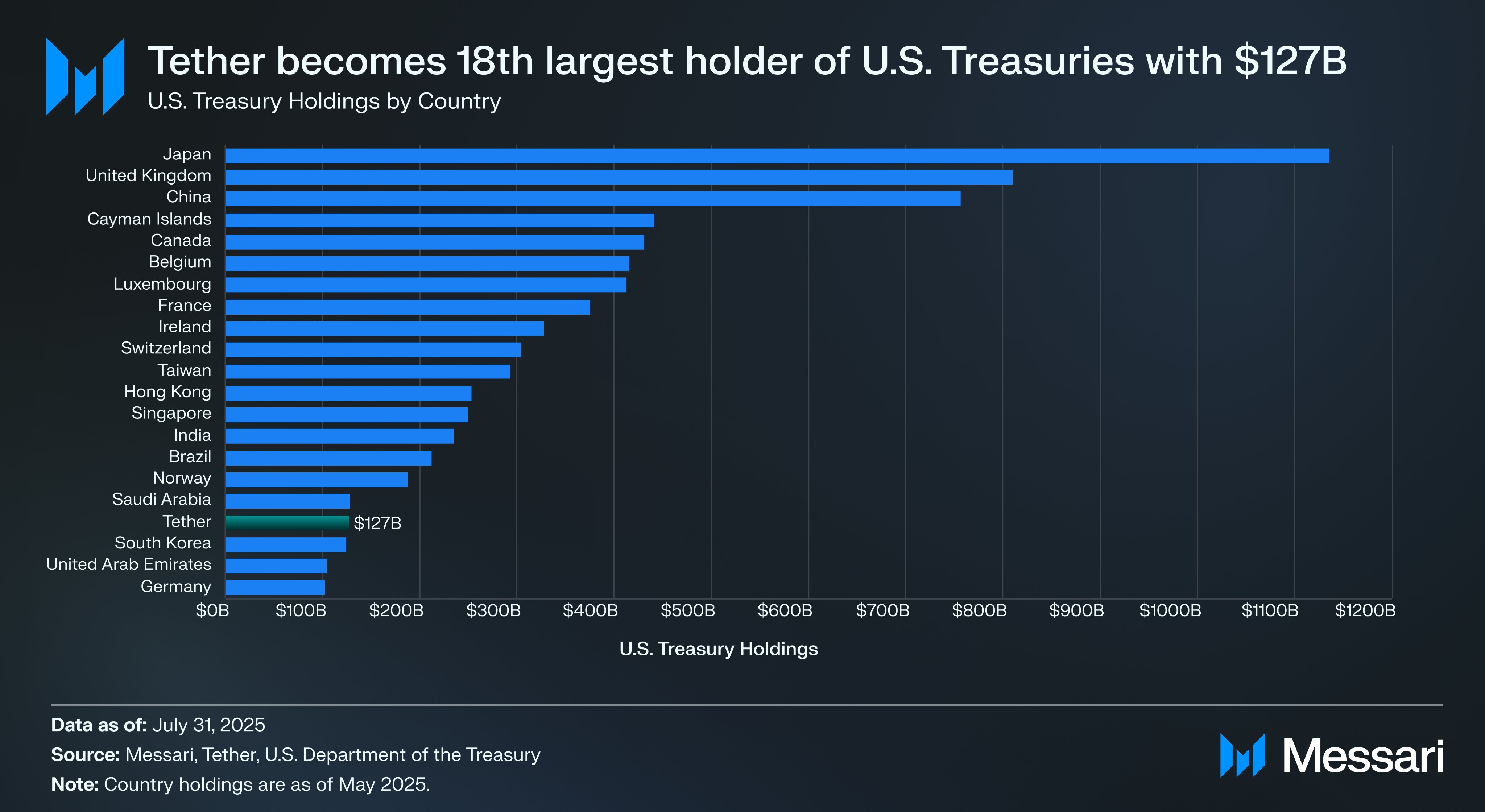

Stablecoin issuer Tether has surpassed South Korea in the volume of U.S. treasury bond holders after it issued extra resources with entire exposure to U.S. Treasuries. How mighty U.S. debt does the agency preserve?

- Tether’s U.S. Treasury reserves surpass South Korea, Germany and United Arab Emirates.

- Tether continues to generate acquire profit, reaching $4.9 billion in Q2 2025 on my own.

Fixed with files from prognosis agency Messari, the Paolo Ardoino-led firm has climbed the ranks and surpassed three sovereign states in the volume of U.S. treasury bonds it holds. On August 1, the agency used to be ready to surpass South Korea, which at this time holds much less than $127 billion in bonds.

In Q2 2025, the USDT stablecoin issuer agency severely expanded its holdings of U.S. authorities debt, reporting over $127 billion in U.S. Treasuries, including $105.5 billion in dispute holdings and $21.3 billion circuitously. This marks an $8 billion magnify from Q1 and boosts Tether’s space as regarded as most doubtless the most greatest holders of U.S. debt globally, rivaling sovereign nations.

Switch over, sovereign nations.

Tether becomes the 18th most attention-grabbing holder of U.S. Treasuries. https://t.co/2gwZlDT1j2

— Messari (@MessariCrypto) July 31, 2025

Fixed with Messari’s prognosis, the stablecoin agency stays the fully firm on the checklist with extra U.S. treasuries than other states mentioned on the checklist. Besides South Korea, Tether (USDT) also holds extra U.S. treasury bonds when put next to the United Arab Emirates and Germany.

Both nations preserve a tiny better than $100 billion in U.S. debt respectively.

Tether’s reserves surpass liabilities in Q2

Besides the milestone in U.S. treasury bonds held, the account also confirms that Tether’s reserves exceed its liabilities, with entire resources at roughly $162.6 billion versus $157.1 billion in liabilities.

The firm holds $5.47 billion in shareholder capital as a protecting equity buffer, reinforcing its financial strength and solvency. More importantly, the $127 billion in U.S. Treasuries serves because the essential backing for USD₮, guaranteeing high liquidity and low possibility for token holders.

Within the second quarter of 2025, USDT’s issuer generated a acquire profit of around $4.9 billion, pushed by profits from its U.S. Treasury holdings and strategic reserves in Bitcoin (BTC) and gold. Out of the $5.7 billion in entire year-to-date profits, $3.1 billion got right here from stable habitual income, with the last $2.6 billion from mark-to-market gains.

This financial efficiency permits the agency to gradually reinvest, with $4 billion already deployed in U.S. strategic initiatives, including initiatives love XXI Capital and Rumble Wallet.