Tether CEO Paolo Ardoino has denied hottest rumors that the stablecoin issuer is offloading its Bitcoin holdings to aquire gold.

In a Sunday put up on X, Ardoino said the firm “didn’t sell any Bitcoin,” and reaffirmed its process of allocating earnings into assets like “Bitcoin, gold, and land.”

The feedback came basically based on hypothesis from YouTuber Clive Thompson, who cited Tether’s Q1 and Q2 2025 attestation files from BDO to speak the firm had reduced its Bitcoin (BTC) field. Thompson pointed to a fall from 92,650 BTC in Q1 to 83,274 BTC in Q2 as evidence of a sell-off.

Nevertheless, Jan3 CEO Samson Mow debunked the speak, noting that Tether transferred 19,800 BTC to a separate initiative called Twenty One Capital (XXI) all around the the same interval. That included 14,000 BTC sent in June and one more 5,800 BTC in July.

Connected: Tether holds talks to make investments across gold present chain: Report

Tether strikes $3.9 billion in BTC to XXI

In early June, Tether moved over 37,000 BTC, worth approximately $3.9 billion, across a big replace of transactions to pork up XXI, a Bitcoin-native monetary platform led by Strike CEO Jack Mallers.

“Tether would prefer had 4,624 BTC more than on the discontinue of Q1 if the switch is accounted for,” Mow explained, including that the firm in fact increased its web holdings.

Ardoino echoed the clarification, asserting the Bitcoin became moved, now now not offered. “Whereas the realm continues to fetch darker, Tether will continue to make investments allotment of its earnings into precise assets,” he wrote.

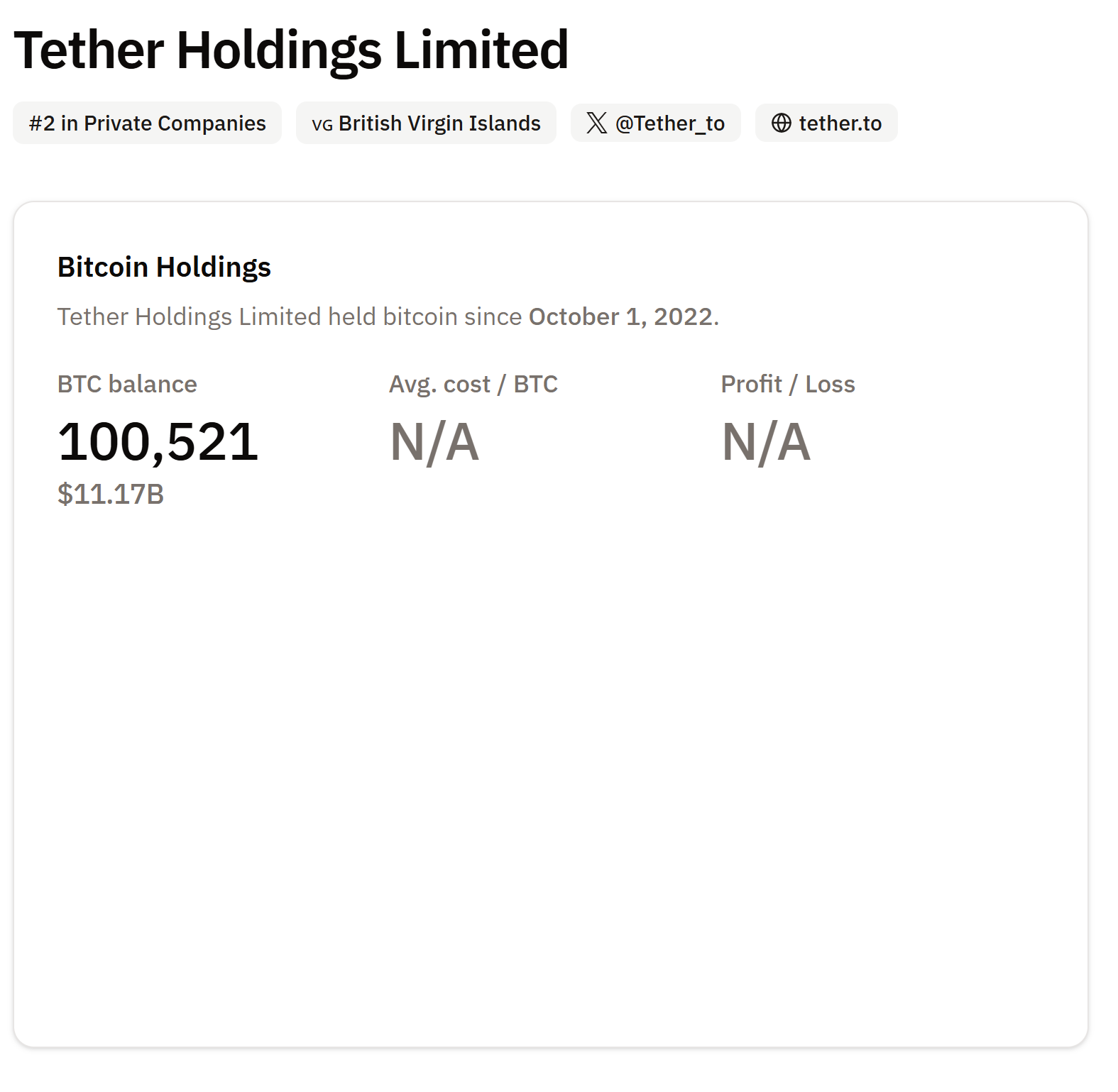

Tether, the issuer of the USDt (USDT) stablecoin, holds over 100,521 BTC, worth around $11.17 billion, per files from BitcoinTreasuries.NET.

Connected: Tether scraps belief to freeze USDT on 5 blockchains

El Salvador buys $50 million in gold

Tether’s Bitcoin sell-off rumors came as El Salvador published it has added 13,999 troy oz of gold worth $50 million to its foreign reserves, marking its first gold acquisition since 1990. The central monetary institution said the switch is allotment of a diversification device to slit reliance on the US greenback.

Sooner than turning to gold, El Salvador built a $700 million Bitcoin reserve, preserving 6,292 BTC. Nevertheless, an International Financial Fund portray in July claimed that the Central American nation has now now not made any original Bitcoin purchases since February.

Magazine: Bitcoin is ‘droll web money’ all over a disaster: Tezos co-founder