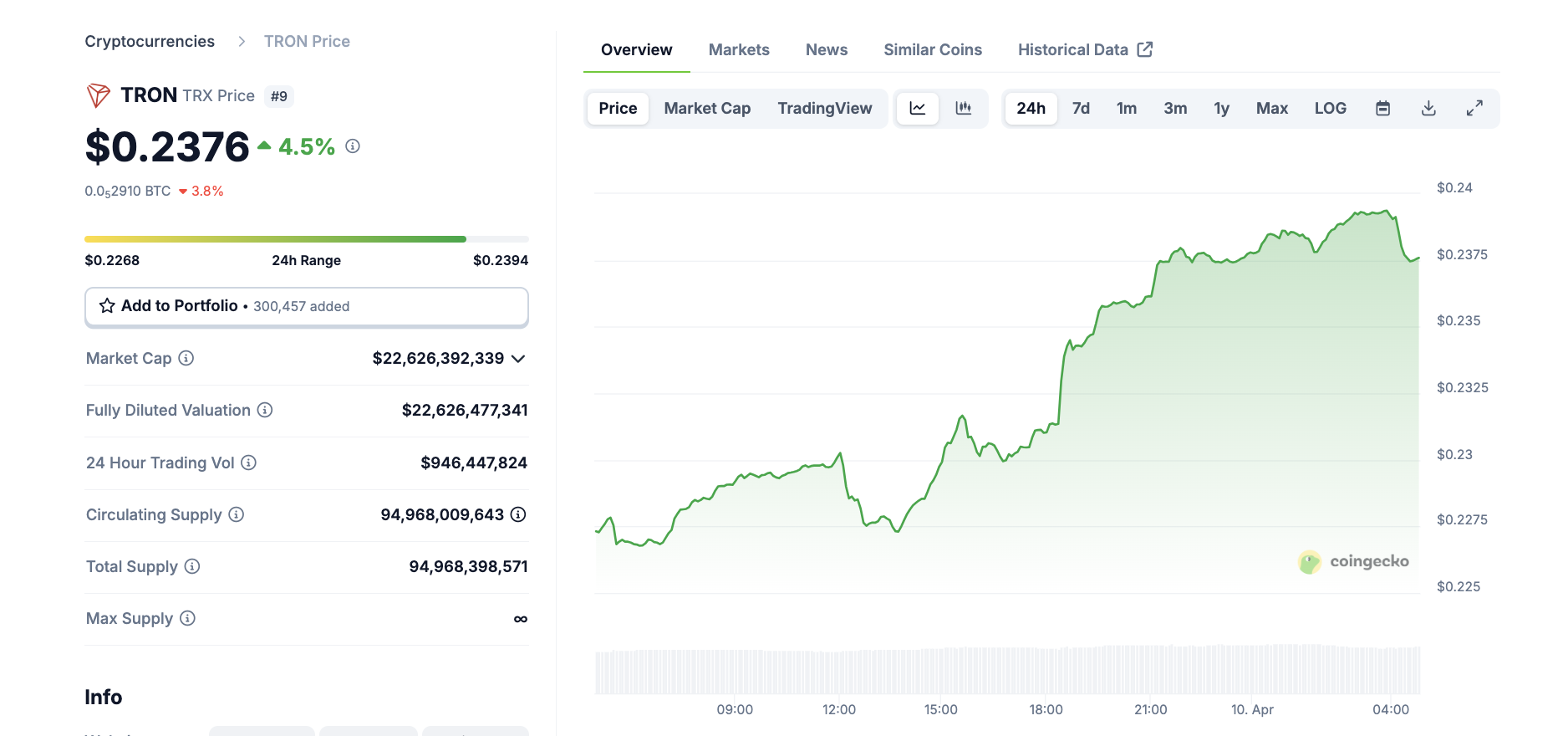

Tron (TRX) Tag Action, April 10 | Provide: Coingecko

With TRX imprint up 4.5% at press time on Thursday, trading at $0.2831 and 24-hour trading volume reaching $946 million, market sentiment is starting to align with the on-chain strength.

Moreover, change balances for TRX maintain declined sharply in the past forty eight hours, as traders migrate tokens to personal wallets or stake them—one more signal of lowered sell-aspect strain and long positioning.

If upcoming macroeconomic data confirms dovish inflation trends, TRX may per chance well per chance spoil through non everlasting resistance near $0.135, a level no longer considered in 30 days. This may per chance per chance well presumably watch fresh TRX holders produce one more 4.7% earnings in the near time-frame.